The chief executive officer of reAlpha Tech Corp., a small property technology startup, briefly gained billions of dollars in paper wealth during a hot direct-listing debut this week, only to see most of that erased as the stock plunged in the following days.

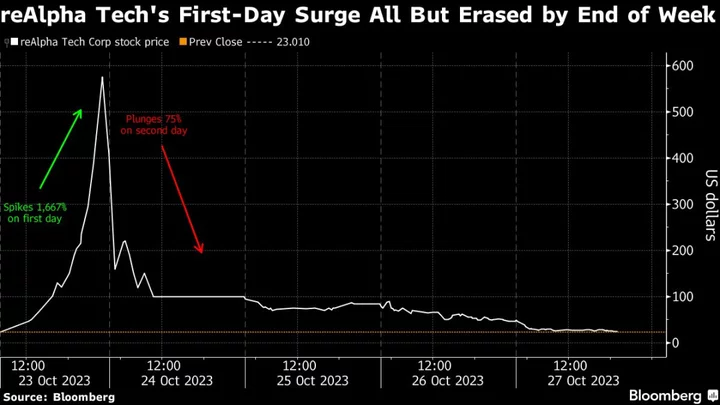

The Dublin, Ohio-based company’s stock surged a whopping 1,667% in its first day of trading Monday, after it went public via a direct listing on the Nasdaq. Shares began trading at $23.01 — already above the $8 reference price — and closed at $406.67.

At the end of that first trading day, CEO Giri Devanur added $11.2 billion to his personal wealth from the large stake of reAlpha stock he holds, according to data compiled by Bloomberg. But things quickly took a turn. The stock plunged 75% on Tuesday and continued to slide in a week that saw trading halted more than 40 times for volatility. On Friday, shares extended losses to a level just shy of where they debuted after short seller Spruce Point said to avoid shares.

That reversal of fortunes knocked the value of Devanur’s majority stake down to about $700 million, according to data compiled by Bloomberg.

Before the direct listing, Devanur disclosed he holds 27.6 million shares, and in a filing this week the company said his holdings amounted to about 65% of outstanding common stock.

“The float is a problem, it’s locked up,” said Kim Forrest, founder and chief investment officer at Bokeh Capital Partners. Even if Devanur were to sell to add liquidity, it could look bad that he’s offloading stock, she added.

“This company is kind of stuck between a rock and a hard place,” she said. “It’s a numbers game and the numbers are not working for this small company at this time.”

reAlpha is the latest example of a relatively small and thinly traded company to see huge stock gains after listing be swiftly erased, meaning large paper losses for the top holders of shares. In August, VinFast Auto Ltd.’s founder Pham Nhat Vuong saw his net worth surge by tens of billions of dollars when the stock spiked in the days following its debut, only to have most of that erased as shares fell back to Earth.

The first-week stumble also shows how investors are feeling about newly listed firms amid a tenuous backdrop for equities pressured by earnings season, economic uncertainty and geopolitical tension. Highly watched initial public offerings this year such as Arm Holdings Plc and Instacart jumped in their trading debuts but have slumped since.

Of course, not all companies have been warmly welcomed by the public markets this year. Birkenstock Holding Plc, which makes the famous sandals with the same name, fell in its October trading debut and has remained under pressure.

reAlpha Tech, which says that it uses “artificial intelligence-focused technology” to allow retail investors to participate in short-term rental properties like those listed on Airbnb, said in a filing with the US Securities and Exchange Commission that Denavur’s majority stake means it is a controlled company under Nasdaq listing rules. The company did not immediately respond to a Bloomberg News request for comment.

--With assistance from Kristine Owram.