After a federal law to curb surprise medical bills in the US triggered a handful of the year’s biggest bankruptcies, investors are eyeing corporate-debt piles for potential pain ahead.

KKR & Co.-backed ambulance company Global Medical Response is in talks to push out some $4 billion of maturing debt in 2025, Bloomberg reported last month. Blackstone Inc.-backed staffing firm TeamHealth Inc., meanwhile, could face as much as $2.5 billion of debt due next year, and Radiology Partners Inc. has roughly $2 billion due over the next two years.

Those are hefty sums given investors’ concern that revenues may take a hit from the rollout of the No Surprises Act — a law that last year banned companies from unexpectedly billing insured patients for care from out-of-network providers at in-network facilities.

Credit-rating assessors have been warning about a drag from the new rules, which stand to magnify other risks, like elevated interest rates and labor costs. TeamHealth, for one, was cut deeper into junk territory earlier this month by S&P Global Ratings as its upcoming maturities spotlight uncertainty.

“The No Surprises Act certainly puts pressure on health-care companies that have that exposure,” said Clare Moylan, a co-founder of Gibbins Advisors, which consults health-care firms. “If you’re tight on margin already, and you lose that margin, then you have to find it elsewhere.”

Draining Cash

For years, the byzantine nature of the US health-care system created an opening for companies to shoehorn costly services into patient experiences. But with the dawn of the No Surprises Act, those firms have had to rethink parts of their business models to preserve revenue streams.

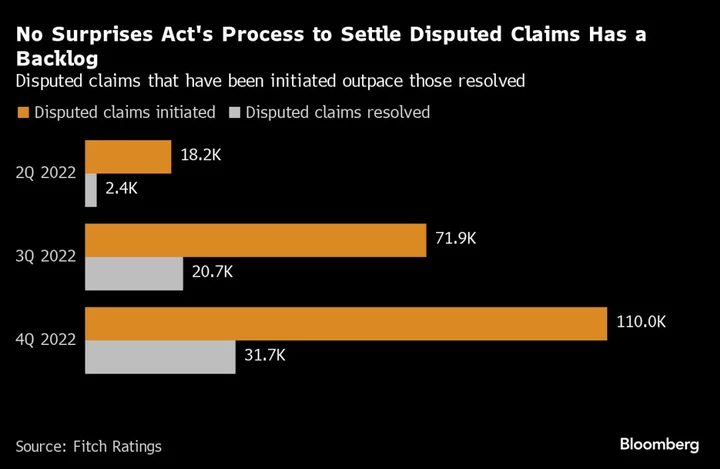

That’s especially true given the unexpectedly lengthy process created by the law to arbitrate disputes over charges. With some 100,000 claims still outstanding at the end of 2022, by Fitch Ratings’ count, investors are growing increasingly concerned about the impact on corporate cash flows.

Already, the law has been cited as one reason for the downfalls of three major health-related companies — including Envision Healthcare Corp., which is backed by private equity giant KKR & Co. and was one of the largest physician staffing firms in the country before it filed for bankruptcy in May. Competitor American Physician Partners followed shortly after, then helicopter ambulance company Air Methods Corp., which filed in October after missing an interest payment on its debt.

“It was an exogenous shock to business models that already had very narrow margins for error,” said Brian Gelfand, co-head of global credit and head of credit trading at TCW Group. Businesses that avoided the hit either had less debt or enough revenue coming from other sources to offset the losses, he added.

Risks Remain

Now, investors are focused on the risks for similar companies, where looming debt maturities are turning into crucial tests.

Health transportation company Global Medical Response has around $4.3 billion of debt coming due in 2025, including $600 million of senior notes and $3.7 billion of a term loan. The firm signaled third-quarter growth and has kicked off talks about extending the debt, Bloomberg recently reported.

A spokesperson for Global Medical Response said the company supports the law, but that the majority of the firm’s disputed claims are still waiting in the arbitration process. The company is also experiencing delays in opening the resolution portal to submit new claims, according to the spokesperson. A representative for KKR, the firm’s private equity sponsor, declined to comment.

Medical practice network Radiology Partners, meanwhile, has a $440 million revolver due in November 2024, and more than $2 billion of debt maturing in 2025. S&P Global Ratings downgraded the company to CCC+ in June, citing cash outflows as a result of the law. A representative for the firm said the company has ample liquidity and that earnings haven’t been materially impacted by the No Surprises Act.

And at TeamHealth, the stakes are also high, even as it recently addressed a portion of its debt stack. The company still has $714 million of unsecured 2025 notes outstanding. If a majority of those notes aren’t refinanced, TeamHealth could face a springing maturity on all secured debt of more than $2.5 billion in November 2024.

A spokesperson for TeamHealth, said the company supports the No Surprises Act and added that the firm is using the dispute resolution process to get fair payment from insurers. A representative for Blackstone declined to comment.

While payers and providers are likely to eventually compromise on viable contracted rates for services and conclude ongoing litigation in the coming years, in the interim, there’s little certainty on how companies will fare.

“The question is what happens in between?” said Spencer Perlman, managing partner and director of health-care research at consultancy firm Veda Partners. “That also happens to be the period where a lot of these companies have to refinance — and that’s the big concern.”

--With assistance from Reshmi Basu.

Author: Jill R. Shah, Amelia Pollard and Lauren Coleman-Lochner