From the weakest borrowers in Corporate America to the abandoned districts of the S&P 500, Wall Street traders are placing fresh all-or-nothing bets that the US economy will survive Jerome Powell’s war on inflation.

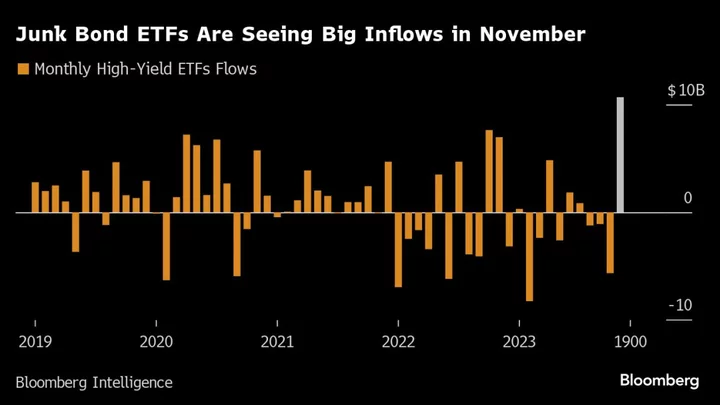

Small-cap stocks just surged the most versus the broader market since February 2022, while a version of the large-cap benchmark that dilutes the influence of megacaps posted its biggest weekly outperformance since early summer. After money was drained from them for months, funds tracking high-yield bonds have sucked in nearly $11 billion. Even Cathie Wood’s flagship Ark fund is back en vogue.

Underpinning the revival is a speculative frenzy tied to views that the Federal Reserve can beat inflation without spurring a recession. While soft-landing evidence mounted this week, via a tame consumer-price report as well as strength in retail spending and housing, recent history is littered with examples of similar optimism ending up misplaced.

“It’s a pipe dream,” says Wells Fargo Investment Institute’s Sameer Samana. “Either the economy will reaccelerate and inflation along with it, which will lead to the Fed starting another round of rate hikes and there will be a harder landing later. Or, the soft landing will quickly turn into a broader and deeper economic slowdown.”

Investors are growing more certain that the central bank is finished with its historic tightening campaign and are penciling rate cuts for the first half of next year. The Russell 2000 index of small caps added more than 5%, while automakers and banks rallied. Just as global stock funds saw their second-biggest inflow of the year, according to EPFR Global data, the ARK Innovation ETF (ARKK) had its best week of inflows this year with traders opting for rate-sensitive speculative tech stocks.

After three straight months of outflows, junk-bond exchange-traded funds are on track for their best month of inflows on record, according to data compiled by Bloomberg.

Fueling it is a hope that has surfaced repeatedly during Fed Chair Powell’s campaign to subdue consumer prices: That growth may bend but is unlikely to break even as the central bank works to undo stimulus. Since the start of November, data on everything from hiring to consumer sentiment and retail sales have depicted an economy losing vigor but exceeding worst-case forecasts. Third-quarter S&P 500 earnings are on track to rise about 4%, compared with estimates for a 1% decline a month ago.

Still, it’s not the first time euphoria pegged to the Fed has arisen to foment gains in economically sensitive corners. Deutsche Bank AG macro strategist Henry Allen points to six instances over the past two years when the Fed was derailed from the dovish pivot market participants were betting on. Take July of last year when a print showing cooling inflation, along with Powell’s comments about slowing the pace of increases, lifted sentiment. That helped spur a double-digit gain for the S&P 500 in the span of a month — only for a hawkish speech at Jackson Hole to fade the gains.

“Some of my concern is how quickly investors have re-allocated the flows,” said John Porter, chief investment officer of equities at Newton Investment Management. “The things that they had complete disdain for two or three weeks ago, they’re now all in on. It just feels like too rapid of a switch in sentiment.”

While risk-on bets have pushed the S&P 500 up three weeks in a row, much of the advance is the result of gains in technology stocks that have proven themselves resistant to the economic cycle. Increases in small caps remain but a blip on longer-term charts showing them down 20% from the start of last year, while financial firms are flat in 2023 and the equal-weight S&P 500 only recently turned positive.

Early stage as the moves may be, money managers on the whole are showing signs of more durable optimism. Almost 75% of investors recently surveyed said a soft landing is their base case for the global economy in 2024, according to a Bank of America Corp. poll.

Markets are now pricing in 92 basis points of rate cuts next year, according to the interest-rate swap market, compared with Fed officials’ estimating half a point of easing for 2024. That threatens bad surprises for those investors positioned for a sharp easing in monetary policy.

“The lesson of the past few years is that all good investors must be humble in their economic projections,” said Lindsay Rosner, head of multi-sector fixed income investing at Goldman Sachs Asset Management. “It is best to run a probabilistic view of the world and that is not one which soft-landing happens with 100% probability.”

--With assistance from Emily Graffeo, Isabelle Lee and Michael Mackenzie.