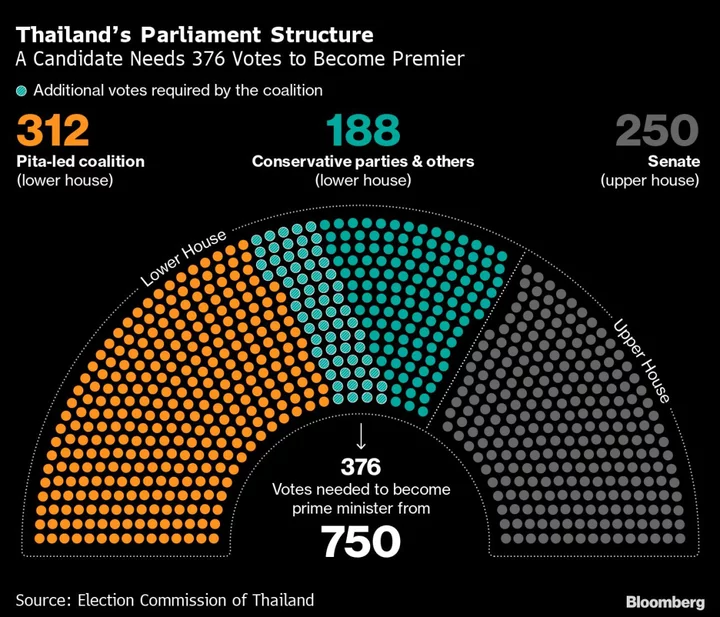

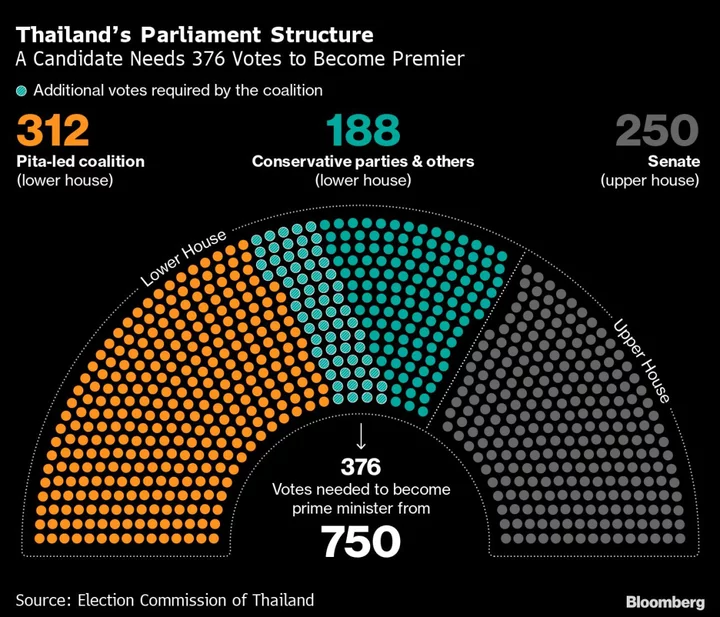

Latest Hurdle for Thai Election Winner Centers on Media Shares

One month after Thailand’s pro-democracy parties won the election that ended nearly a decade of military-backed rule, hurdles

