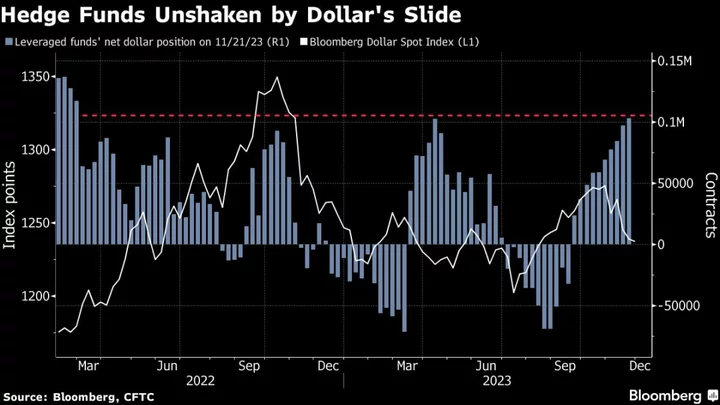

Hedge funds piled into bullish dollar bets this month despite the currency’s slide on softening economic data and increasing expectations that the Federal Reserve’s most aggressive rate-hiking cycle in a generation is near an end.

A metric of net dollar positioning that measures leveraged funds’ long bets on the greenback against eight currencies rose to its highest level since February 2022 as of Nov. 21, according to data from the Commodity Futures Trading Commission aggregated by Bloomberg. It stood at net long 103,042 contracts, just above a previous year-to-date high seen in April, after bottoming around a net short position of around 72,000 contracts in March.

The surge in long dollar bets comes as a Bloomberg gauge of the dollar is on pace for its worst month since last November, when the greenback’s sudden slide similarly caught investors wrong-footed after a months-long advance.

Earlier this month, the Bloomberg Dollar Spot Index had its worst week since July, erasing its year-to-date gains as traders boosted bets that Fed rate increases may be over and pushed forward expectations of cuts by the central bank. On Monday, the index fell for a third straight session as Treasuries rallied amid a strong sale of five-year notes.

Read more: Dollar’s Worst Week in Months Erases 2023 Gains on Rate Cut Bets

“We often think about USD performance in the context of its interaction with rate differentials and risk appetite,” wrote Dominic Bunning, head of European FX research at HSBC, in a Monday note prior to the release of the CFTC data. “On this front, the USD is caught between two stools. Much stronger risk appetite, in the form of higher global equity markets, has driven the USD weaker. But the USD’s broad yield advantage has not softened, and may ultimately act as a speed limit on further dollar weakness,” Bunning added.