Malaysia kept its benchmark interest rate unchanged yet again on Thursday, as the Southeast Asian country looks to sustain economic growth following months of slowing inflation and exports.

Bank Negara Malaysia maintained the Overnight Policy Rate at 3% for a second straight meeting, as forecast by all 21 analysts in a Bloomberg survey. The monetary policy committee has one remaining meeting scheduled for the year.

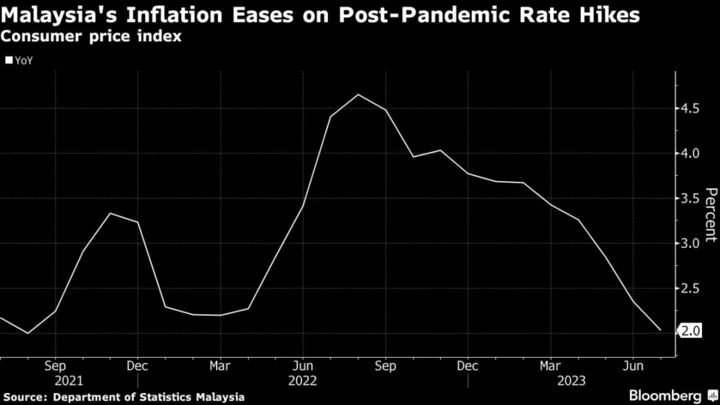

The decision affirms Malaysia’s pro-growth stance after its success in taming inflation over the past year via rate hikes as well as government policies on living costs. Price pressures in July dipped to levels not seen in nearly two years, allowing the central bank to focus on shielding the trade-reliant economy from the brunt of the global slowdown.

The ringgit was little changed at 4.6772 against the dollar after the decision, as was the main equities index.

The rate-setting panel will ensure that the monetary policy stance remains conducive to sustainable economic growth amid price stability, the central bank said in a statement Thursday. Central bank Governor Abdul Rasheed Ghaffour last month said the economy would likely expand closer to the lower band of the central bank’s 4% to 5% forecast range this year, after growth came in below expectations in the second quarter.

Domestic demand and stronger tourism activity, according to BNM, will be among the key growth drivers and cushion the impact of slowing exports to the country’s economy. Weaker-than-expected external demand, and larger and protracted declines in commodity output could weigh on the outlook, it added.

The statement no longer describes monetary stance as “slightly accommodative,” removing any residual expectation for additional tightening, said Frances Cheung, a rates strategist at Oversea-Chinese Banking Corp. in Singapore.

Malaysia’s inflation will likely continue to moderate in the second half of the year, according to the bank. The outlook remains subject to risks, mainly stemming from changes to domestic policy on subsidies and price controls, global commodity prices and financial market developments, BNM said Thursday.

--With assistance from Tomoko Sato, Cecilia Yap, Kevin Varley and Marcus Wong.

(Updates with market reaction in the fourth paragraph.)