Wanda in Talks With Banks on Loan Relief as Challenges Mount

Dalian Wanda Group Co. is in talks with major Chinese banks on a loan relief plan that could

2023-05-09 10:26

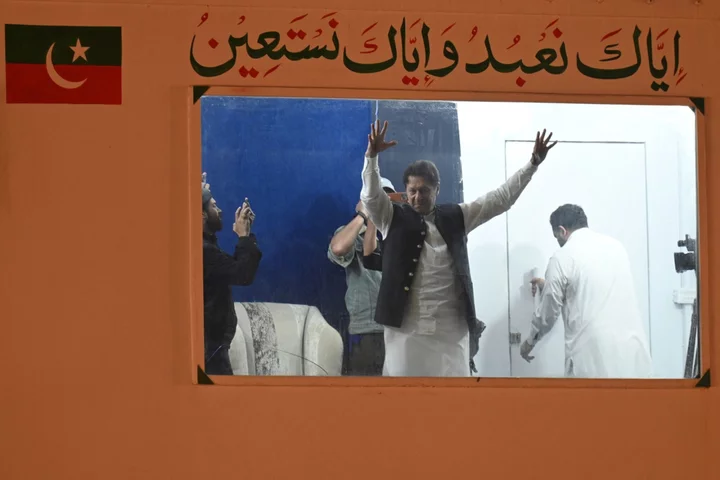

Pakistan Army Slams Imran Khan for Murder Attempt Allegations

Pakistan’s army criticized former premier Imran Khan for accusing one of their senior officials of orchestrating assassination attempts

2023-05-09 10:15

Biden meets Republican leaders in debt limit standoff

President Joe Biden will convene a high-stakes meeting with Republican leaders Tuesday in hopes of breaking an impasse over the US debt limit -- with repercussions that could...

2023-05-09 09:47

Palantir Gains After Posting Rosy Forecast, Touting Demand for AI Tools

Palantir Technologies Inc. rallied 20% in late trading after giving a strong earnings forecast and saying that demand

2023-05-09 08:48

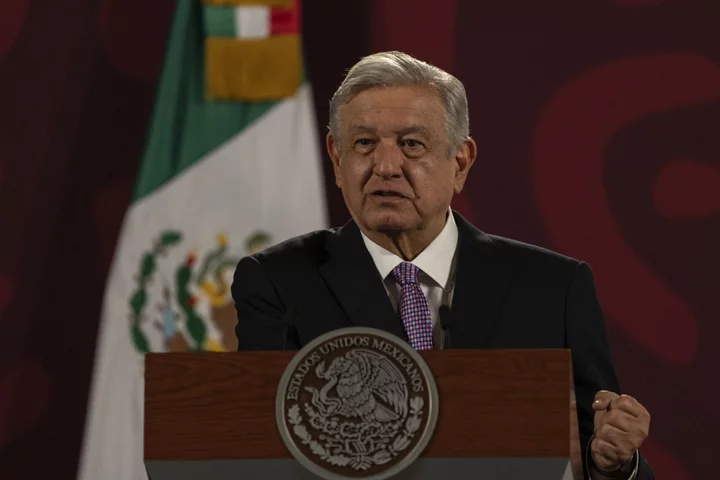

Mexico Top Court Votes to Invalidate Part of Electoral Reform

Mexico’s Supreme Court annulled part of a reform of the country’s electoral rules that had been sponsored by

2023-05-09 08:24

Biden and McCarthy set for Oval Office showdown as US edges closer to defaulting on debt

