Britain’s stock market is getting back on its feet.

Less than a year after losing the crown of Europe’s biggest equity market, London looks set to recapture it from Paris, as the rally in French luxury shares falters.

The combined dollar-based market capitalization of primary British listings stands now at $2.90 trillion versus France’s $2.93 trillion, according to an index compiled by Bloomberg. The gap between the two has narrowed steadily, primarily driven by a slide in France’s value from last year’s $3.5 trillion record as economic gloom in the key Chinese market deepens.

London, meanwhile, is seeing signs of investor bullishness for the first time in years, with HSBC Holdings Plc, Barclays Plc and JPMorgan Chase & Co. strategists all predicting upside for a market long tarnished by the Brexit overhang. It’s a marked change in tone from last year when a Bank of America Corp investor survey ranked UK the most disliked market globally.

Barclays’ strategist Emmanuel Cau reckons the UK market is currently a “good place to hide” and expects that energy exposure and easing inflation could spark “meaningful” investment inflows. His counterpart at HSBC, Max Kettner, turned bullish on UK equities this week for the first time since May 2021.

So what’s going right for the UK? First, its stocks are benefiting from a 30% rally in oil in the past three months. Second, inflation is finally cooling, potentially enabling the Bank of England to end its 22-month policy-tightening cycle. That in turn could weaken the pound versus the dollar, crucial for an index packed with exporters’ stocks.

BofA data from the latest week showed outflows from UK equity funds are still continuing, reversing a brief interlude of gains in mid-September. There’s certainly scope for investors to add to UK positions — global funds still have a net 22% underweight on the market, the most bearish in almost a year, according to a BofA survey.

“The advantage of the UK market is that it is heavily weighted on energy stocks, which have been doing relatively better,” said Liberum Capital Ltd. strategist Susana Cruz. The energy sector has a 14% weighting in the FTSE 100, while Bloomberg Intelligence data shows analysts expect the industry to generate 20% of the index’s earnings this year.

One of the FTSE’s blue chip oil stocks, Shell Plc, is hovering near five-year highs. That 2018 peak coincided with a $75-a-barrel oil price. Now, if forecasts of $100 oil are right, the FTSE 100 could be headed much higher.

The picture contrasts with Paris, which is under pressure from China’s economic slowdown. LVMH, L’Oreal SA, Hermes International and Kering SA between them comprise almost a fifth of the CAC 40 index, and drove the rally earlier this year. All have slid from the highs hit earlier this year, as analysts warn that demand for posh handbags and jewelry is likely to slow in China, as well as at home in Europe.

Meanwhile, the pound has shed about 4% against the dollar this month, key for FTSE 100-listed firms which generate about 75% of their sales overseas. Strategists at Goldman Sachs Group Inc. expect pound weakness to continue boosting exporters.

London’s problems are by no means over, with an economy in doldrums and companies fleeing to New York for share listings. Outflows from the market have been relentless, totaling $23 billion year to date — according to Barclays’ analysis of EPFR data.

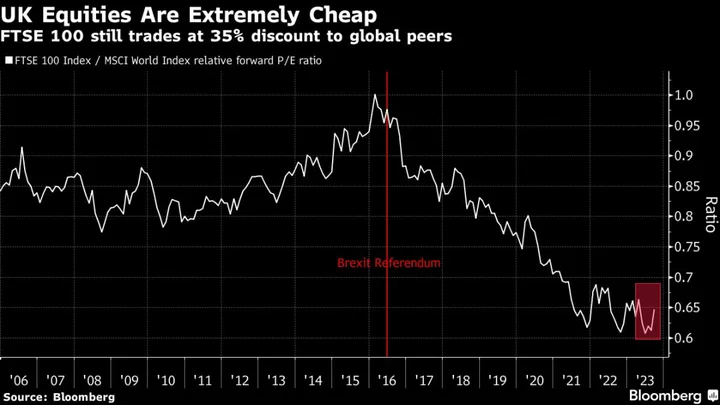

Years of declines have made London-listed shares extremely cheap relative to peers. Based on a forward price-to-earnings ratio, the FTSE 100 trades currently at a 35% discount to the MSCI World Index.

“For quite a while there has been a real UK discount, we see that discount sort of baked into prices,” said Dan Kemp, chief investment officer at Morningstar, which has $295 billion under management. “From that fair-value perspective, the UK is certainly a more attractive market than some others.”