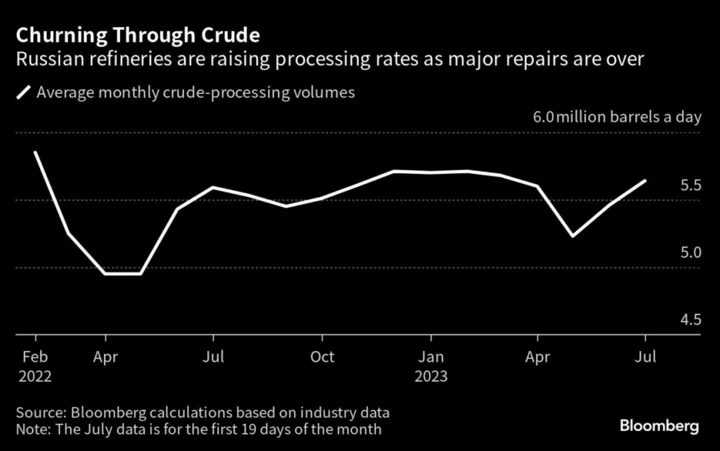

Oil edged higher after a string of losses as the market weighed the possibility of deeper output cuts from OPEC+ against signs supply is running ahead of demand.

West Texas Intermediate traded near $75 a barrel, while global benchmark Brent was close to $80. WTI briefly rose on Monday on reports that alliance heavyweight Saudi Arabia is asking other members to reduce their production quotas before closing down 0.9%.

A Bloomberg survey of traders and analysts late last week showed around half expect OPEC+ to take additional measures to tighten the market.

Crude has dropped by around a fifth since late September due to plentiful supplies and concerns about the global economic backdrop, increasing pressure on the 23-nation alliance to intervene at its meeting on Thursday. The International Energy Agency warned earlier this month that markets would move back into surplus next year amid a dramatic slowdown in demand growth.

Elsewhere, a storm in the Black Sea halted loadings of commodities including crude from key ports in Russia and Ukraine. The storm is expected to last most of this week, according to Russia’s oil-pipeline operator Transneft PJSC.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.