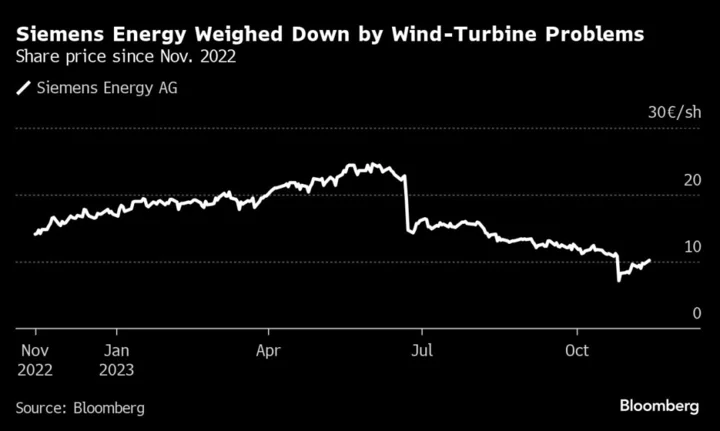

After multiple shocks wiping off billions of euros of market value, Siemens Energy AG will be trying to avoid another storm this Tuesday.

Whether it can largely depends on the company delivering a convincing message about its disastrous wind unit during an investor day in Hamburg. Even after announcing asset sales and a government-led package of loan guarantees and cash, concerns remain that the company will need to raise more capital going forward.

Faulty turbines at Gamesa, the Spanish wind unit, paired with an industry in disarray are driving losses that are now engulfing Siemens Energy’s profitable gas and grid business. In question are roughly 2,900 installed onshore turbines of its older 4.X and current generation 5.X platforms that could have flaws.

The company has had to halt production and sales of the 5.X platform and it’s not yet clear when they’ll resume. Despite it all, Siemens Energy plans to stick it out alongside government assurances wind is a key part of the climate transition.

“We bought into the wind business because we believe a future energy technology company must be present in renewables,” Chief Executive Officer Christian Bruch last week said in an interview with Bloomberg Television. “The question is where to play and how to play.”

Next steps will be rolling out “corrective and containment measures” to repair the onshore product that is set to go on for a couple of years, costing €1.6 billion ($1.8 billion), and figuring out which markets to focus on to become profitable.

Despite wind’s central role in the energy transition, turbine makers are fighting for survival after soaring raw-materials costs and higher borrowing costs result in project failures and multi-billion dollar writedowns.

Read more: Europe’s Battered Wind Sector Starts to Find Hope In Year of Crisis

There are signs some of the pressure in wind is coming off. Vestas Wind Systems A/S this month announced a big increase in orders and lifted its outlook. At the same time, the reality that getting projects off the ground will cost more and needs more support appears to be getting through with governments in Europe reacting.

At Siemens Energy, things will stay bleak for a while. The company last week warned the problems at Gamesa will lead to another operating loss this fiscal year, despite profit in its other business lines. Gamesa itself won’t break even until 2026.

It plans some more divestments to reach a total of €3 billion in proceeds, with roughly €2.6 billion already accounted for by the sale of a stake in an Indian joint venture and a high-voltage components unit.

Author: Wilfried Eckl-Dorna