Federal Reserve Chair Jerome Powell said returning US inflation to 2% is crucial to support the long-term health of the US economy, and that more interest-rate increases may be needed this year.

Policymakers feel “it will be appropriate to raise rates again this year, and perhaps twice,” if the economy performs about as expected, even as they’ve been hiked to an appropriately restrictive level, Powell told the Senate Banking Committee Thursday.

The Fed chair said it is working families who suffer most directly and quickly from high inflation.

“It is for the benefit of those people and all other people that we need to restore 2% inflation in this country on a sustained basis,” he said. “We are committed to getting inflation under control and a strong majority of the committee feels that we’re close, but there’s a little further to go with rate hikes.”

Two-year treasuries declined further as he spoke, while the dollar gained against a basket of currencies.

Powell was on Capitol Hill for a second day, presenting the Fed’s semiannual economic update to Congress. He repeated the message he shared with the House Wednesday that the central bank was laser focused on reducing elevated inflation back to target despite Democrat lawmakers’ concerns that tighter credit will push up unemployment.

Fed officials held rates steady last week after 10 straight increases, giving themselves more time to evaluate how the economy is responding to recent banking stress and higher borrowing costs.

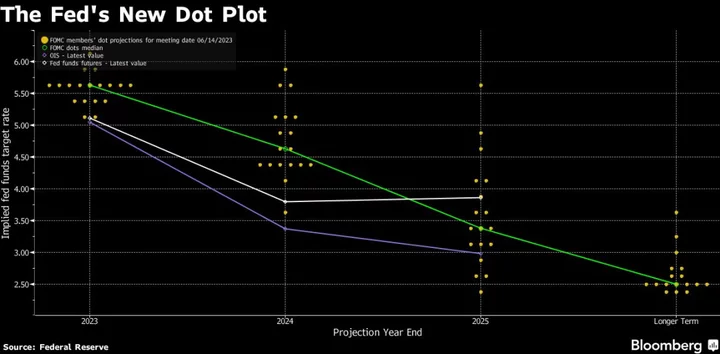

The move left the Fed’s benchmark rate steady in a range of 5% to 5.25%. But fresh economic projections released at the meeting show policymakers see interest rates rising by another 50 basis points this year, according to the median forecast.

Fed Governor Michelle Bowman reinforced Powell’s hawkish remarks earlier Thursday, telling a Fed Listens event in Cleveland that “additional policy-rate increases will be necessary” to curb inflation that is still unacceptably high.

--With assistance from Hannah Pedone and Jonnelle Marte.

(Updates with comment from Powell in second paragraph.)