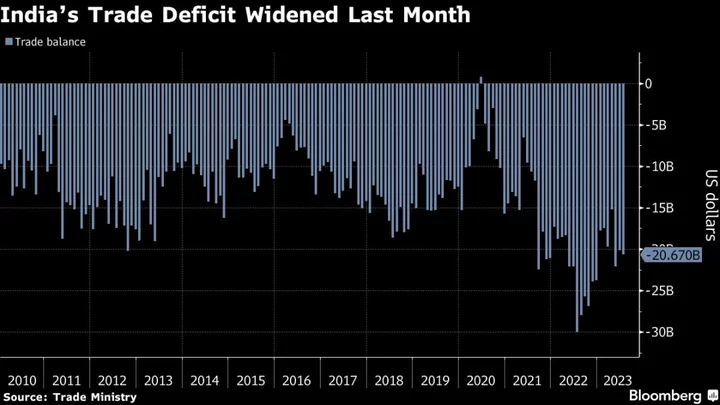

India’s trade deficit widened last month as exports and imports stayed weak on slowing demand.

The gap between exports and imports was at $20.67 billion in July, the Trade Ministry said on Monday. The reading is lower than a deficit of $20.9 billion seen by economists in a Bloomberg survey but is well above a $20.13 billion gap in June.

Exports dropped 15.9% from a year earlier to $32.25 billion in July, while imports stood at $52.92 billion, down 17% from a year ago.

“Global headwinds still there and we are looking to find ways to mitigate that,” Commerce Secretary Sunil Barthwal told reporters. “Negative export growth in big economies like China impacting India as well.”

Elevated interest rates and inflationary pressures in developed economies like US and European Union have slowed demand for Indian goods, leading to less shipments. Higher borrowing cost at home and some import curbs have also reduced inbound shipments.

Despite snapping up cheaper Russian oil cargoes, the import bill for the world’s third-biggest consumer of oil is getting pricier due to an upswing in international prices and the falling rupee against the dollar.

The crude oil basket has averaged $80.37 a barrel in July compared to $74.93 in June, according to oil ministry data. The rupee slid past 83 to a dollar for the first time since October last year and is seen heading lower amid broader strength in the greenback.

“We continue to expect the external sector environment to remain comfortable in the current fiscal year,” said Madhavi Arora, lead economist at Emkay Global Financial Services. She expects the current account gap to moderate to 1.4% of the gross domestic product for the year ended March 2024 compared to 2.0% for previous fiscal year.

Services sector exports, driven by information technology and business consulting work, remain a bright spot. Exports from the sector were estimated at $27.17 billion last month.

(Updates with economist comment in eighth paragraph)