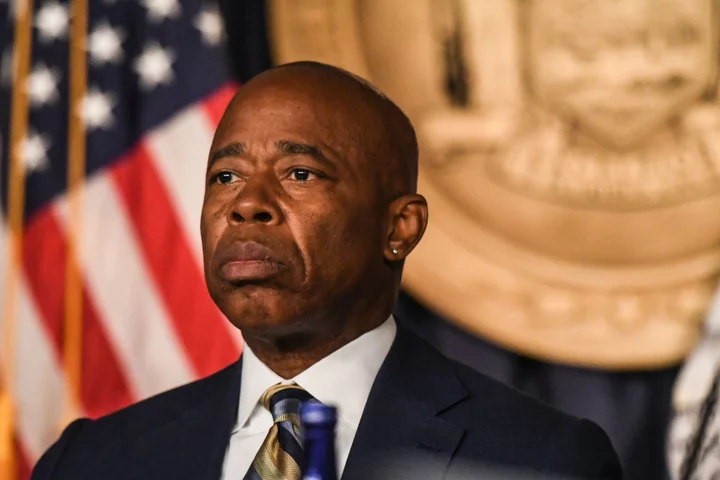

New York Mayor Eric Adams Blasts SCOTUS Decision, Advocates for Education

The Supreme Court’s recent decision to strike down affirmative action is effectively “undoing all of our rights,” New

2023-07-03 07:57

Americans Divided Over Landmark Supreme Court Decisions in Poll

About half of Americans support the Supreme Court decision curtailing the use of race in college admissions and

2023-07-02 23:46

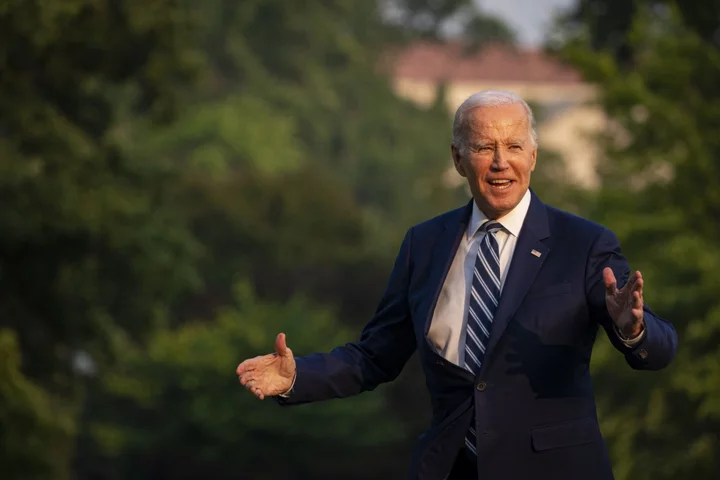

Biden to Visit UK, Lithuania on Way to NATO Summit in Finland

US President Joe Biden will travel to the UK, Lithuania and Finland July 9-13, the White House said.

2023-07-02 22:48

Trump Praises Supreme Court Decisions at Rally in South Carolina

Donald Trump praised Supreme Court rulings that ended affirmative action in college admissions and a student debt-relief program,

2023-07-02 04:17

Biden to Discuss NATO Membership in Meeting With Swedish Premier

President Joe Biden will discuss security cooperation when he hosts Swedish Prime Minister Ulf Kristersson at the White

2023-07-01 21:23

Sunak’s Struggles, Water Woes and Pride: Saturday UK Briefing

Pride flags are flying over London for today’s annual LGBTQ parade. More than 1.5 million people attended last

2023-07-01 19:20

Supreme Court Flexes Conservative Muscles in Term’s Final Days

The US Supreme Court waited until the end of its nine-month term to remind the country just how