2023-06-15 17:57

Championship clubs’ wage bill exceeds revenue for fifth year running – report

Championship clubs’ spending on wages exceeded revenue for a fifth successive season in 2021-22, according to a new report. Deloitte’s Annual Review of Football Finance found second-tier teams’ combined wages-to-revenue ratio was an astonishing 108 per cent, as clubs continued to chase the dream of reaching the Premier League. Nottingham Forest, who ultimately succeeded in reaching the top flight at the end of the 2021-22 season via the play-offs, spent almost 200 per cent more on wages than they earned in revenue – £58.6million compared to £29.3m – in their promotion year, according to figures in the Deloitte report. Championship clubs’ total revenue was up 13 per cent in 2021-22 compared to the season before, reaching £676million. However, while wage costs fell for a second consecutive year, they remained higher than revenue for the fifth season in a row. Tim Bridge, lead partner in Deloitte’s Sports Business Group, said: “The glamour of Premier League promotion is spearheading the continual drive for investment in Championship clubs, often in an unsustainable manner, driving some clubs to overstretch financially. “It is critical that long-term decisions are now made by clubs’ owners and, with the introduction of the independent regulator, focus will turn to improving the distribution mechanism of revenues between the leagues and clubs. “This must be accompanied by appropriate governance and financial controls to ensure that any proposed solution is suitable and sustainable.” EFL chairman Rick Parry believes the disparity in revenue between the Premier League and the Championship has created a “cliff edge” between the leagues, and argues parachute payments are also fuelling inequality within the Championship. Deloitte’s report underlines the value to clubs of reaching the Premier League. Relative to the 2022-23 season, it says revenue from broadcasters is expected to provide a minimum uplift of more than £90m for Luton, approximately £84m for Sheffield United and £54m for Burnley, with both of those two clubs in receipt of parachute payments whilst participating in the Championship. The report said that should a club suffer immediate relegation, assuming they are not in receipt of parachute payments at that point, under existing arrangements the parachute payments from the Premier League will continue to provide an uplift over the following two seasons of at least £80m. For a Championship club not otherwise in receipt of parachute payments, the value of promotion will be at least £170m across the next three seasons and, if a club survives their first season in the Premier League, they will be entitled to three seasons of parachute payments and the incremental revenue will be over £290m across five years. Discussions over a new financial settlement between the two leagues are ongoing. The Government said in its White Paper on football governance that a new regulator will be given backstop powers to impose a settlement if one cannot be agreed, but it is unlikely the regulator will be up and running until 2024-25 at the earliest. Parry accepts that reform of the distribution package has to go hand in hand with cost control measures, which are also part of the ongoing ‘New Deal For Football’ talks between the EFL, the Premier League and the Football Association. What we really want to see in the English game is a variety and diversity of clubs coming through the league at different points in time Tim Bridge, lead partner in Deloitte’s Sports Business Group Bridge believes it is vital for the leagues to see the common ground they share to resolve the dispute on distribution. “The point I would make is that the longevity of the Premier League and the ability for clubs to move up and down between the Premier League and the Championship and to achieve variety in those clubs is a good thing for the overall brand and the marketing position of English football,” he said. “Part of the beauty of the Premier League is always that any team can beat any other team. And so at any one point in time, what we really want to see in the English game is a variety and diversity of clubs coming through the league at different points in time, bringing new storylines, bringing new faces to the league because frankly that keeps it fresh.” Wage spending in the Premier League in 2021-22 grew by £192m compared to the previous season, but this was outpaced by a £586m increase in revenue, meaning the top flight’s wages-to-revenue ratio fell for the second consecutive season from 71 per cent to 67 per cent. That is still a significantly higher ratio than the average of the three seasons pre-pandemic up to 2018-19 – 58 per cent. Across Europe’s ‘Big Five’ leagues as a whole however, revenue growth was outpaced by wages, which stood at 12.3 billion euros (£10.5bn). This comes at a time when the continent’s football governing body UEFA has introduced new financial sustainability regulations, including a cost control rule which by 2025-26 will limit a club’s spending on wages, transfer fees and other player and coach costs at 70 per cent of turnover. UEFA could go even further in the future, with president Aleksander Ceferin raising the possibility of a Europe-wide salary cap in an interview in April.

2023-06-15 07:25

MTN Fights ‘Bizarre’ Funds Seizure in Cameroon Over Dispute

A Cameroon court ordered banks used by South Africa’s MTN Group Ltd. to transfer its funds into escrow

2023-06-14 23:28

Factbox-Vodafone, Hutchison UK merger to create country's largest mobile operator

Vodafone and CK Hutchison unveiled the merger of their British operations, creating the country's largest mobile operator. Hutchison

