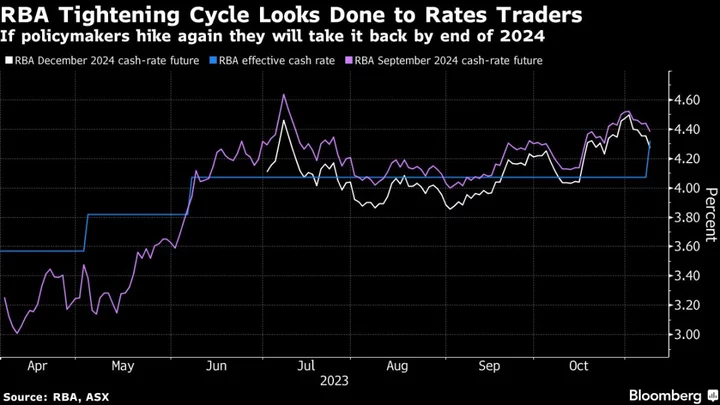

National Australia Bank Ltd. Chief Executive Officer Ross McEwan said the expectation that the rate-hike cycle is nearly over is boosting consumer and business confidence.

With markets now pricing little change in benchmark borrowing costs over the next year in Australia, McEwan said rates look close to the top of the market and there’s a more benign economic outlook for next year. That’s good for customers who benefit from greater stability, he said.

“We’re probably getting close to the top if not at the top,” McEwan said on a call with reporters Thursday. “Certainty is a really important thing for both business and for individual customers.”

Firms have had to grapple with the steepest rate-hike cycle in decades that’s left the cash rate at a 12-year high. Still, Reserve Bank of Australia Governor Michele Bullock this week tempered the central bank’s tightening bias and its base forecast is for inflation to continue to ease.

Read more: National Australia Bank Profit Gains on Business Lending

McEwan also said he sees no change to NAB’s push in recent quarters to prioritize business and private banking — its largest profit generator.

“We’re optimistic in our business bank and we will continue to keep investing in it,” he said.

--With assistance from Garfield Reynolds.