2023-07-01 10:58

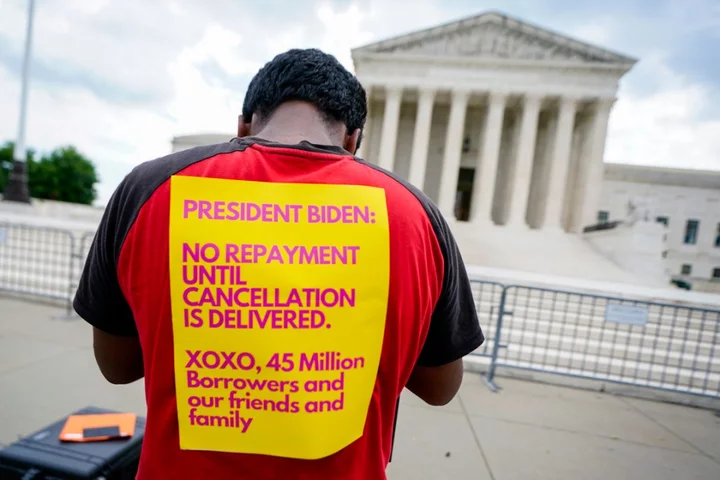

New York Times under fire for including ‘death’ on list of six ways to cancel student debt

The New York Times has been roasted on social media for listing “death” as a means to escape crippling student loans, after the Supreme Court struck down the Biden administration’s plan to cancel debt for millions of Americans. In an article soon after the Supreme Court’s ruling was released on Friday, the Times explained six ways “to get your student debt wiped away”. The suggestions included making an income-driven repayment, appealing for public service loan forgiveness, and bankruptcy and disability discharges. Under a subhead “death”, the Times wrote: “This is not something that most people would choose as a solution to their debt burden”. It went on to explain that federal student loan debt “dies with the person or people who take it on”. The macabre phrasing drew a swift backlash on social media. “That's a little dark, NYT,” writer Parker Molloy tweeted. “We’ve reached the point where The New York Times is suggesting death as a viable solution to crushing student debt,” wrote former Secretary of Labor Robert Reich. “I’ll try it out and tell u guys how it went,” another posted. The article was later revised, with the “death” subhead being changed to “debt won’t carry on”. The Times did not respond to a request for comment by The Independent. In a 6-3 decision, the Supreme Court ruled that the Biden administration had overstepped its authority in implementing a sweeping $400bn student debt relief plan. The decision means an estimated 43 million Americans will be back on the hook for student loan repayments later this year. In a press conference on Friday, President Joe Biden insisted the fight was not over, and promised a “new path” for relief that would be legally sound. He has tasked Secretary of Education Miguel Cardona with coming up with a new forgiveness plan that was consistent with the Supreme Court’s ruling. Read More Supreme Court strikes down Biden’s plan to cancel student loan debts Biden reveals ‘new path’ to student debt relief after Supreme Court strikes down president’s plan An Area 51 blogger was raided at gunpoint by federal agents. He says the US Government is trying to silence him Trump makes brash Georgia 2020 case prediction as DoJ ‘prepares new charges’ – live Biden reveals ‘new path’ to student debt relief Army combat veteran to take over key election security role working with state, local officials

2023-07-01 05:17

Biden reveals ‘new path’ to student debt relief after Supreme Court strikes down president’s plan

