Israeli jets struck Hezbollah targets in Lebanon after the militia launched guided missiles at an Israeli army post in spreading violence.

Iran-backed Hezbollah has expressed solidarity with Hamas, the Gaza-based militant group which launched an attack on Israel with a ground incursion and rockets this weekend. It is thought to have tens of thousands of missiles and analysts have said it may opt to attack Israel more forcefully, especially if Israeli troops move into Gaza.

At least 1,200 Israelis have been killed so far in the violence with Hamas, which is designated a terrorist organization by the US and EU. Retaliatory attacks have left more than 1,000 Palestinians dead, authorities say.

For more on the Israel-Hamas war, click here.

All time stamps are Israeli time.

CDS Show Investors Most Jittery in a Decade on Israel (13:30 p.m)

With the shekel being defended by Israel’s central bank, investors were using credit default swaps as the means of expressing their concerns about the conflict.

The cost to hedge against default by the Israeli government in the next five years jumped for a second day to 97 basis points, showing the highest level of risk perception since January 2014.

The TA-35 equity benchmark drifted lower, halting two days of gains, though the country’s technology stocks continued to rally. The shekel was little changed around the 3.95-per-dollar mark, the level it has held since policymakers unveiled a $45 billion program to limit volatility.

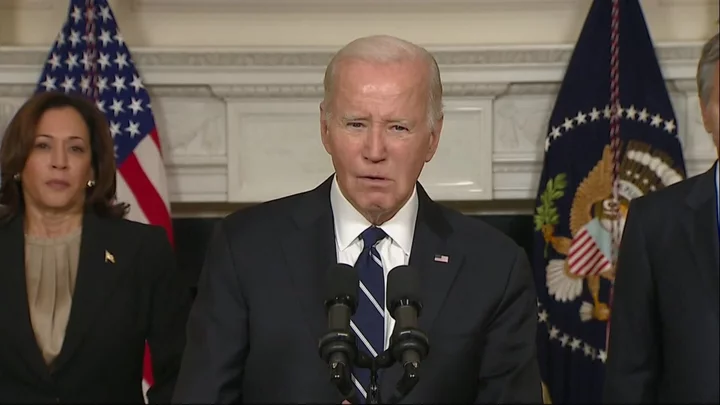

US Doesn’t Rule Out Iran Sanctions, Economic Impact Muted (1:30 p.m.)

US Treasury Secretary Janet Yellen said the Biden administration hasn’t ruled out new sanctions against Iran in relation to renewed conflict in the Middle East, but no decisions have been made.

“I wouldn’t take anything off the table in terms of future possible actions, but I certainly don’t want to get ahead of where we are now,” Yellen said during a press conference in Marrakech, Morocco, where she was speaking to reporters at the annual meetings for the International Monetary Fund and World Bank.

Yellen downplayed concerns over the conflict’s potential to upend the global economy. “We’re monitoring potential economic impacts from the crisis, but I’m not really thinking of that as a major likely driver of the global economic outlook,” she said.

Oil And Gas Drift Lower As Supply Unaffected (1 p.m.)

Oil and gas prices drifted lower as no further supply disruptions emerged as a result of the conflict. In Europe, the first cold snap of the season was set to become the main driver of natural gas prices in the coming days. The top oil officials from Russia and Saudi Arabia, Deputy Prime Minister Alexander Novak and Energy Minister Prince Abdulaziz bin Salman, will meet in Moscow later on Wednesday to discuss the situation in Israel and how it might affect markets.

Bonds Gain and Stocks Stall on War Escalation (1 p.m.)

The 10-year US Treasury yield fell 10 basis points after Israel intensified air strikes on Hamas targets in Gaza and missiles were fired at Israel from Lebanon. Treasuries held gains even after Federal Reserve Governor Michelle Bowman said higher rates may be needed to curb inflation. Germany’s 10-year yield dropped six basis points.

Israeli Aircraft Strike Back at Hezbollah in Lebanon (12.57 p.m.)

Israeli aircraft struck terror targets belonging to the Hezbollah organization in Lebanon in response to an anti-tank missile fired earlier. The Israeli Defense Force also struck the area from which the launch originated.

Erdogan Warns Israel Over ‘Disproportionate’ Attacks (12:46 p.m.)

“Disproportionate and unconscionable attacks on Gaza could push Israel to an unexpected and unwanted position in the eye of world public opinion,” President Recep Tayyip Erdogan said in Ankara, addressing his ruling AK Party members.

Erdogan said Turkey was against civilian killings in both Gaza and on Israeli soil. Turkey does not consider Hamas a terrorist organization.

Netanyahu Meets Gantz for Talks on Unity Government (12:05 p.m.)

Prime Minister Netanyahu and opposition leader Gantz are meeting to discuss the formation of a possible emergency government.

Israel’s ruling coalition said Tuesday it wants to establish a national unity government with the opposition, authorizing Netanyahu to act for its formation.

Gantz is the leader of Israel’s second-largest opposition party, with 12 seats in Israel’s parliament. Gantz has said that a wartime cabinet would focus strictly on security challenges.

Bank of Israel Interventions Should Suffice to Hold Markets (12:03 p.m.)

The Bank of Israel’s $45 billion package of support measures for the shekel “should be sufficient to hold the market around these levels,” according to Daniel Hass, head of fixed income and currency strategy at Bank Hapoalim in Tel Aviv.

“It may slide a little bit further but that will be dependent on how the conflict continues,” he said in an interview with Bloomberg Television. The program wasn’t designed to return the Israeli currency back below 3.8 per dollar, he said. “Their objective isn’t to change the trend, what they want to do is regulate volatility in the market and they want to stabilize the currency.”

Gaza Set to Lose All Power Supply Soon (10:43 a.m.)

Zafer Melhem, an official with the Palestinian energy authority, said Gaza’s only power plant had a diesel stockpile of around 300,000 liters left — just enough to keep it going for about 12 hours.

The power plant is unable to receive additional fuel after Israel cut off supplies in the wake of the Hamas attack.