2023-06-14 19:52

Sportswashing is about to change football beyond anything you can imagine

After Pep Guardiola put down the European Cup, he immediately implored his players to embrace that feeling. The Catalan may have joked in his press conference about catching up with Real Madrid but he was deeply serious in private about now going on to retain the Champions League and win many more. It wasn’t just the joy of victory that ran through the club in the early hours of Sunday morning, after all. It was the sense a psychological barrier had been broken. That has also meant we are in new territory for the game, as it faces a period of huge upheaval. A first Champions League for a state-owned club is a historic landmark, most of all for a future that has long been coming. Such success is a statistical inevitability when you can invest as much as possible without any risk. Many would point to how all of this is actually part of an economic plan for states like the United Arab Emirates and Saudi Arabia, and that is true, even if sport is one part of this where it’s more about normalisation and image than actual economic return. The differences in figures are too great. The “sportswashing” aims are more sophisticated. They still form a core of projects outlined by documents such as The Abu Dhabi Economic Vision 2030 and Saudi Arabia’s Vision 2030. The parallel selection of that year, and how all of this has influenced the game, now provokes a more searching question. What will football actually look like by 2030? That year is all the more important since it is when the centenary World Cup will take place, a competition that has immense symbolic value. The hosts will be decided in the third quarter of 2024 and that process is still seen by football industry figures as one of the most influential factors in the game. The outcome essentially dictates the next decade of football, if not longer. That is primarily because they shape the next biggest factors, which are broadcasting deals and the purchase of clubs. This can be tracked over the last 30 years. The 1994 World Cup introduced the United States business world to the true scale of football’s global popularity. It is not a coincidence that, by March 2003, the Glazers purchased their first tranche of shares in Manchester United. A new business trend had been set. The winning of the 2022 World Cup is meanwhile not just as one of the most influential moments in football history but also in the Middle East. Virtually every serious analyst on the area sees it as a direct cause of the Gulf blockade, and it clearly accelerated a sporting race between the involved countries. Other World Cups have had different effects, 2002 for example initiating changes in the calendar, but it was 1994 and 2022 that have contributed the two driving forces shaping football for the next seven years. One is western capitalism, mostly through US venture capitalists and private equity funds. The other is Gulf politics. It is inevitable that the most powerful competition in the world, the Premier League, showcases this. Half of next season’s clubs have American owners with controlling influence. City and Newcastle United are owned by Abu Dhabi and Saudi Arabia, respectively. The competition’s biggest club, Manchester United, may fittingly become a juncture point in this if the Glazers take the immensely consequential - and equally controversial - decision to sell to Qatar. It would also largely illustrate how this works. Barcelona, ‘economic levers’ and the next phase of sportswashing Money from the Gulf blockade countries is the dominant factor, since they are willing to pump in so much of it in all areas. It is within the gaps created by this dramatically expanding game that Western capitalists then exert their influence, picking off purchases where there is opportunity. You only have to look at the capital-raising deals Barcelona struck last summer to stay competitive, all from a world where they had their best executives and players picked off by City and Paris Saint-Germain respectively. La Liga itself pursued the deal with private equity group CVC to try and catch up with the Premier League, while Serie A has been looking at similar. There is a growing theory within the game that the next step in this will be sovereign wealth funds seeking to strike similar deals. That could completely change the power balance between domestic competitions, as one league could suddenly see many of its clubs inflated to Premier League level. It would be an entirely logical evolution from just buying clubs, in the way buying clubs was an evolution from sponsorships and staging events. The recent Saudi announcement of the Public Investment Fund privatising four of its clubs even offers a model. The current model of the game, a global pyramid that has been growing for over a century, is being chipped away at from all angles. Abu Dhabi’s City currently sit at the peak, one which has been made narrower by the financial power required to get to that level. We have reached a point where it feels like only about eight clubs can win the Champions League, although Newcastle will surely join that group. Whether any others do may depend on some huge regulatory decisions. Moves like the Premier League capping spending or Uefa changing prize money rules could bring a badly needed increase in competitive balance. The role of the new English independent regulator is going to be instructive, too. Many football figures in other major countries are watching keenly, and believe the idea could spread. Some even think that would eventually pose a threat to Fifa in terms of removing some of the global body’s power. If the independent regulator can actually prove effective in giving supporters increased stakes in clubs, it could serve to actually row some of this back; to put more of the game back in the hands of fans. The repercussions of the Premier League’s charges against Manchester City It is also why so much hinges on the outcomes of the Premier League charges against Manchester City and the Spanish public prosecutor’s charges against Barcelona. Both could change the face of the game and bring chain reactions. On the other side, a huge question is what Uefa’s stance on multi-club models is going to be. While much of the focus on this is regarding American consortiums, the greatest relevance could be with sovereign wealth funds and states. Since there aren’t actually that many states that want to buy clubs, such a change could facilitate multiple purchases by the same funds. Uefa president Aleksandr Ceferin’s recent softening on this - at least in terms of public statements - has naturally been viewed through the prism of Qatar’s interest in Manchester United with the state already owning PSG. That would pose huge questions of the game’s actual values, given the persistent criticism from human rights groups as regards “sportswashing”. This is also where private equity firms and other capitalist interests could further exert their influence. The intention of many of their club purchases is to flip them within five years after increasing the value. But, who will be able to afford such clubs? More private equity firms, perhaps. More state-linked groups, most likely. That could bring a world where the same state or sovereign wealth fund owns six clubs in the Champions League. The LIV Golf precedent It is why Uefa’s stance on this is so important. LIV Golf’s recent deal with the PGA Tour nevertheless proves what one prominent federation executive told the Independent last year. Autocratic states have so much more money and such a greater will to spend it that sporting authorities can find themselves almost powerless without government backing. That leads many to decide “it’s ultimately better to work with these interests rather than have them working against you”. A connected issue is how examples such as the LIV Golf case and City chairman Khaldoon al Mubarak’s notorious line about “the 50 best lawyers” show that such states can “weaponise” legal systems. The gradual purchase of sporting infrastructure has already led to a situation where PSG president Nasser Al-Khelaifi has become one of the most powerful figures in football, rising to the top of the European Club Association. Such moves do always bring responses, though, and the Independent has been told that there is growing unease within the European Union about the influence of states and private equity funds. That is where government backing could be sparked. Otherwise, another unintended consequence of sporting bodies repeatedly allowing certain takeovers is the growth of particular voting blocs. That's where some very new ideas could come in. The Premier League is currently divided along a few lines, with the greatest split coming over City’s charges. Saudi Arabia’s strategy to host World Cup 2030 Saudi Arabia have already been acutely aware of voting blocs ahead of that World Cup decision next year. They have made inroads into Europe through the inclusion of Greece in their bid. They have split north Africa through the inclusion of Egypt. There’s a growing theory in the game they could split the emotional South American bid by bringing in Uruguay. It is a push that is only going to grow in the next year, as Mohamed bin Salman wants to make the World Cup the centrepiece of ‘Vision 2030’. All of this is why one figure in the game says it is to be the “decade of Saudi Arabia”. This is another way the politics of the Gulf drives the game. It is not just the willingness to invest, but also the willingness for one-upmanship. There’s a sense it wasn’t a coincidence that Saudi Arabia made such expansion announcements and Qatar upped their attempt to buy Manchester United in the same week City were going to secure the treble. This is likely to be an indication of the next few years. It just could bring more change than anyone can imagine. Read More Pep Guardiola sets sights on becoming the greatest – and Abu Dhabi’s masterplan can make it a reality The lesson Qatar has learnt as Manchester United takeover bid enters final stages First golf, now football? Saudi Arabia’s grand plan and the 72 hours that changed everything Football rumours: Man United, Real Madrid and Chelsea fight for Kylian Mbappe Marcus Rashford brushes off critics and insists he is committed to England ‘Serial winners’ can help England finally celebrate silverware – Tyrone Mings