After the US Supreme Court struck down his administration’s plan to cancel federal student loan debts for millions of Americans, President Joe Biden has unveiled a “new path” for relief, one that he assured is “legally sound” but will “take longer”. In remarks from the White House on 30 June, the president hit out at Republican state officials and legislators who supported the lawsuit which enabled the nation’s highest court to strike down his student debt forgiveness initiative, accusing many of them of hypocrisy for taking money from pandemic-era relief programs while opposing relatively meager relief for student loan borrowers. “Some of the same elected Republicans, members of Congress who strongly opposed relief for students, got hundreds of thousands of dollars themselves ... several members of Congress got over a million dollars — all those loans are forgiven,” he said. “The hypocrisy is stunning,” he said. Accompanied by Secretary of Education Miguel Cardona, Mr Biden opened his remarks by acknowledging that there are likely “millions of Americans” who now “feel disappointed and discouraged or even a little bit angry about the court’s decision today on student debt”. “And I must admit, I do too,” he said. Still, Mr Biden reminded Americans that his administration has previously taken actions to reform student loan repayment programs to make them easier to access, and to keep borrowers from spending more than five per cent of disposable income on monthly repayments, and to strengthen loan forgiveness options for borrowers who take public service jobs. The president has directed Mr Cardona to “find a new way” to grant similar loan relief “as fast as we can” in a way that is “consistent” with the high court’s decision. On Friday, the Education Department issued the first step in the process of issuing new regulations under this so-called “negotiated rulemaking” process. In the mean time, Mr Biden said his administration is creating a temporary year-long “on-ramp repayment programme” under which conditions will remain largely the same as they have during the three-year pandemic-era pause in payments which is set to expire this fall. The department’s 12-month “on ramp” to begin repayments, from 1 October through 30 September, aims to prevent borrowers who miss repayments in that time period from delinquency, credit issues, default and referral to debt collection agencies. “During this period if you can pay your monthly bills you should, but if you cannot, if you miss payments, this on-ramp temporarily removes the threat of default,” he said. “Today’s decision closed one path. Now we’re going to pursue another — I’m never gonna stop fighting,” the president continued, adding that he will use “every tool” at his disposal to get Americans the student debt relief they need so they can “reach [their] dreams”. “It’s good for the economy. It’s good for the country. It’s gonna be good for you,” he said. Asked by reporters whether he’d given borrowers false hope by initiating the now-doomed forgiveness plan last year, Mr Biden angrily chided the GOP for having acted to take away the path to debt relief for millions. “I didn’t give any false hope. The question was whether or not I would do even more than was requested. What I did I felt was appropriate and was able to be done and would get done. I didn’t give borrowers false hope. But the Republicans snatched away the hope that they were given and it’s real, real hope,” he said. The Supreme Court’s 6-3 ruling from the conservative majority argues that the president does not have the authority to implement sweeping relief, and that Congress never authorised the administration to do so. Under the plan unveiled by the Biden administration last year, millions of people who took out federally backed student loans would be eligible for up to $20,000 in relief. Borrowers earning up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans to be wiped out. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants. Roughly 43 million federal student loan borrowers would be eligible for that relief, including 20 million people who stand to have their debts cancelled completely, according to the White House. Lawyers for the Biden administration contended that he has the authority to broadly cancel student loan debt under the Higher Education Relief Opportunities for Students Act of 2003, which allows the secretary of education to waive or modify loan provisions following a national emergency – in this case, Covid-19. Since March 2020, with congressional passage of the Cares Act, monthly payments on student loan debt have been frozen with interest rates set at zero per cent. That pandemic-era moratorium, first enacted under Donald Trump and extended several times, was paused a final time late last year. Over the last decade, the student loan debt crisis has exploded to a balance of nearly $2 trillion, most of which is wrapped up in federal loans. The amount of debt taken out to support student loans for higher education costs has surged alongside growing tuition costs, increased private university enrollment, stagnant wages and GOP-led governments stripping investments in higher education and aid, putting the burden of college costs largely on students and their families. Read More Supreme Court strikes down Biden’s plan to cancel student loan debts Supreme Court strikes down affirmative action, banning colleges from factoring race in admissions Biden condemns Supreme Court striking down affirmative action: ‘This is not a normal court’ Justice Ketanji Brown Jackson delivers searing civil rights lesson in dissent to affirmative action ruling

2023-07-01 04:52

US Spies Issue Warnings Over Risks of Doing Business in China

US intelligence officials renewed warnings for American companies doing business in China, citing an update to a counterespionage

