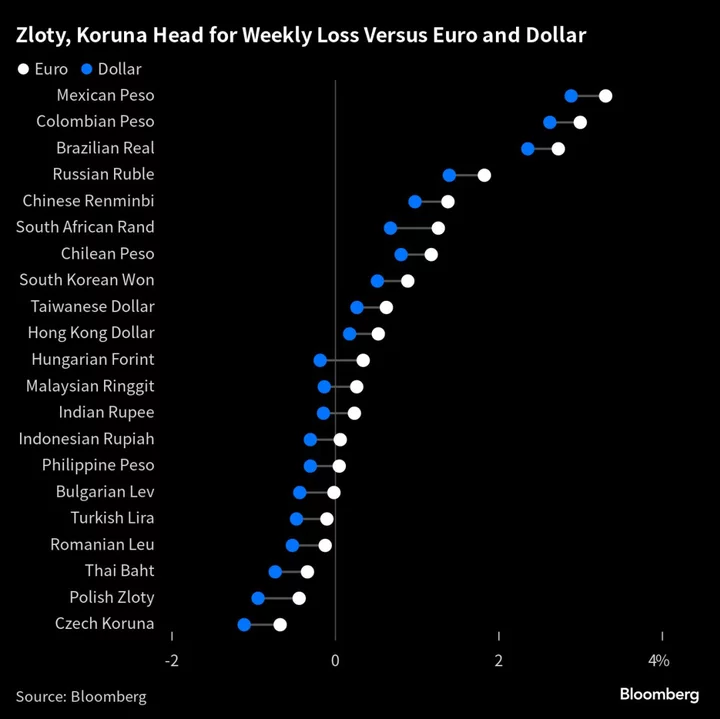

A gauge of developing-market currencies posted its best week since July, with gains in Latin America high-yielders overshadowing a turbulent week for foreign-exchange rates in emerging Europe.

Currencies from Mexico, Colombia, Brazil and Chile — countries with some of the highest interest rates in the world — gained over the past five days, outperforming peers. Investor appetite for risky assets rose on signs of economic stabilization in China and US data remained resilient. The Peruvian sol, meanwhile, bucked the regional trend as the central bank kicked off its easing cycle.

Hungary, Czech Republic, Bulgaria and Romania all saw their currencies weaken against the dollar in the week, even though they pared losses Friday. They were dragged down after the European Central Bank’s decision to raise borrowing costs on Thursday, underscoring concerns over growth.

“The policy response is likely to be hold and hope, but with a risk that if inflation conditions don’t cool, a policy-induced recession may be required,” said Simon Harvey, head of FX analysis at Monex Europe in London.

That would hurt Eastern European currencies the most among emerging markets, given their high economic exposure to the common currency area, Goldman Sachs Group Inc. said in a note.

Poland’s zloty resumed its free-fall Friday after a respite following a senior official’s pledge Wednesday to intervene in the currency market.

Zambian President Hakainde Hichilema will meet Xi Jinping in Beijing, while an update from Moody’s Investors Service on Senegal’s credit rating is expected at market close following recent political turbulence.

--With assistance from Philip Sanders and Andras Gergely.

(Updates market pricing throughout.)