Ships sailing to European ports face a combined carbon emissions bill of $3.6 billion next year, the start of a levy that’s almost certainly going to rise as the continent steps up efforts to combat climate change.

The figure is an estimate of the total price of complying with the European Union’s Emissions Trading System from Drewry Shipping Consultants Ltd.

Under the regulation, which takes effect Jan. 1, vessels going into and out of EU ports must pay for their carbon pollution, affecting deliveries of everything from container loads of finished goods to the liquefied natural gas needed to keep homes warm in winter.

The global shipping industry spewed more than a billion tons of CO2 into the atmosphere in 2018 and is almost exclusively powered by oil-derived fuels, which are significantly cheaper than low carbon alternatives. Folding it into the ETS is part of the EU’s plan to decarbonize the sector to combat climate change.

Despite stretching into the billions, the bill is a sliver of the revenues generated by international shipping and is unlikely to have a major impact on the prices consumers ultimately pay for goods. Last year, container giant A.P. Moller-Maersk A/S alone enjoyed profit just shy of $30 billion.

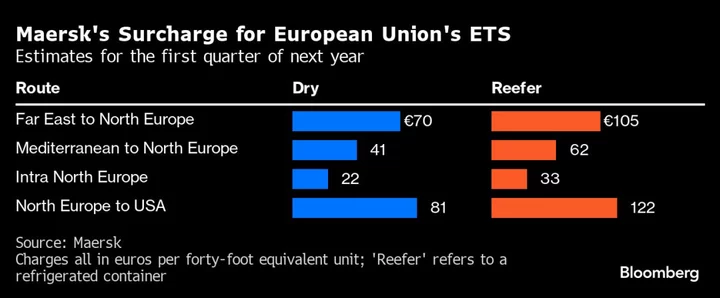

See also: Shipping Lines Put a Price on Fast-Approaching EU Climate Rules

In 2024, a container ship sailing between Europe and Asia could incur charges of about €810,000 ($887,000) under the ETS, according to a recent estimate from marine classification society DNV that assumes a carbon price of €90 a ton.

Based on Monday’s marine fuel price in northwest Europe, that’s only about 10% of what the same ship’s annual fuel bill would be — meaning swings in the oil price alone could easily outweigh the entire cost of the ETS.

Containers

Similarly, variations in the cost of carrying goods in containers between Europe and Asia in recent years have dwarfed the EU’s ETS costs. And the mechanism would make up only a tiny fraction of oil — and gas — freight bills.

The new rules are unlikely to enable clean alternatives like green methanol to compete on price with fossil fuels in the near future, according to Stijn Rubens, a senior consultant at Drewry.

“Even if the cost of green fuels halves in the next three years, there is more taxation required to level the playing field,” he said. “Green methanol is likely to remain at a considerable cost disadvantage until at least 2026.”

Trading Loopholes

Despite the ETS making up a small part of freight costs, there has already been talk of how traders and companies could exploit loopholes to avoid paying the fees.

Six EU member states — mainly along the Mediterranean coastline — raised concerns last month that shippers may dodge ETS fees by docking at ports close to, but outside of, the EU. The bloc has already said Egypt’s East Port Said and Morocco’s Tanger Med should be identified as “neighboring container transshipment ports” to prevent evasion.

Another potential way round the charges would be to use ship-to-ship transfers, whereby cargoes are transferred between vessels at sea.

For instance, if an oil tanker sailed from Singapore to just outside a European port area, unloaded via STS transfer, and then sailed back to Singapore, it would not owe anything under the ETS, according to DNV. That’s because it never actually called at an EU port.

“The Commission will closely monitor possible ship-to-ship transfers in the context of the upcoming application of EU ETS to the maritime sector,” a spokesperson for the European Commission said.

“Where appropriate, the Commission would be ready to propose measures to address any evasive behavior, to preserve the integrity and effectiveness of the EU ETS.”

Rising Costs

The costs of complying with the ETS, which applies to European Economic Area as well as EU ports, may for now be relatively small for an industry as big as shipping. But it will almost certainly get more expensive: while shippers only have to cover 40% of their emissions in 2024, that ratchets up to 70% in 2025 and 100% in 2026 — the same year methane and nitrous oxide emissions come under the rules.

Using the same assumptions that went into Drewry’s 2024 estimate, which was based on 2022 actual emissions and a price of €100 per ton of CO2, that would generate a total 2026 bill of $9 billion.

And assuming ETS compliance does indeed get significantly more expensive, the economic case for using loopholes could grow too.

With only 40% covered next year, the ETS “may not be seen as high enough to change business patterns,” said Alain Savary, founder of Carbonex, a consultancy focused on the EU ETS. But this may change in years to come when more emissions are covered, he said.

--With assistance from Serene Cheong and Anna Shiryaevskaya.

(Adds chart on oil tanker rates)

Author: Jack Wittels, Yongchang Chin and John Ainger