2023-07-01 02:55

Supreme Court strikes down Biden’s plan to cancel student loan debts

The US Supreme Court has struck down President Joe Biden’s plan to cancel student loan debts for millions of Americans, reversing his campaign-trail promise as borrowers prepare to resume payments this summer. Chief Justice John Roberts delivered the 6-3 decision from the court’s conservative majority on 30 June. The ruling, which stems from a pair of cases challenging the Biden administration and the US Department of Education, argues that the president does not have the authority to implement sweeping relief, and that Congress never authorised the administration to do so. Within 30 minutes on the last day of its term, the court upended protections for LGBT+ people and blocked the president from a long-held promise to cancel student loan balances amid a ballooning debt crisis impacting millions of Americans. Under the plan unveiled last year, millions of people who took out federally backed student loans would be eligible for up to $20,000 in relief. Borrowers earning up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans to be wiped out. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants. Roughly 43 million federal student loan borrowers would be eligible for that relief, including 20 million people who stand to have their debts canceled completely, according to the White House. Roughly 16 million already submitted their applications and received approval for debt cancellation last year, according to the Biden administration. The long-anticipated plan for debt cancellation was met almost immediately with litigation threats from conservative legal groups and Republican officials, arguing that the executive branch does not have authority to broadly cancel such debt. Six GOP-led states sued the Biden administration to stop the plan altogether, and a federal appeals court temporarily blocked any such relief as the legal challenges played out. Lawyers for the Biden administration contended that he has the authority to broadly cancel student loan debt under the Higher Education Relief Opportunities for Students Act of 2003, which allows the secretary of education to waive or modify loan provisions following a national emergency – in this case, Covid-19. Justice Roberts wrote that the law allows the secretary to “waive or modify” existing provisions for financial assistance, “not to rewrite that statute from the ground up.” The Supreme Court’s final decision of its 2022-2023 term also comes one day after another major education ruling, as the same conservative majority upended decades of precedent intended to promote racially diverse college campuses, what civil rights groups and the court’s liberal justices have derided as the court’s perversion of the 14th Amendment and the foundational concept of equal protection. Moments before its decision in the student debt plan, the Supreme Court decided a case involving a website designer who refused to cater to same-sex couples, but the case did not involve any such couple. Likewise, the case at the centre of the court’s decision on student loans involved an independent loan servicer in Missouri that did not want to be associated with the lawsuit. The six GOP-led states that led the challenge – Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina – opposed the Biden administration’s plan for a range of reasons that amount to “just general grievances; they do not show the particularized injury needed to bring suit,” Justice Elena Kagan wrote in her dissent. “And the States have no straightforward way of making that showing – of explaining how they are harmed by a plan that reduces individual borrowers’ federal student-loan debt,” she added. “So the States have thrown no fewer than four different theories of injury against the wall, hoping that a court anxious to get to the merits will say that one of them sticks.” She admonished a decision in which “the result here is that the Court substitutes itself for Congress and the Executive Branch in making national policy about student-loan forgiveness.” “The Court acts as though it is an arbiter of political and policy disputes, rather than of cases and controversies,” and by deciding the case, the court exceeds “the permissible boundaries of the judicial role,” Justice Kagan wrote. Since March 2020, with congressional passage of the Cares Act, monthly payments on student loan debt have been frozen with interest rates set at zero per cent. That Covid-19-pandemic era moratorium, first enacted under Donald Trump and extended several times, was paused a final time late last year – until the Education Department is allowed to cancel debts under the Biden plan, or until the litigation is resolved, but no later than 30 June. Payments would then resume 60 days later. The amount of debt taken out to support student loans for higher education costs has surged within the last decade, alongside growing tuition costs, increased private university enrollment, stagnant wages and GOP-led governments stripping investments in higher education and aid, putting the burden of college costs largely on students and their families. The crisis has exploded to a total balance of nearly $2 trillion, mostly wrapped up in federal loans. Millions of Americans also continue to tackle accrued interest without being able to chip away at their principal balances, even years after graduating, or have been forced to leave their colleges or universities without obtaining a degree at all while still facing loan repayments. Borrowers also have been trapped by predatory lending schemes with for-profit institutions and sky-high interest rates that have made it impossible for many borrowers to make any progress toward paying off their debt, with interest adding to balances that exceed the original loan. One analysis from the Education Department found that nearly 90 per cent of student loan relief would support people earning less than $75,000 per year. The median income of households with student loan balances is $76,400, while 7 per cent of borrowers are below the poverty line. That debt burden also falls disproportionately on Black borrowers and women. Black college graduates have an average of $52,000 in student loan debt and owe an average of $25,000 more than white graduates, according to the Education Data Initiative. Four years after graduating, Black student loan borrowers owe an average of 188 per cent more than white graduates. Women borrowers hold roughly two-thirds of all student loan debt, according to the American Association of University Women. Mr Biden’s announcement fulfilled a campaign-trail pledge to wipe out $10,000 in student loan debt per borrower if elected, though debt relief advocates and progressive lawmakers have urged him to cancel all debts and reject means-testing barriers in broad relief measures. In November 2020, the president called on Congress to “immediately” provide some relief for millions of borrowers saddled by growing debt. “[Student debt is] holding people up,” he said at the time. “They’re in real trouble. They’re having to make choices between paying their student loan and paying the rent.” ReNika Moore, director of the Racial Justice Program with the ACLU, among civil rights groups that filed briefs with the Supreme Court to defend the loan cancellation plan, said the “one-two punch” to end affirmative action and block debt relief will lock Americans out of economic oppurtunity and worsen wealth equality. “We urge the Biden administration and the Department of Education to move quickly to explore other pathways to ease the debt load on student loan borrowers once payments resume after a pandemic-related pause, including new executive action under the Higher Education Act, a law that allows for student loan relief for certain groups,” she added. Read More Supreme Court allows Colorado designer to deny LGBT+ customers in ruling on last day of Pride Month Biden condemns Supreme Court striking down affirmative action: ‘This is not a normal court’ Justice Ketanji Brown Jackson delivers searing civil rights lesson in dissent to affirmative action ruling The Supreme Court’s ruling on affirmative action is ugly and frustrating – but no surprise

