Africa’s first verifiable emissions reduction platform has begun operations with a carbon futures transaction of more than two million credits, a record for offsets issued on the continent.

Nairobi-based CYNK traded the credits, which will be produced by Tamuwa, Kenya’s largest biomass company, it said in a response to questions. Tamuwa’s credits are verified by Gold Standard.

This “showcases the potential for climate projects and sovereign nations in the Global South,” Sudhu Arumugam, CYNK’s chief executive officer, said in a statement on Monday. They can “monetize this fast-growing asset class,” he said.

Nations from Zimbabwe to Kenya are racing to regulate and benefit more from the trade in carbon credits from projects in Africa, enacting laws and revenue-sharing arrangements, as well as pushing for the offsets to be traded on exchanges based on the continent.

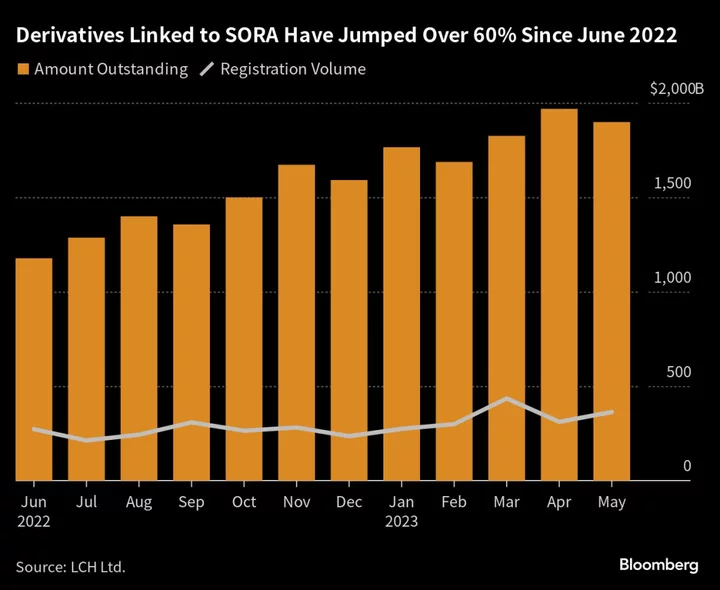

A single carbon credit is equivalent to a ton of climate-warming carbon dioxide or its equivalent that is either removed from the atmosphere or prevented from entering it in the first place. They are bought by emitters of greenhouse gases to offset their polluting activities. The global trade is currently worth $2 billion a year, and Bloomberg BNEF has forecast it could grow to $1 trillion in 15 years.

Tamuwa, which founded CYNK, produces biomass briquettes from waste known as bagasse that comes from sugar milling operations in Kenya. Bagasse emits methane if left to rot.

“Our landmark trade illustrates the value of carbon credits as an asset class,” Nils Razmilovic, Tamuwa’s CEO, said in the statement. They “can create climate action and benefits for local communities.”

CYNK declined to provide the buyer’s identity or details of pricing of the trade.

(Updates with verifying company in second paragraph)