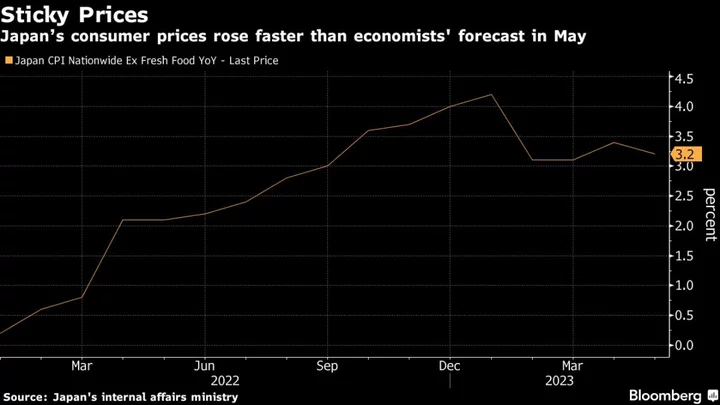

Japan’s consumer prices rose at a faster pace than economists expected in May, an outcome that could fuel speculation the central bank will raise its inflation forecasts in July and even tweak its stimulus program.

Prices excluding those for fresh food gained 3.2% from a year ago, decelerating from a 3.4% rise in April, the internal affairs ministry reported Friday.

While the national data was consistent with the results of earlier figures for Tokyo showing a renewed slowdown due to lower electricity prices, the reading still outpaced analysts’ forecast of a 3.1% increase.

A measure of the deeper inflation trend, meanwhile, continued to strengthen, in another indication that prices have more upward momentum than expected.

Sticky prices will likely feed into economists’ view that the Bank of Japan may bump up its quarterly price forecasts in July. Some analysts see a sharp upward revision also triggering an adjustment of the BOJ’s yield curve control program.

In the latest quarterly outlook released in April, the bank sees its key inflation gauge averaging 1.8% in the year ending in March. Governor Kazuo Ueda has said prices will slow below 2% toward the middle of the year. For fiscal 2025, the BOJ projects core prices rising 1.6%.

What Bloomberg Economics Says...

“A slowdown would reinforce the Bank of Japan’s case for holding stimulus in place to pursue more durable demand-led inflation...We see the nationwide core inflation rate falling to as low as 1.7% by 4Q23, squeezed by a higher year-earlier base.”

— Taro Kimura, economist

For the full report, click here.

Going ahead, utility rates will continue to have a significant impact on Japan’s price trends. Electricity prices fell at a much faster pace of 17% in May from a year earlier, driven by a reduction in a levy for renewable energy development — a drop that was first indicated by earlier Tokyo data.

Uncertainty surrounding utility costs remains high, as power rates are next expected to go up again by as much as 42% from June. Government subsidies that currently hold down electricity prices by around 20% are also set to be halved in September.

The government has yet to reveal whether it will continue or terminate the subsidies from October. Ending the measures will add to inflationary pressure.

Stripping out electricity and other energy prices alongside fresh food, consumer prices rose by 4.3%, accelerating from 4.1% in April and indicating that the underlying inflation trend is still gaining momentum.

--With assistance from Jon Herskovitz.

(Adds more details from release)