Akzo Nobel reported profit that beat estimates as input pressures for the paint maker eased and cost-reduction programs kicked in during the third quarter.

The Dutch company’s adjusted earnings before interest, taxes, depreciation and amortization jumped to €414 million ($439 million). That’s slightly higher than the €411 million estimated by analysts in a Bloomberg survey.

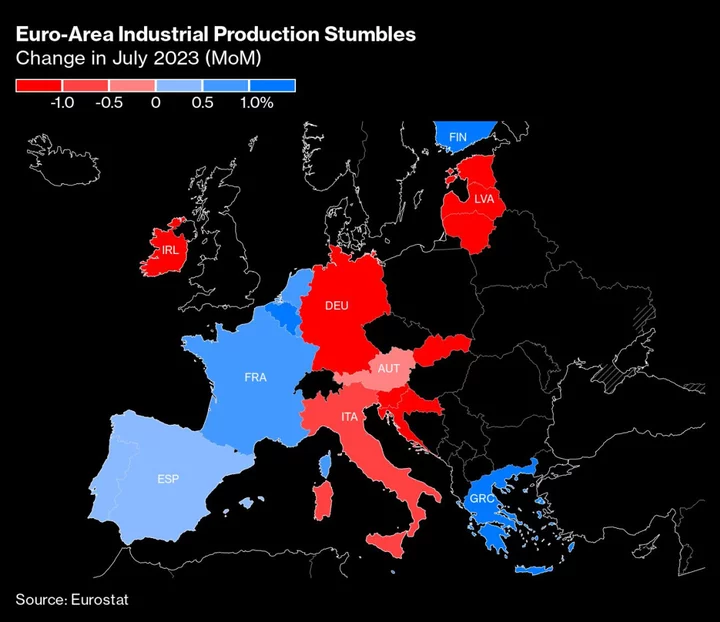

The owner of the Dulux paint brand, which also sells coatings and chemical products used across automotive, industrial, infrastructure and marine industries, has been grappling with softer demand as economic growth slows in several of its markets. The company’s cost-reduction programs and declining raw material costs would bolster profitability, it said, to combat macro-economic uncertainties weighing on organic volume growth.

Volumes were flat, Amsterdam-based Akzo Nobel said. Revenue dropped to €2.74 billion in the quarter ended September.

It now forecasts adjusted earnings before interest, tax and amortization for the year of around €1.45 billion compared to a range of €1.4 billion to €1.55 billion previously.