US Bank Stocks Post First Monthly Gain Since Regional Tumult

Bank stocks notched their first monthly gain since before the collapse of Silicon Valley Bank in March after

2023-07-01 05:28

Why social media is being blamed for fueling riots in France

Social media companies are once again under scrutiny, this time in France as the country’s president blames TikTok, Snapchat and other platforms for helping fuel widespread riots over the fatal police shooting of a 17-year-old driver

2023-07-01 05:27

JPMorgan, Wells Fargo, Morgan Stanley to Pay Higher Dividends After Fed Stress Tests

JPMorgan Chase & Co., Wells Fargo & Co., Morgan Stanley and Goldman Sachs Group Inc. led US banks

2023-07-01 05:23

Crypto Exchange Kraken Ordered to Turn Over Its Users’ Information to IRS

Cryptocurrency exchange Kraken was ordered to comply with demands from the Internal Revenue Service to turn over information

2023-07-01 05:21

New York Times under fire for including ‘death’ on list of six ways to cancel student debt

The New York Times has been roasted on social media for listing “death” as a means to escape crippling student loans, after the Supreme Court struck down the Biden administration’s plan to cancel debt for millions of Americans. In an article soon after the Supreme Court’s ruling was released on Friday, the Times explained six ways “to get your student debt wiped away”. The suggestions included making an income-driven repayment, appealing for public service loan forgiveness, and bankruptcy and disability discharges. Under a subhead “death”, the Times wrote: “This is not something that most people would choose as a solution to their debt burden”. It went on to explain that federal student loan debt “dies with the person or people who take it on”. The macabre phrasing drew a swift backlash on social media. “That's a little dark, NYT,” writer Parker Molloy tweeted. “We’ve reached the point where The New York Times is suggesting death as a viable solution to crushing student debt,” wrote former Secretary of Labor Robert Reich. “I’ll try it out and tell u guys how it went,” another posted. The article was later revised, with the “death” subhead being changed to “debt won’t carry on”. The Times did not respond to a request for comment by The Independent. In a 6-3 decision, the Supreme Court ruled that the Biden administration had overstepped its authority in implementing a sweeping $400bn student debt relief plan. The decision means an estimated 43 million Americans will be back on the hook for student loan repayments later this year. In a press conference on Friday, President Joe Biden insisted the fight was not over, and promised a “new path” for relief that would be legally sound. He has tasked Secretary of Education Miguel Cardona with coming up with a new forgiveness plan that was consistent with the Supreme Court’s ruling. Read More Supreme Court strikes down Biden’s plan to cancel student loan debts Biden reveals ‘new path’ to student debt relief after Supreme Court strikes down president’s plan An Area 51 blogger was raided at gunpoint by federal agents. He says the US Government is trying to silence him Trump makes brash Georgia 2020 case prediction as DoJ ‘prepares new charges’ – live Biden reveals ‘new path’ to student debt relief Army combat veteran to take over key election security role working with state, local officials

2023-07-01 05:17

Biden's student loan forgiveness program was rejected by the Supreme Court. Here's what borrowers need to know

The Supreme Court struck down President Joe Biden's student loan forgiveness program Friday, blocking millions of borrowers from receiving up to $20,000 in federal student debt relief, just months before student loan payments are set to restart after a yearslong pause.

2023-07-01 05:17

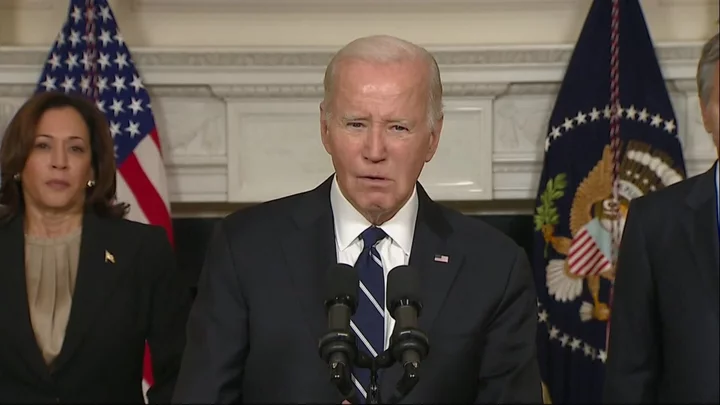

Biden reveals ‘new path’ to student debt relief after Supreme Court strikes down president’s plan

