Toyota Motor Corp., Honda Motor Co. and Nissan Motor Co. all raised their operating profit forecasts for the current fiscal year on the back of strong sales, in what can be seen as a validation of their view that the shift to fully electric vehicles will take longer and require more patience by the industry.

General Motors Co. and Ford Motor Co. learned that the hard way. They were forced to pull guidance recently following weeks of strikes by the United Auto Workers over wage hikes and job security in the EV future. They also scaled back aggressive electrification plans.

“You go too fast, you crash,” said Christopher Richter, senior analyst at CLSA Securities Japan Co. “Ignoring the external pressures and getting it right is more important than doing it fast. The Japanese makers seem to appreciate that there would be bumps on the road to electrification.”

Profits at Toyota and Nissan have more than doubled in April through September from a year earlier, while Honda posted 54% in gains in the first half. By comparison, companies in the Topix Index — excluding wholesalers and financial firms — with a fiscal year ending March had a 30% jump in first-half operating profit, according to Hikaru Yasuda, strategist at SMBC Nikko Securities Inc.

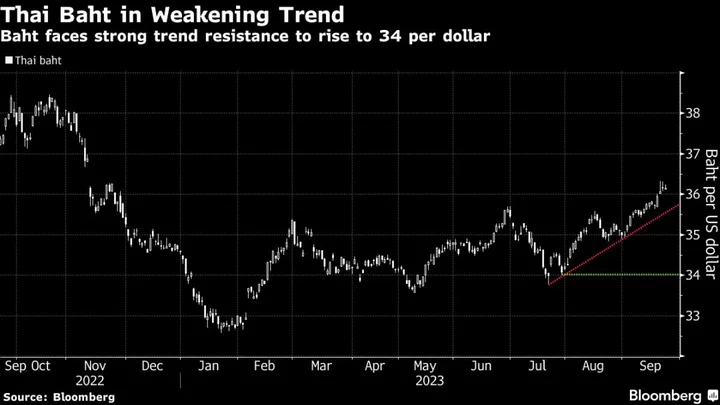

Boosted by the weaker yen, recovering supply chains and strong sales overseas, Nissan raised its full-year profit outlook to ¥620 billion ($4.1 billion) Thursday, exceeding analysts’ average estimate and pointing to a 64% gain for the full year. Nissan shares fell 1.5% in early morning trading in Tokyo on Friday.

Honda also increased its guidance by 20% to ¥1.2 trillion, but the figure fell short of analysts’ projections. Honda shares fell as much as 6.1%.

Mazda Motor Corp. surged 10% and Suzuki Motor Corp. climbed to a five-year high on Wednesday after raising their profit forecasts. Toyota extended gains after raising its operating profit forecast 50% on Nov. 1.

Led by Toyota, Japan’s carmakers have long asserted that the path to reducing carbon emissions won’t just depend on battery EVs, but a variety of technologies, including hybrid powertrains and hydrogen. The success of Tesla Inc., as well as BYD Co. and other EV manufacturers in China, has been fueling criticism that they were increasingly falling behind, much to the frustration of Toyota Chairman Akio Toyoda.

Koji Sato, Toyoda’s successor as chief executive officer, said at last month’s Japan Mobility Show that Toyota’s multipathway approach will remain on track. “Our goals won’t change,” Sato said in one of his first interviews since his promotion in April.

While EV sales in China are expanding at a steady clip, there are signs of waning demand in the US, where Tesla has cut prices and sales of Ford’s loss-making F-150 Lightning electric pickup declined by almost a half in the latest quarter.

Read More: Tesla, EV Investors Face a Reckoning as Demand Starts to Crack

The positive surprises by Japanese carmakers have helped make the sector the top performer on the Topix Index. A gauge of car producers is up 50% this year, compared with 23% for the broader index, according to data compiled by Bloomberg. Share gains by automakers were lagging behind commodity companies until last week.

Tatsuo Yoshida, Bloomberg Intelligence senior auto analyst, warned that investors shouldn’t expect the current market enthusiasm to continue for too long. “Near-term good news are almost all factored in the stock price,” he said. “It may be tough to find another surprise or driver from now on.”

One area of concern is China, where all of the Japanese carmakers — except Toyota — have seen drastic declines in sales as car buyers switch to battery EVs. That may have led some investors to underestimate the health of Japan’s automakers, prompting some who had been late to the party to rush into buying those stocks.

“Investors were expecting Japanese automakers’ earnings to be good, but they had not anticipated their strong performance in the US would cancel out challenges that they face in China,” said Shinya Naruse, an analyst at Okasan Securities Co.

Still, the Japanese auto sector — which still mainly sells combustion engine and hybrid cars — is on track this year to exceed its peak operating profit of around ¥5.4 trillion in fiscal 2015, according to Naruse.

“I don’t think that Japanese automakers will become complacent with these good results,” Yoshida said. “This is because they know that they have benefited from the tailwind of a weaker yen and reduced sales costs due to the continued tight, albeit loosening, supply-demand balance for vehicles.”

--With assistance from Akemi Terukina and Aya Wagatsuma.