How much worse can China's economic slowdown get?

HONG KONG (Reuters) -China's economic activity data for July, including retail sales, industrial output and investment failed to match expectations,

2023-08-16 07:15

Spanish Inflation Unexpectedly Slows on Fuel, Tourism Costs

Spanish inflation unexpectedly eased, retreating for the first time since June thanks to drops in the costs of

2023-11-29 16:27

Treasury Cash Pile Slumped to Match 2015 Low During Debt-Cap Saga

The amount of money the US government had to pay its bills plunged to the lowest level in

2023-06-03 04:29

Mining boosts Australia business investment to 8-year high, outlook upbeat

By Wayne Cole SYDNEY Australian business investment rose to an eight-year high in the September quarter thanks to

2023-11-30 09:48

Ukraine Needs Its Women Back for a Shot at Economic Recovery

Ukraine needs its women refugees to come home, and soon. Almost a year and a half into President

2023-07-24 23:54

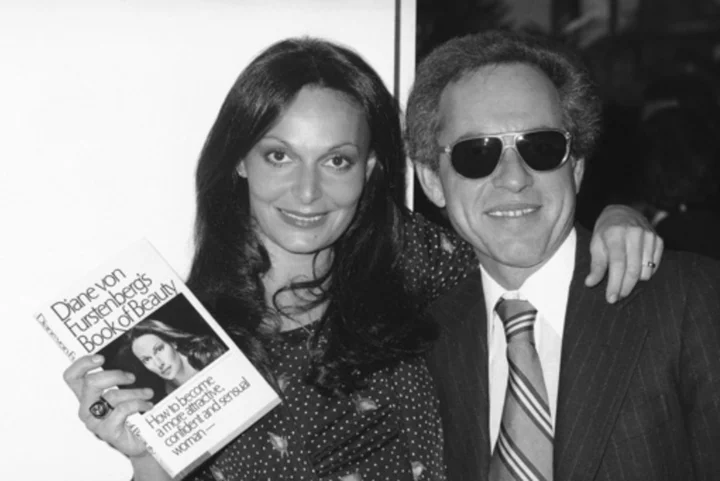

Richard Snyder, ‘warrior-king’ of publishing who presided over rise of Simon & Schuster, dead at 90

Richard Snyder, a visionary and imperious executive at Simon & Schuster who presided over the publisher’s exponential rise during the second half of the 20th century and helped define an era of growing corporate power, has died

2023-06-08 04:58

Seabury Aviation Partners to Deliver Best-in-Class Aviation and Aerospace Advisory Services

NEW YORK--(BUSINESS WIRE)--Oct 18, 2023--

2023-10-18 21:52

Special Report-Inside the downfall of embattled property developer China Evergrande

By Engen Tham, Julie Zhu and Clare Jim SHANGHAI/HONG KONG - In the beginning, Hui Ka Yan followed a simple

2023-08-31 18:56

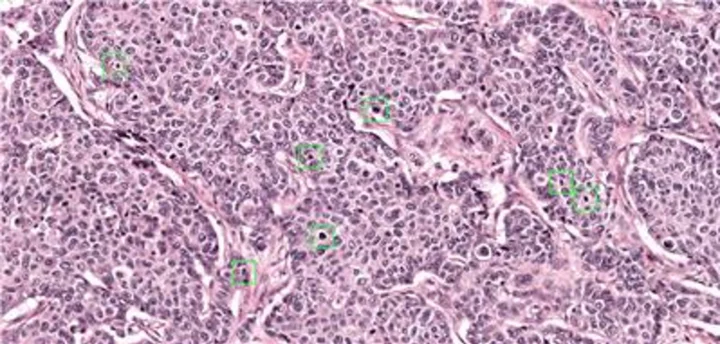

Aiosyn, Radboud university medical center, and Pathologie-DNA are Awarded a EUR 1.300.000 EFRO Grant to Develop AI-Powered Solutions for Cancer Diagnostics