2023-07-01 01:54

Man Who Took Part in Capitol Attack Arrested Near Obama’s Home

A man who took part in the Jan. 6 attack on the US Capitol was arrested Thursday night

2023-06-30 14:28

You Might Like...

Saudi Football Club Refuses to Play in Iran Over Pitchside Bust

Taiwan Frontrunner Plans Low-Key US Trip With China Looming

Truth Social’s merger partner reaches $18m settlement with SEC

McCarthy Faces Attempt by Far Right to Remove Him as Speaker

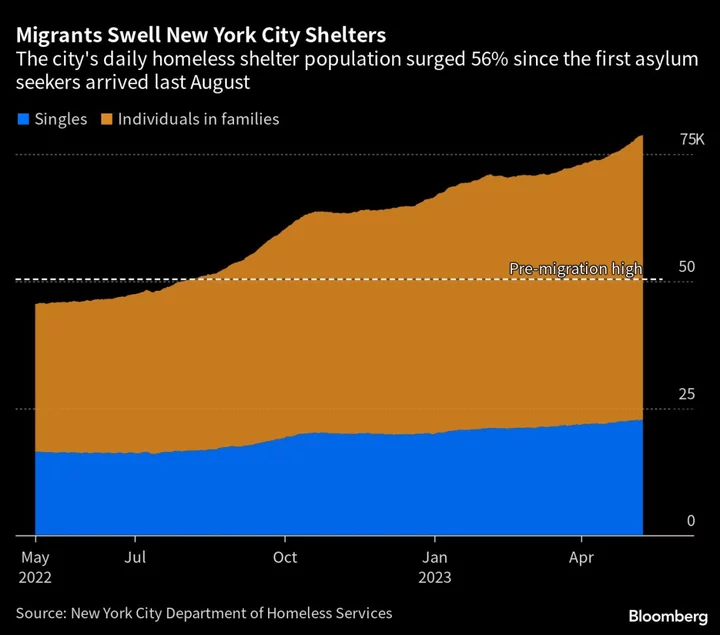

NYC, Chicago Clash With Biden as Migrant Surge Crushes Cities’ Finances

Trump Indictments Sparked Threats Linked to Russians, Extremists

IMF closely monitoring situation in Israel, Gaza

Imran Khan’s Former Minister Exits Politics After Pakistan Army Clash