The Kenyan shilling’s sharp slide against the dollar follows years of policy missteps at the central bank, according to Treasury Secretary Njuguna Ndung’u.

“We are actually paying the price of misalignment that happened in the last five to seven years,” he told the National Assembly in the capital, Nairobi. “The most important thing is to accept that there have been policy mistakes.”

The shilling has depreciated about 17% this year alone. That means the currency is on course for the steepest decline since 2008, when the East African economy suffered the devastating impact of deadly post-election violence that left more than 1,100 people dead.

The unit, Africa’s sixth worst-performing currency this year, is not in “free-fall” and is only adjusting to past central bank decisions, including a directive that the exchange rate could only “fluctuate 20 cents either way,” the minister said.

Read More: Kenya Pays $238 Million to Gulf Firms for Fuel Bought on Credit

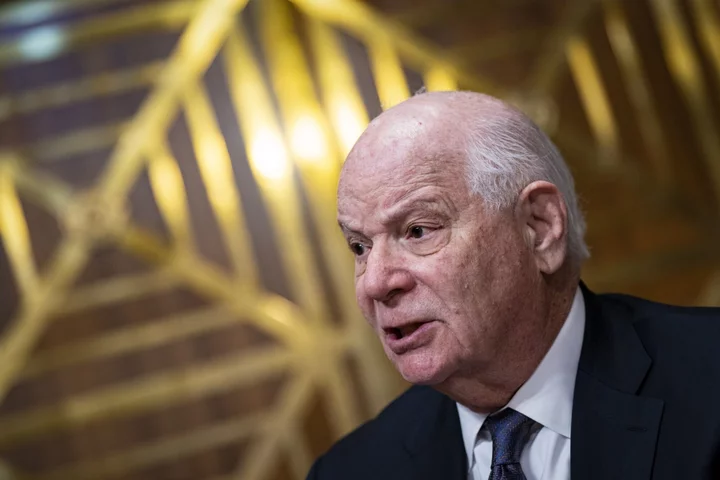

Ndung’u was picked by President William Ruto as head of the East African nation’s Treasury a year ago. While interbank trade has resumed under current Governor Kamau Thugge, the shilling’s decline has persisted, compounded by a shortage of dollars in the market, Ndung’u said.

The shilling depreciated steeply as soon as the new authorities “allowed the nominal exchange rate to move,” Ndung’u, a former central bank governor, said. He wasn’t “part of the problem,” as he left the policy making role in March 2015, Ndung’u said.

Ndung’u was succeeded by Patrick Njoroge, whose second four-year term ended in June. Njoroge didn’t respond to a phone call and text message.

A government-brokered deal to purchase fuel on credit from three state-owned Gulf firms helped reduce dollar demand in the spot forex market, the minister said. That “safeguarded the supply and we have actually protected ourselves against extreme volatility,” he said.

There are concerns that pressure on the shilling could continue into 2024 when Kenya is expected to repay a maturing $2 billion Eurobond.

(Updates with attempt to contact ex-central bank governor in seventh paragraph.)