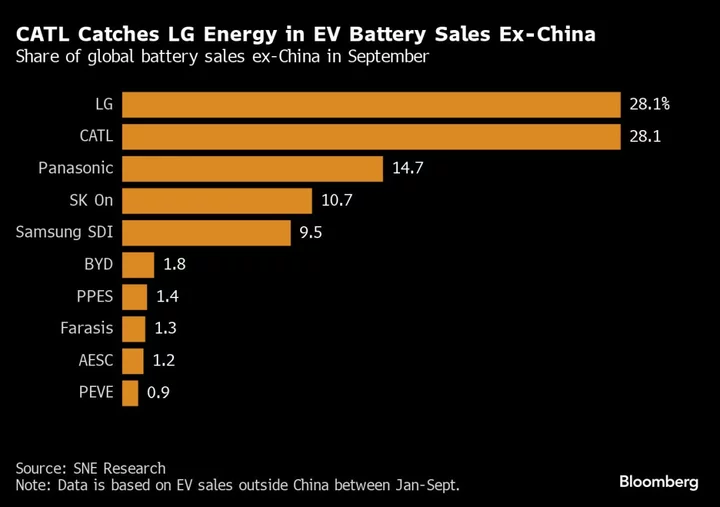

China’s Contemporary Amperex Technology Co. caught up with South Korea’s LG Energy Solution Ltd. in the global electric-car battery market outside China, according to SNE Research.

CATL, as the Chinese giant is known, and LG Energy both had 28.1% of the global market ex-China in September, Seoul-based SNE said in a report Thursday. Japan’s Panasonic Holdings Corp. ranked third with a 14.7% share.

The growing influence of CATL outside its home market comes as global carmakers look for cheaper battery — the most expensive component of an EV — in order to lower EV prices. Chinese battery firms specialize in so-called lithium-iron-phosphate (LFP) cells, which are cheaper than Korea’s nickel-based batteries suitable for long-range EVs.

Overall, CATL maintained its position as the world’s biggest battery maker with a 36.8% share of the global market. BYD Co. ranked second with 15.8%, while LG Energy was third with a 14.3% share.

Read More: China’s CATL, BYD Account for 53% Global EV Battery Sales: SNE

CATL supplies batteries for Tesla Inc.’s Model 3 and Y as well as for Mercedes-Benz Group AG and Volvo Car AB, according to SNE. Recently, even Korean automaker Hyundai Motor Co.’s new Kona and Kia Corp.’s Ray EV used CATL cells, it added.

Global demand for EVs has weakened as they remain expensive and higher interest rates hurt consumer sentiment, SNE said. Global automakers including Ford Motor Co., General Motors Co. and Toyota Motor Corp. have recently wound back their outlook for EV sales. China’s cheaper batteries will eventually boost sales of budget EVs it said.