Nigerian banks are heading for their best quarterly performance in six years as a return to more conventional economic policies and a sharp devaluation of the naira are expected to boost profits in the West African nation.

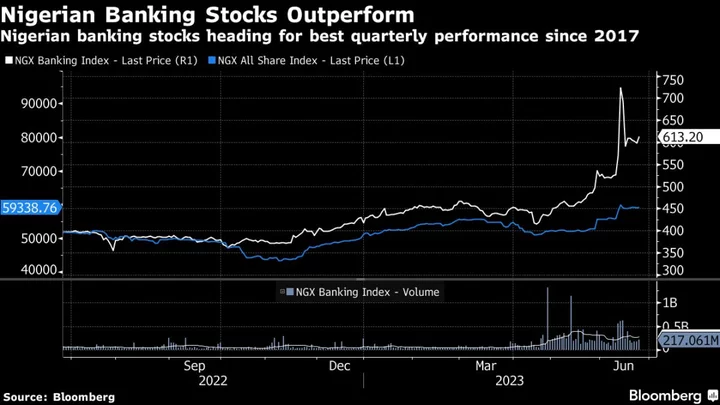

Banking stocks are up 34% this quarter and headed for the best quarterly performance since 2017, according to data compiled by Bloomberg. The NGX10 index, which tracks the performance of the lenders on the Nigerian Exchange, is up 45% so far this year, extending its gain to 54% in the last 52 weeks. That compares with a 2.3% loss on the MSCI Emerging Markets Europe, Middle East and Africa Index over the same period.

Nigeria’s biggest lender by market value, Access Holdings Plc, contributed the most to the increase, advancing 78% since the beginning of the year. Other top performers include Fidelity Bank Plc, which is up 61% and UBA Plc, up 50%. Lenders in Africa’s most populous country trade at a price-to-earnings ratio of 3.02 on a trailing basis, still a discount compared with the 4.99 average among emerging-market peers, according to data compiled by Bloomberg.

Nigerian stocks rallied to a 15-year high after President Bola Tinubu, who took power last month, removed the country’s central bank governor, the architect of unorthodox monetary policies that had deterred local and foreign investors.

The strong out-performance in financial stocks suggest that equity markets are pricing an end to those policies, said Wale Okunrinboye, chief investment officer at Access Pensions Limited in Lagos. “From a valuation standpoint, Nigerian assets have been heavily discounted over the last eight years,” he said.

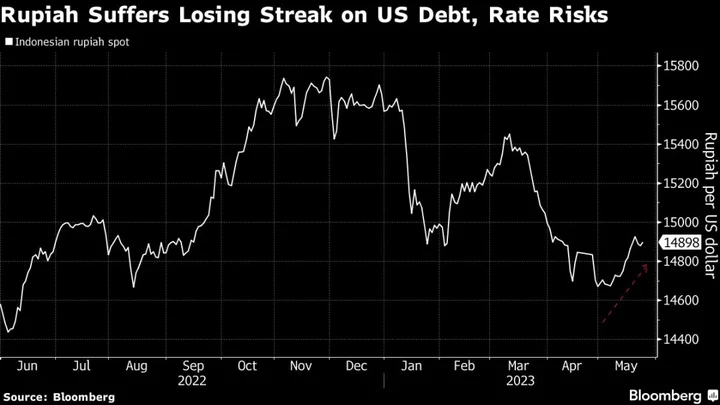

Folashodun Shonubi, who was appointed acting central bank governor, has since allowed the naira to trade more freely, resulting in a rapid depreciation of the currency by nearly 40%, the second biggest loss in the world after the Zimbabwe dollar.

The depreciation will benefit some Nigerian banks with large net foreign asset positions including First Bank, Guaranty Trust Bank, Zenith, UBA, and Access Banks, according to Lagos-based investment banking firm Chapel Hill. These banks are set for “impressive EPS expansion potential for investors,” on revaluation profits, it said.

The broader Nigerian All Share Index, with a total market value of 32.4 trillion naira ($43 billion), is up 15% in the past 52 weeks.

“In the event the Tinubu administration is able to deliver on key measures that unlock economic economic growth and great foreign investment, there is more room for Nigerian stocks to re-rate,” Okunrinboye said.

Author: Anthony Osae-Brown