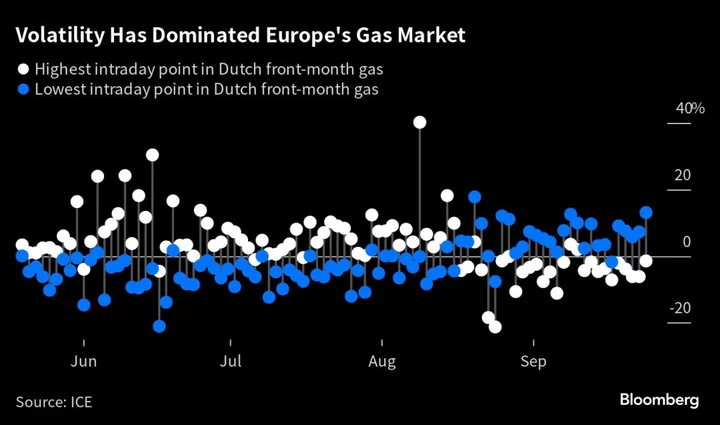

Europe’s energy crisis has made its main gas market a popular destination for traders around the world seeking to get exposure to extreme volatility.

While large international trading desks in Europe, the US and Asia are regular participants in the market, it was previously less common for institutions outside of those key hubs to trade the region’s fuel. But Russia’s war in Ukraine sent Europe’s gas prices to record highs last summer, and while they’ve eased since then, they still remain volatile and have lured new entrants to the market.

“The increased presence of these newer actors in the European market is now itself contributing to volatility in the market with major price swings this summer,” said James Waddell, head of European gas and global LNG at Energy Aspects.

The reach is so wide that traders at Brazil’s biggest investment bank Banco BTG Pactual SA have been using Europe’s gas market to take advantage of price swings and high trading volumes. The bank was attracted by the spread between contracts traded on the Dutch hub and Asian spot LNG prices, according to people familiar with the move who asked not to be identified discussing confidential matters. A spokesperson for the bank declined to comment.

“High volatility creates opportunity,” said Francisco Blanch, commodity strategist at Bank of America Corp. The constant price swings have “attracted a lot more investors into the market.”

BTG sought to offload gas contracts it bought to fuel three power plants under an agreement with the government to help prevent blackouts. The agreements were made in October 2021 as a precaution while the country’s hydropower plants were running dry. When water reserves rose, the gas plants were no longer needed all the time and the government severed the deal, leaving BTG with fuel it didn’t need.

Selling it in Europe was profitable enough to offset the liabilities of the early finish of the contracts, the people familiar said.

In a sign that BTG is far from the only new entrant to Europe’s market, open interest on Dutch natural gas futures topped 1.4 million contracts last week — a record for the year and a 30% increase from the same period in 2022, according to data from Intercontinental Exchange Inc. While ICE doesn’t split volumes by geography, the growth suggests that trading is expanding beyond the most active hubs in Europe and the US.

Volumes traded in futures and options contracts have also surged, and are now 50% higher than a year ago, the ICE data show. Meanwhile, trading volume for contracts tied to Asian liquefied natural gas is growing at a slower pace of 7% versus a year ago.

--With assistance from Anna Shiryaevskaya, Cristiane Lucchesi and Elena Mazneva.