NIJMEGEN, Netherlands--(BUSINESS WIRE)--May 9, 2023--

2023-05-09 17:18

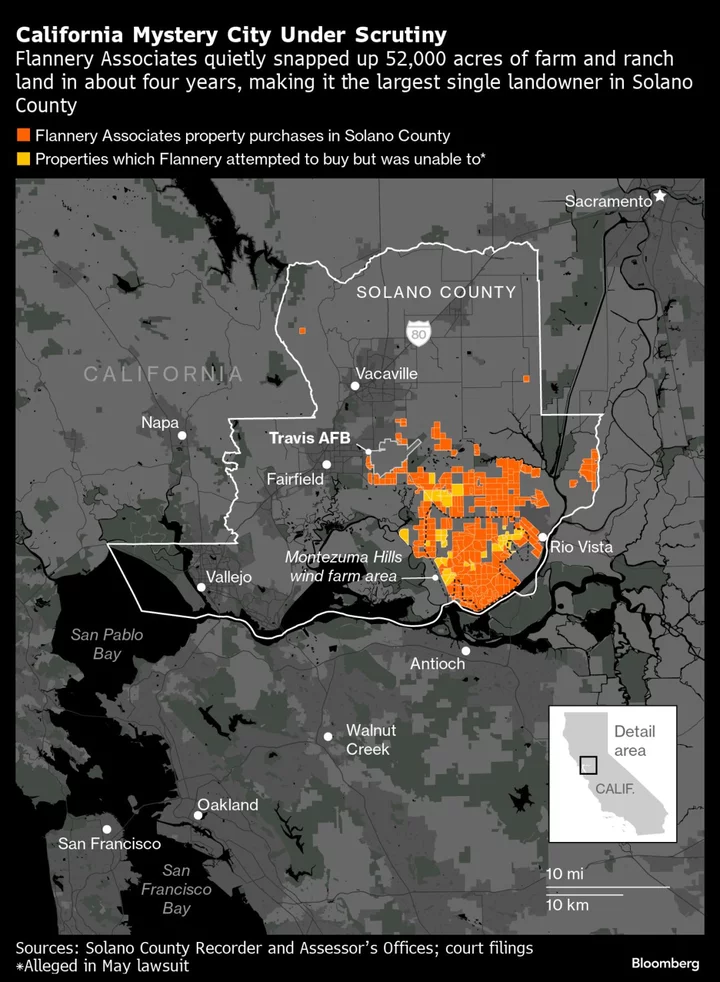

Biden in Florida, Dreams of Utopia: Your Saturday US Briefing

All hail Labor Day Weekend, when we honor workers by taking off Monday to enjoy what may be

2023-09-03 00:50

Ex-Barclays Bank boss Staley banned from senior UK finance roles over misleading Epstein statements

Britain’s financial regulator has fined the American former chief executive of Barclays, Jes Staley, 1.8 million pounds — about $2.2 million — and banned him from holding senior financial roles for misleading it over the nature of his relationship with the late sex offender Jeffrey Epstein

2023-10-12 20:20

Credit Market Thaw Paves Way for Two New M&A Debt Deals

Carrier Global Corp. and Tapestry Inc. are tapping investment-grade bond investors to raise funding for planned mergers and

2023-11-16 03:53

You Might Like...

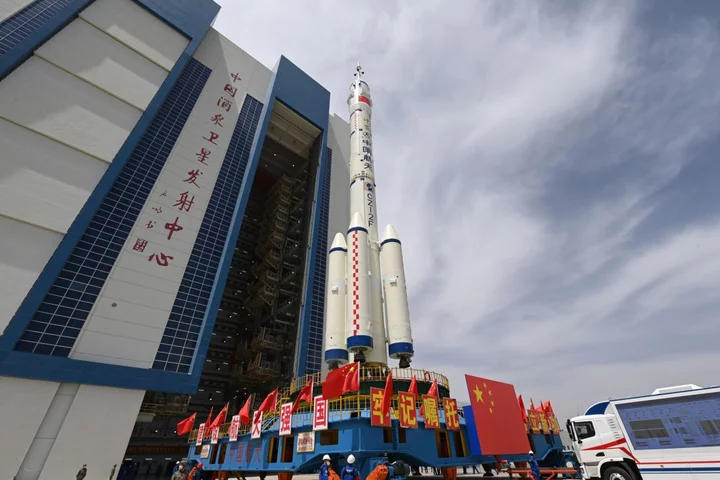

Xi Charm Offensive Turns to Space as ‘Divine Craft’ Launches

The UAE holds an annual oil and gas conference just ahead of hosting UN COP28 climate talks in Dubai

Birdseye Raises $3M in Seed Funding to Revolutionize How Brands and Retailers Target Customers

Stocks slide, US yields climb amid hawkish Fed, China tensions

SpaceX lawsuit could be key test of US policy on bias against refugees

AngloGold shifts primary listing to US, completing S.Africa exit

GigNet Promotes Luis de Potestad to Vice President – Public Affairs and Special Projects

NHL rumors: Latest on William Nylander contract hints at future with Maple Leafs