After the US Supreme Court struck down his administration’s plan to cancel federal student loan debts for millions of Americans, President Joe Biden has unveiled a “new path” for relief, one that he assured is “legally sound” but will “take longer”. In remarks from the White House on 30 June, the president hit out at Republican state officials and legislators who supported the lawsuit which enabled the nation’s highest court to strike down his student debt forgiveness initiative, accusing many of them of hypocrisy for taking money from pandemic-era relief programs while opposing relatively meager relief for student loan borrowers. “Some of the same elected Republicans, members of Congress who strongly opposed relief for students, got hundreds of thousands of dollars themselves ... several members of Congress got over a million dollars — all those loans are forgiven,” he said. “The hypocrisy is stunning,” he said. Accompanied by Secretary of Education Miguel Cardona, Mr Biden opened his remarks by acknowledging that there are likely “millions of Americans” who now “feel disappointed and discouraged or even a little bit angry about the court’s decision today on student debt”. “And I must admit, I do too,” he said. Still, Mr Biden reminded Americans that his administration has previously taken actions to reform student loan repayment programs to make them easier to access, and to keep borrowers from spending more than five per cent of disposable income on monthly repayments, and to strengthen loan forgiveness options for borrowers who take public service jobs. The president has directed Mr Cardona to “find a new way” to grant similar loan relief “as fast as we can” in a way that is “consistent” with the high court’s decision. On Friday, the Education Department issued the first step in the process of issuing new regulations under this so-called “negotiated rulemaking” process. In the mean time, Mr Biden said his administration is creating a temporary year-long “on-ramp repayment programme” under which conditions will remain largely the same as they have during the three-year pandemic-era pause in payments which is set to expire this fall. The department’s 12-month “on ramp” to begin repayments, from 1 October through 30 September, aims to prevent borrowers who miss repayments in that time period from delinquency, credit issues, default and referral to debt collection agencies. “During this period if you can pay your monthly bills you should, but if you cannot, if you miss payments, this on-ramp temporarily removes the threat of default,” he said. “Today’s decision closed one path. Now we’re going to pursue another — I’m never gonna stop fighting,” the president continued, adding that he will use “every tool” at his disposal to get Americans the student debt relief they need so they can “reach [their] dreams”. “It’s good for the economy. It’s good for the country. It’s gonna be good for you,” he said. Asked by reporters whether he’d given borrowers false hope by initiating the now-doomed forgiveness plan last year, Mr Biden angrily chided the GOP for having acted to take away the path to debt relief for millions. “I didn’t give any false hope. The question was whether or not I would do even more than was requested. What I did I felt was appropriate and was able to be done and would get done. I didn’t give borrowers false hope. But the Republicans snatched away the hope that they were given and it’s real, real hope,” he said. The Supreme Court’s 6-3 ruling from the conservative majority argues that the president does not have the authority to implement sweeping relief, and that Congress never authorised the administration to do so. Under the plan unveiled by the Biden administration last year, millions of people who took out federally backed student loans would be eligible for up to $20,000 in relief. Borrowers earning up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans to be wiped out. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants. Roughly 43 million federal student loan borrowers would be eligible for that relief, including 20 million people who stand to have their debts cancelled completely, according to the White House. Lawyers for the Biden administration contended that he has the authority to broadly cancel student loan debt under the Higher Education Relief Opportunities for Students Act of 2003, which allows the secretary of education to waive or modify loan provisions following a national emergency – in this case, Covid-19. Since March 2020, with congressional passage of the Cares Act, monthly payments on student loan debt have been frozen with interest rates set at zero per cent. That pandemic-era moratorium, first enacted under Donald Trump and extended several times, was paused a final time late last year. Over the last decade, the student loan debt crisis has exploded to a balance of nearly $2 trillion, most of which is wrapped up in federal loans. The amount of debt taken out to support student loans for higher education costs has surged alongside growing tuition costs, increased private university enrollment, stagnant wages and GOP-led governments stripping investments in higher education and aid, putting the burden of college costs largely on students and their families. Read More Supreme Court strikes down Biden’s plan to cancel student loan debts Supreme Court strikes down affirmative action, banning colleges from factoring race in admissions Biden condemns Supreme Court striking down affirmative action: ‘This is not a normal court’ Justice Ketanji Brown Jackson delivers searing civil rights lesson in dissent to affirmative action ruling

2023-07-01 04:52

Biotech Cyteir’s Drug Flop Turns Into Boon for Investors on Cash Return

A little-known biotech company, Cyteir Therapeutics Inc., notched its best day ever — on the back of plans

2023-07-01 04:47

Unlicensed Hong Kong radio station that hosted pro-democracy guests goes off the air after 18 years

An unlicensed pro-democracy radio station in Hong Kong is going off the air after 18 years of service

2023-07-01 04:46

Nokia renews patent license agreement with Apple

Nokia said on Friday it had signed a new long-term patent license agreement with Apple, as the current

2023-07-01 04:46

Stock Market Rally That Shocked Everyone Is Finally Broadening Beyond Tech

The big knock on the 2023 stock rally is that it rests on half-a-dozen companies thriving on hype.

2023-07-01 04:45

Fox News settles with former Tucker Carlson producer who testified in Dominion case for $12 million

A lawyer for a former Fox News producer who says the network coerced her into giving false testimony in Dominion Inc.'s defamation lawsuit says her former employer is paying her $12 million to settle her legal claims

2023-07-01 04:24

You Might Like...

Sazae Japan Partners With Boomi to Tackle Integration Issues Faced by Japanese Companies

Walmart staffed up for holidays; US retailers cautious about economy

Morgan Stanley’s Ellen Zentner Says Fed Is Done Raising Rates for Now

WeWork Shares Sink After Report It Plans to File for Bankruptcy

Lilly extends tender offer to acquire Point Biopharma to Dec 1

Chevron poised for mediation talks to avert Australia LNG strike

Israel Latest: Hezbollah, Israel Trade Fire on Lebanon Border

Qantas chairman refuses to quit amid investor pressure - ABC News