China lashed out at the European Union’s investigation into electric vehicle subsidies, saying the move will harm relations, while chiding foreign automakers for failing to keep up with technological innovations.

The chorus of criticism was joined by China’s top auto industry body and a leading Communist Party newspaper, signaling a new front may be set to open in global trade wars.

European Commission President Ursula von der Leyen on Wednesday said the global market is overrun with cheap Chinese cars with prices kept “artificially low by huge state subsidies.” The probe, which could take up to nine months, may lead to tariffs close to the 27.5% level already imposed by the US on Chinese EVs, according to a person familiar with the matter.

“The EU’s proposed measures to protect its own industry in the name of ‘fair competition’ are protectionism,” the nation’s Ministry of Commerce said in a statement Thursday. “China’s EV sector has grown rapidly in recent years and its competitiveness keeps improving, which is the result of persistent efforts of tech innovation. It is a competitive advantage won through hard work and its own strength.”

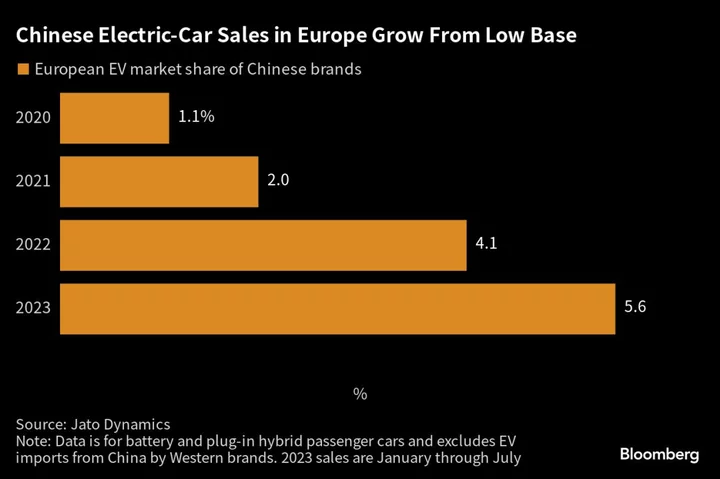

If the EU imposes duties, it would curtail one of the major growth markets for Chinese EV makers. While their European sales pale in comparison to market leaders like Volkswagen AG, Tesla Inc. and Stellantis NV, they are growing quickly. Zhejiang Geely Holding Group Co. is the top Chinese presence with brands that include Polestar, Volvo Cars and Lotus, and the likes of BYD Co. and Nio Inc. are also pushing into the continent.

Read More: Chinese EV Makers Are Bit Players in EU’s Clean Car Market

Shares of leading Chinese EV makers fell Thursday. BYD declined as much as 3.8% and SAIC Motor Corp., which owns MG, dropped as much as 3.4%. Xpeng Inc. shed as much as 2.2% and Nio fell 2.7%.

While the near-term impact of the EU probe will likely be limited, it “may cast a shadow on the growth outlook of companies with aggressive expansion plans in the EU, like BYD,” Morgan Stanley analysts including Tim Hsiao said in a note to clients.

Nio, SAIC and Geely all declined to comment on the European probe.

The China Passenger Car Association, which represents automakers, said the nation’s booming EV exports aren’t because the industry received large subsidies, but because China’s supply chain is highly competitive. It is only now that Chinese companies pose a competitive threat that Western nations are starting to react.

Read More: Rise of China’s EV Makers Threatens Western Firms, UBS Says

The EU’s concerns are an “inevitable accompanying phenomenon after China’s new energy vehicles became stronger,” Cui Dongshu, secretary general of the PCA said in a statement. “Only when they become stronger will some people pay attention, and some people will feel uncomfortable.”

What Bloomberg Opinion says:

Over the past 12 months, Europe has woken up to the fact that China is now capable of building technologically sophisticated electric models. Rather than seeking political favors, European auto manufacturers should focus on improving their own competitiveness and developing EVs that consumers can actually afford. — Chris Bryant

In a commentary Thursday, the Global Times newspaper said Europe’s economy may suffer if protectionist measures are used to suppress China’s EV industry, and suggested retaliatory steps might be taken.

“Clearly, Europe is afraid,” the commentary said. “They are afraid of competition from China, so they want to seek trade protectionism as a protective umbrella for European automakers who are slowly transitioning toward electrification. If unfair action is taken by the EU, China has various tools to use as countermeasures to protect the legal interests of Chinese firms.”

The newspaper stressed that the price advantages enjoyed by Chinese EV makers aren’t a result of government subsidies, but “because of China’s advantages in terms of value chain, talent, technology, infrastructure and logistics.”

The China Chamber of Commerce to the EU pushed a similar line, saying the substantial industrial edge of Chinese EV makers is a result of concerted innovative efforts from both upstream and downstream players.

“The EU’s commitment to market openness must be translated into tangible measures, ensuring a fair, impartial, and non-discriminatory business environment for foreign companies,” the chamber said.

Europe’s investigation, as well as aggressive moves by Washington to counter China, are part of a broader rethink by governments in developed economies to bring production closer to home.

“There is some history that makes Europeans extra nervous,” said Deborah Elms, executive director at the Asian Trade Centre in Singapore. “They watched as China built up a dominance in steel, solar, and so forth and then, with more supply than China’s domestic market could absorb, start exporting at very low prices and in huge quantities. Once the domestic industry in other markets gets swept away, the space is clear for foreign firms to dictate prices and standards.”

--With assistance from Chunying Zhang, Jinshan Hong and Jasmine Ng.

(Adds comment from Ministry of Commerce in third paragraph.)