With the US government just weeks away from being legally unable to pay its bills for the first time, President Joe Biden and House Speaker Kevin McCarthy will meet at the White House on Tuesday. The meeting is an attempt to break what has become an economy-threatening logjam over Republican demands for Mr Biden to endorse rolling back large swaths of his legislative record. The Oval Office confab will be the first face-to-face sit-down between the two men since 1 February, when Mr Biden and the House Speaker met for what the White House described as a “frank and straightforward dialogue”. This time, the president and speaker will be joined by House Minority Leader Hakeem Jeffries, Senate Majority Leader Chuck Schumer and Senate Minority Leader Mitch McConnell. After their last meeting, Mr McCarthy told reporters outside the West Wing that the meeting with Mr Biden that the meeting left him hopeful that he and the president could “find common ground”. It was the first meeting the California Republican had with the president since he won the speaker’s gavel after a week-long marathon of 15 separate ballots. Mr McCarthy also said he’d told Mr Biden that he wanted to hammer out an agreement that would see the GOP-controlled House vote to raise the US statutory debt limit “long before” the June deadline laid out by Treasury Secretary Janet Yellen. Ms Yellen notably warned in January that the Treasury had begun taking “extraordinary measures” to avoid defaulting on the nation’s sovereign debt. Since that February meeting, the White House and the House of Representatives have remained far apart on what is needed before legislation allowing the US to resume issuing new debt instruments can reach Mr Biden’s desk for his signature. For his part, the president’s view has remained consistent since the beginning of the year. Mr Biden has repeatedly said that Congress should pass a “clean” debt ceiling increase and negotiate on spending cuts desired for next fiscal year when Congress begins work on a budget. Mr McCarty, who only gained the Speaker’s gavel after promising far-right members of the House Republican Conference that he’d weaponise the debt limit to extract massive cuts to programs favoured by Democrats, is insisting that he and House Republicans have provided a solution to the problem with what the House calls the “Limit, Save and Grow Act”. That legislation, which passed the House with a bare majority of GOP votes last month, would provide just a year’s worth of relief coupled with spending provisions that slash non-defence spending by as much as 20 per cent. Among the programmes on the chopping block: President Joe Biden’s student debt relief initiative, as well as funding for new IRS personnel. The plan would also add new work requirements for adults on Medicaid, cap the growth of the federal government, and impose 2022 limits on discretionary spending. The White House said in response to the bill’s passage that Republicans were attempting to “strip away health care services for veterans, cut access to Meals on Wheels, eliminate health care coverage for millions of Americans and ship manufacturing jobs overseas”. While the House-passed bill is unlikely to go anywhere in the Democratic-controlled Senate, thus far Mr McConnell and Senate Republicans have backed up Mr McCarthy’s demand for Mr Biden to sign off on GOP-endorsed austerity measures in exchange for Republican votes to allow the US to continue paying its’ debts. Prominent GOP figures frequently claim that raising the statutory debt limit to enable the US to continue meeting financial obligations — a practice that was once routine under presidents of both parties and met no objections when it was done under Mr Biden’s predecessor — is akin to authorising new spending. That claim, however, is not how the debt limit works. Raising the debt limit does not increase or decrease the amount of money that is spent on programmes that have already been authorised by Congress and have had funds allocated to them in appropriations legislation. Experts say a failure to raise the debt limit would force the government to default on its debt and precipitate a worldwide financial crisis. The last time the US flirted with that disastrous outcome was 2011, when Republicans controlled the House and Democrats controlled the Senate and the White House. Mr Biden, then the vice president under Barack Obama, led the negotiations with congressional leaders that headed off a default, but not before the US had its credit rating decreased for the first time in history. That 2011 dispute ended with Republicans suffering a drop in their approval ratings and facing accusations of endangering the US economy for political reasons. It also came along with an unprecedented downgrade in America’s credit rating. Those same charges are being raised again now by the White House and the president’s allies in Congress, who are holding firm on Mr Biden’s call for a clean debt limit boost. With both sides as far apart as they were three months ago, it’s unclear whether the White House expects Tuesday’s congressional confab to end with any positive progress on ending the impasse and preventing a default. One clue as to what Mr Biden’s advisers may be thinking can be found in the president’s travel schedule. The White House has said Mr Biden will travel to New York on Wednesday for what it describes as remarks on “why Congress must avoid default immediately and without conditions, and how the House Republican Default on America Act will cut veterans’ health care visits, teachers and school support staffs, and Meals on Wheels for seniors”. White House aides have also refused to describe the Tuesday meeting as a negotiating session. At Monday’s daily press briefing, White House Press Secretary reiterated the president’s position opposing any negotiations and demanding a clean debt ceiling increase. “There shouldn't be negotiations on the debt on the debt limit. This is something that they should get to regular order and get to work on. We should not have our House Republicans manufacturing a crisis on something that has been done 78 times since 1960. This is their constitutional duty, Congress must act. That's what the President is going to make very clear with with the leaders tomorrow,” she said.

2023-05-09 07:57

Asia Stocks Poised for Mixed Open; Dollar Steady: Markets Wrap

Asian equity futures pointed to a mixed start for the region’s stocks Tuesday after US shares eked out

2023-05-09 06:53

Trump Ally Sidney Powell Defeats One Ethics Probe, Now Faces a New One

Conservative attorney Sidney Powell recently prevailed against an ethics case in Texas tied to her failed legal fight

2023-05-09 06:51

Marketmind: Investors’ glass still half full

By Jamie McGeever A look at the day ahead in Asian markets from Jamie McGeever. Chinese trade and

2023-05-09 05:55

Yellen says 'no good options' if Congress fails to raise debt ceiling

By Andrea Shalal and David Lawder WASHINGTON Treasury Secretary Janet Yellen said on Monday that a failure by

2023-05-09 05:47

Yellen Blasts Draconian Republican Cuts, Pushes Debt-Limit Hike

Treasury Secretary Janet Yellen said Monday that the administration will be forced into making “decisions” on how to

2023-05-09 05:27

AP wins public service, photo Pulitzers for Ukraine coverage

The Associated Press has won two Pulitzer Prizes in journalism for its coverage of the Russian invasion in Ukraine, in the categories of public service and breaking news photography

2023-05-09 05:22