Chinese stocks declined in catch-up trade as weak holiday spending data added to concerns that the recovery has lost momentum.

The CSI 300 benchmark of mainland shares closed down 1.4%, with the information technology and telecommunication services sectors leading the losses. Onshore markets were closed Thursday and Friday. Hong Kong stocks also mostly weakened after a selloff last week, with the Hang Seng China Enterprises Index down 0.1%.

Chinese shares have been facing renewed selling pressure amid sluggish economic data and a lack of aggressive stimulus. Tourism spending during the dragon boat festival holidays fell short of pre-Covid levels. Passenger vehicle sales for June are expected to drop 5.9% year-on-year, according to preliminary data released over the weekend.

READ: Gloom Grips China Markets Again as Stimulus Trade Fizzles Out

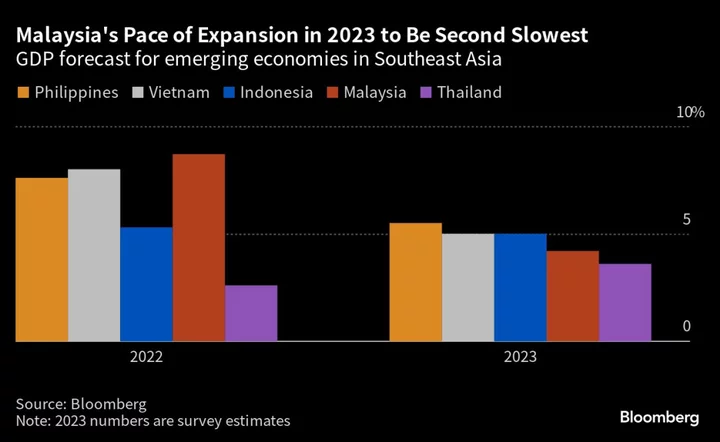

A strong rebound seen earlier this month has been cut short as traders come to terms with a more modest outlook for the economy. JPMorgan Chase & Co., UBS Group AG, Standard Chartered Plc and Citigroup Inc. have recently trimmed their 2023 gross domestic product growth forecasts to 5.5% or lower as official figures for exports and credit expansion to retail sales undershot expectations.

The decline in mainland shares is partly because “the holiday tourism data was not as good as the Labor Day holiday one,” said Willer Chen, a senior research analyst at Forsyth Barr Asia. Stimulus falling short of aggressive expectations weighs on sentiment, he said.

While China has been rolling out measures to stimulate its economy, including a series of reductions in interest rates and extended tax breaks for consumers buying clean cars, authorities are making it clear that any support will be targeted and measured.

The holiday box office data though was likely a bright spot amid all the gloom. China’s box office receipts during the festival reached 909 million yuan ($126 million), the second highest figure for the holiday on record, the Xinhua News Agency reported, citing official figures.

Traders are keenly watching the PMI survey data due later this week to gauge the recovery’s momentum. Economists expect another month of contraction for manufacturing activity in June.