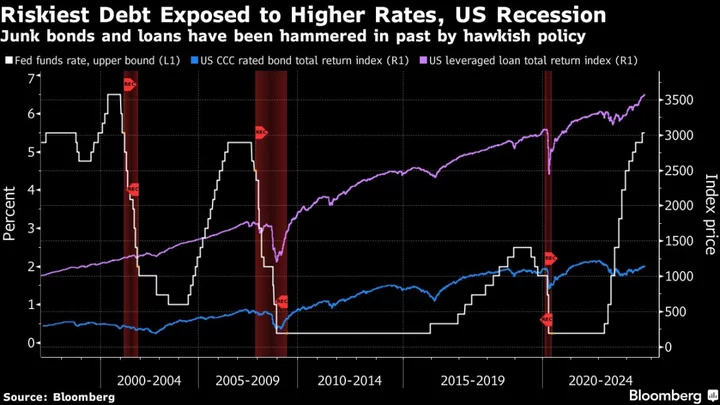

Credit investors have decided that they’re more than willing to fight the Federal Reserve as the central bank vows to keep rates high.

Total returns from leveraged loans and CCC rated junk bonds have rallied strongly this year, outstripping their investment-grade counterparts in recent months as the risk of a severe recession fades. Those gains come even as Fed Chair Jerome Powell has signaled he’s prepared to raise rates even further if he has to.

“The resiliency of the economy is certainly a story that has positively surprised a lot of investors,” said Frank Ossino, a portfolio manager at Newfleet Asset Management. “The base case was a slow down” for this year “and that hasn’t been the case.”

A soft landing in the economy would bolster corporate cash flows. But further rate hikes or an extended period of high interest rates would only suck up more of that cash, particularly for companies that borrowed heavily in the leveraged loan market. Loans come with floating rates, which translates to companies facing higher interest payments as rates rise.

Strategists from Bank of America Corp. to Pacific Investment Management Co. have written in recent days about the rising likelihood that borrowing costs remain higher as the economy holds up.

In early June, interest rate markets had expected rate cuts to begin later this year, but now envision the first cuts to come closer to May 2024.

Indeed, “it’s not unthinkable to envision the Fed not only staying on hold, but announcing further rate hikes next year,” Pimco economist Tiffany Wilding wrote.

Read More: KKR’s Latest Bankruptcy Deal Is a Bad Omen for Lenders

The higher-for-longer outlook is typically supportive of floating-rate assets like US leveraged loans, which have returned 8.8% so far this year through Friday’s close.

That’s left the market feeling confident enough to bring several leveraged buyout loans to market in the coming weeks, helping to quench some of the deal supply drought. Deutsche Bank AG, for example, is preparing a $550 million leveraged loan to fund Bain Capital Private Equity’s purchase of Brazilian steakhouse Fogo de Chão.

With corporate failures rising, portfolio managers are looking hard at the increased risk of losses from loans after investor protections were weakened in the cheap money era. Roberta Goss, head of bank loans and collateralized loan obligations at Pretium Partners expects recoveries in the low 40-cent-on-the-dollar range on soured leveraged loans over the next 12 months compared with the 70 cents to 80 cents that was the norm in previous cycles.

There are also some skeptics who view the high-yield market as too expensive. Barclays Plc strategists led by Bradley Rogoff see opportunities in single-name credit default swaps to hedge, or even short, BB and B rated credits as fundamentals and earnings deteriorate.

Junk bond risk premiums are unlikely to widen materially between now and September, in part because of relatively subdued issuance, they wrote. However, spreads “are too tight at these levels due to continuing severe lending standards, deteriorating fundamentals, and a default rate that is likely to rise.”

Week in Review

- Private equity firm Roark Capital Group expects to borrow nearly $5 billion in a little-known debt market to help permanently fund its investment in US sandwich chain Subway.

- China unveiled a further easing of its mortgage policies to halt a slump in its residential property market and revive growth in the world’s second-largest economy. Meanwhile, Country Garden Holdings Co. delayed until next week a deadline for bondholders to vote on a debt payment extension, while some noteholders are pushing back.

- Investors in direct lending funds are finding that a key measure of returns — distribution to paid-in capital — isn’t growing like it used to.

- UBS Group AG is exploring its first sale of additional tier 1 bonds since its rescue acquisition of collapsed Swiss peer Credit Suisse Group AG.

- Apollo Global Management Inc. is looking to raise debt and equity to help fund the growth of the securitization business it bought from Credit Suisse Group AG.

- Former Credit Suisse star trader Hamza Lemssouguer’s hedge fund is marketing its first collateralized loan obligation deal.

- LibreMax Capital’s main fund notched returns of roughly 6% through July this year, after betting on asset-backed securities and rotating out of commercial and residential mortgage debt and collateralized loan obligations.

- Mallinckrodt Plc plans to file bankruptcy for the second time in less than three years.

- WeWork Inc. is rounding up advisers for help with a restructuring.

On the Move

- AGL Credit Management LP, the firm founded by Peter Gleysteen and the late Thomas H. Lee, hired Taylor Boswell as it plots a push into direct lending.

- Canaccord Genuity Group Inc. shuffled its Canadian capital markets division, installing a new slate of leaders following a round of job cuts.

- Bank of Nova Scotia bond trader Jacqueline Kope is leaving the Canadian bank, adding to recent exits from its North American trading teams.

--With assistance from Tasos Vossos, James Crombie, Ronan Martin, Lisa Lee and Dan Wilchins.