UK lenders, led by HSBC Holdings Plc, are removing mortgage deals from the market again as they prepare to reprice home loans to account for inflation.

Giving only hours’ notice, HSBC told brokers on Thursday that it would remove all its current new business residential and buy-to-let products the same evening. It said the offerings will be back Monday at increased rates. That triggered a surge in demand, prompting the lender to withdraw them before the scheduled time.

The number of home loan products available in the UK was 5,056 on Friday, according to data company Moneyfacts Group Plc. That’s about 4% lower than at the start of May, but the highest daily amount this month, suggesting some lenders may be putting deals back on the market at higher rates.

The move is the latest blow to Britain’s cash-strapped homeowners, who are already grappling with higher borrowing costs and a possible drop in house prices. Households are being forced to cut down other expenses to cover higher loan repayments, while many prospective buyers are avoiding the mortgage market altogether.

“Each time it becomes clear that the Bank of England will soon hike rates, the cheapest lender on the high street gets overwhelmed,” said Hina Bhudia, partner at Knight Frank Finance. “Much is going to depend on the next CPI reading due later this month.”

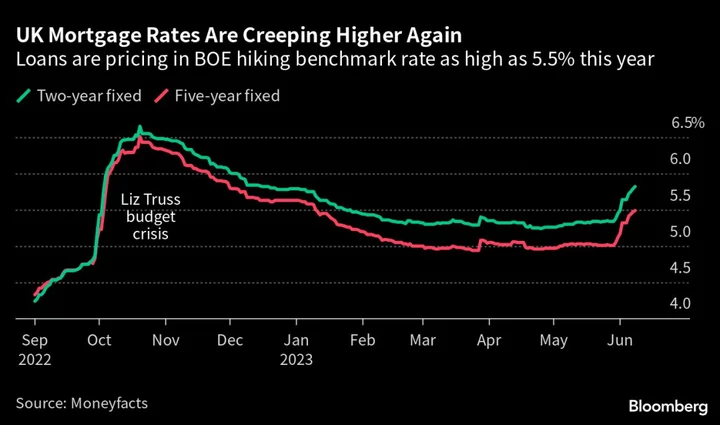

The average two-year fixed-rate mortgage on a home rose to 5.83% on Friday, the highest since December, after a high inflation reading last month prompted money markets to bet that the BOE will keep raising rates through this summer. Meanwhile, the average five-year fixed-rate deal remained just below 5.5%.

Andrew Montlake, managing director at mortgage broker Coreco, said it was inevitable mortgage costs would rise after inflation numbers pushed up swap rates. “I’m praying the worst is over,” he said.

The average two-year fixed-rate mortgage across the nation’s six biggest lenders — which includes HSBC, Lloyds Banking Group Plc, and Nationwide Building Society — has surged above 5% again since the start of June, according to price comparison website Uswitch. That’s a concern for tens of thousands of UK households that are on two-year fixed-rate mortgages which are due to expire in September.

Though the UK inflation rate fell back into single digits in April, it continues to outpace wage growth. Potential buyers are finding it even harder to afford the cost of repaying a home loan, contributing to net mortgage lending falling to virtually zero in March, according to BOE data.

Ray Boulger, a manager at loan broker John Charcol, said at least one more mortgage lender is likely to pull its rates on Friday.

“It was obvious mortgage rates were going to have to go up, I’m just surprised it’s taken so long,” Boulger said. “It’s going to knock people’s confidence and they won’t be able to get as big a loan.”