2023-06-14 14:15

Sheikh Jassim waiting to hear if final offer to buy Man Utd has been successful

Sheikh Jassim is still waiting to hear whether his fifth and final offer for Manchester United has been successful, according to sources close to the Qatari. Recent reports within Qatar had indicated that the Sheikh’s bid – which is for 100 per cent of the club – had seen off the bid from Ineos founder Sir Jim Ratcliffe. However, the Sheikh Jassim camp described those reports as pure speculation and say they remain in a ‘holding pattern’. They expect the next step will be for the United board to meet and consider both bids. United have been approached for comment. Sheikh Jassim’s fifth bid was made last week, but at the same time it was made clear to the Glazer family – who own the club – and to the Raine merchant banking group which is overseeing the sale that he would not engage with the process beyond last Friday. The Qataris are eager to get the deal done with the summer transfer window about to kick into gear. Sheikh Jassim’s bid is understood to be a fully cash deal for 100 per cent of the club, and that all United’s debts would be cleared. Sources close to the Sheikh’s bid say that separate, additional funding would be made available for player recruitment, infrastructure and other investment needs. The Glazers first announced their intention to consider a sale of the club in November last year, with the first bids from Ratcliffe and Sheikh Jassim tabled in February. There have been reports that Ratcliffe’s offer is for 60 per cent of the club, with Avram and Joel Glazer retaining a combined 20 per cent stake, but sources close to Ratcliffe have not confirmed this. Read More Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live

