A bearish research report on Chinese banks by Goldman Sachs Group Inc. has drawn fresh criticism from a major lender and one of the nation’s largest macro hedge funds after receiving a backlash from state media.

Goldman’s assumptions have “misled some investors and caused them to worry about the asset quality,” China Merchants Bank Co. said in a clarification statement to investors that was seen by Bloomberg News.

Shanghai Banxia Investment Management Center also dismissed the note on Monday, saying the US bank’s prediction that local government debts would sink Chinese banks’ profits and push up their bad loans will likely be proven wrong.

At stake was a report published by Goldman analysts including Shuo Yang last Tuesday, which highlighted margin risks and potential credit losses from banks’ exposure to local government debt. Yang, a former official at the China banking regulator, estimated that the “implied loss ratio of credit portfolio in debt investment book” could reach 25% for Merchants Bank, compared with 6% on average for lenders under its coverage.

A representative for Goldman declined to comment.

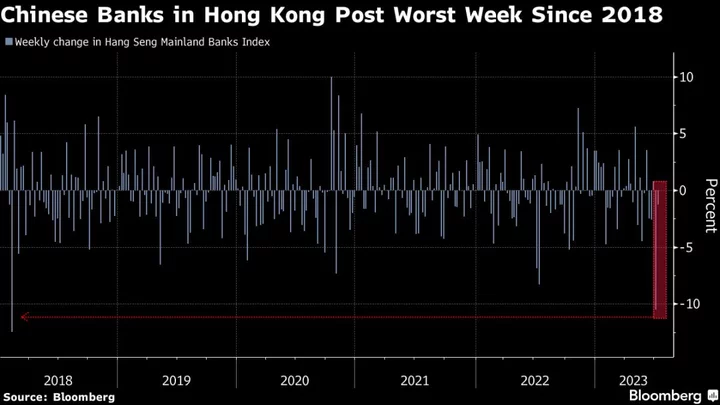

Shares of Merchants Bank have lost 12% in Hong Kong since Goldman cut its target price for the second time in three months with a neutral rating. The US bank now has one of the lowest target prices for the Chinese lender, according to data compiled by Bloomberg.

Merchants Bank argued that Goldman’s report is “illogical” in the way it calculates the potential losses, “lacks basic common sense,” and also overestimates its exposure to the local government financing vehicles.

Pushback against negative financial commentary in China has become more noticeable in recent weeks, with a prominent finance writer and two of his peers getting suspended from a social media platform for spreading “negative and harmful information” about the nation’s faltering stock market. Such moves risk stoking concern among foreign investors about access to independent information on Chinese companies and the economy.

Goldman’s report comes at a time when investor concerns are mounting over the health of China’s debt-laden local-government financing vehicles. Worries that banks may incur losses from these debts started spiraling after some state-owned lenders began to offer extra credit support to LGFVs.

Merchants Bank said it had about 132.6 billion yuan ($18.3 billion) of loans to LGFVs on its balance sheet at the end of 2022, much lower than Goldman’s estimate of 1 trillion yuan.

Separately, Banxia Investment said some local authorities’ recent moves to replace debts with ultra-low-interest, long-term loans can help them avoid defaults and spare banks from booking a big increase in bad loans, according to an article on its Wechat account.

“In a rates market with adequate administrative management and notable segregation, Chinese regulators have enough incentives, wisdom and methods to keep major banks’ balance sheets undisturbed,” the fund said.

This isn’t the first time Wall Street research has proved controversial in China. The last high-profile saga involved an “uninvestable” call on Chinese Internet firms by JPMorgan Chase & Co. last year, which eventually cost the brokerage a senior underwriter role in a stock listing. The incident underscored the tricky path global banks have to navigate as they ramped up their businesses in China, while still giving clients access to candid research on the country’s turbulent markets.

--With assistance from Heng Xie and Jeanny Yu.

(Adds Goldman response)