2023-06-13 17:45

Gold Jewelry Recycling in India Seen Matching Record This Year

Indians will probably sell a record amount of used gold jewelry this year to take advantage of a

2023-06-13 15:56

Factbox-Silvio Berlusconi death: who will take over former Italian PM’s business empire?

MILAN Four-time Italian prime minister and billionaire media tycoon Silvio Berlusconi, who died on Monday at the age

2023-06-12 17:53

Factbox-Who are Crispin Odey and the hedge fund Odey Asset Management?

Crispin Odey, one of Britain's best-known hedge fund managers, is leaving Odey Asset Management following allegations of sexual

2023-06-11 01:45

Thai Election Agency to Probe PM Frontrunner Pita: Bangkok Post

Thailand’s Election Commission will investigate if prime minister frontrunner Pita Limjaroenrat violated an election rule on candidacy after

2023-06-10 17:58

American, JetBlue urge US judge to allow them to keep codeshare arrangements

By David Shepardson WASHINGTON American Airlines and JetBlue Airways asked a U.S. judge late Friday to allow them

2023-06-10 08:29

Andrea Radrizzani agrees to sell controlling Leeds stake to 49ers Enterprises

Leeds chairman Andrea Radrizzani has agreed a deal to sell his controlling stake in the club to co-owners 49ers Enterprises. As a result the American investment group, owner of NFL franchise the San Francisco 49ers and a minority shareholder in Leeds since 2018, will take full ownership. “Leeds United can confirm an agreement has been reached between Aser Ventures and 49ers Enterprises for the purchase of the club,” said a statement. “Both parties continue to work through the details, and further updates will be provided soon. “All of our focus remains on a quick return to the Premier League.” 49ers Enterprises increased its stake in Leeds to 44 per cent in 2021 with the option of buying Radrizzani’s remaining 56 per cent before January 2024. The Americans had been keen to push through a full takeover this summer, but that agreement, which had valued Leeds at around £400million, was contingent on the club remaining in the Premier League. Leeds’ relegation last month forced both parties back into intense negotiations and a valuation of close to £170m has been agreed. The deal marks the end of Radrizzani’s six-year ownership of Leeds. He completed a full takeover from fellow Italian Massimo Cellino in 2017 and initially proved hugely popular. Radrizzani bought back Elland Road stadium, which had been in private ownership since 2004, and brought in fresh investment when 49ers Enterprises purchased its first 10 per cent stake in 2018. The appointment of Marcelo Bielsa soon after proved a masterstroke as Leeds won promotion back to the Premier League for the first time in 16 years. 49ers Enterprises has steadily increased its stake, while Radrizzani’s relationship with the Leeds fanbase began to sour when Bielsa was sacked in February 2022. Leeds escaped relegation on the final day of the 2021-22 season under Bielsa’s successor Jesse Marsch and Radrizzani promised that the club would not be involved in another survival fight. But results this past season failed to improve and after Marsch was sacked in February, his replacement Javi Gracia and then Sam Allardyce, appointed with four games remaining, failed to halt the slide. When relegation was confirmed with a final-day defeat to Tottenham, Radrizzani was absent from Elland Road, opting instead to remain in Italy to finalise his takeover of Sampdoria. He later admitted Leeds’ board had made mistakes and apologised for the club’s relegation in a personal statement posted on social media. But after it emerged he had offered to use Elland Road as collateral when securing a £26m bank loan to buy Sampdoria – one of his companies and not Leeds owned the stadium – his legacy was further tainted. Read More Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live Keely Hodgkinson sets new British record at Paris Diamond League Andy Murray targets the next step after reaching Surbiton semi-finals again French Open day 13: Djokovic reaches final as Alcaraz struggles with cramp

2023-06-10 05:23