Citigroup Inc. led a $260 million asset-backed financing for WeLab Ltd., Hong Kong’s biggest online lending platform, people familiar with the matter said.

Citigroup is the sole senior underwriter on the deal, the people said, asking not to be identified because it’s private. Hong Kong-based representatives for Citigroup and WeLab declined to comment.

Banks are expanding their securitization businesses to diversify funding and hedge credit risk exposures after successive rate hikes slowed traditional loan growth and stretched the capacity of borrowers to repay debt.

Companies can borrow at lower rates using high-quality assets as collateral, rather than issuing unsecured debt. Banks typically pool various forms of debt, including mortgages, auto loans, or credit-card obligations, and sell the repackaged assets to investors.

Read more: Sequoia-Backed WeLab Is Said to Seek Funds at $2 Billion Value

WeLab’s loan balance growth this year has exceeded pre-pandemic levels, driven by its partnerships with global firms including Tesla Inc. and Apple Inc. The firm, whose backers include Sequoia Capital and tycoon Li Ka-shing, has seen 37% year-on-year loan growth and its delinquency rates are well below the industry average. It has an almost 90% market share for Tesla’s car loans in Hong Kong, and is the exclusive financial service provider for Apple’s subscription program in Asia, one of the people said.

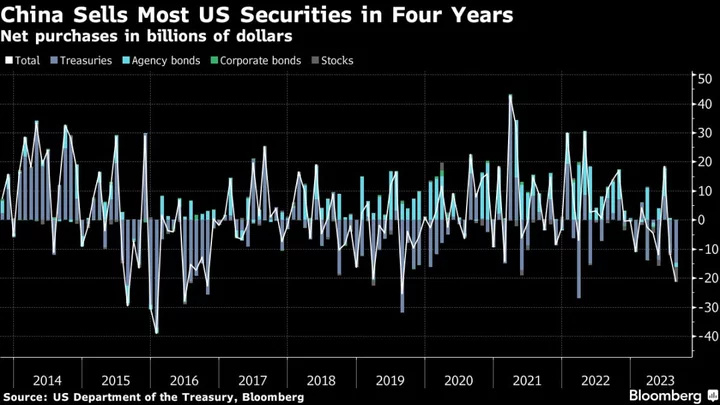

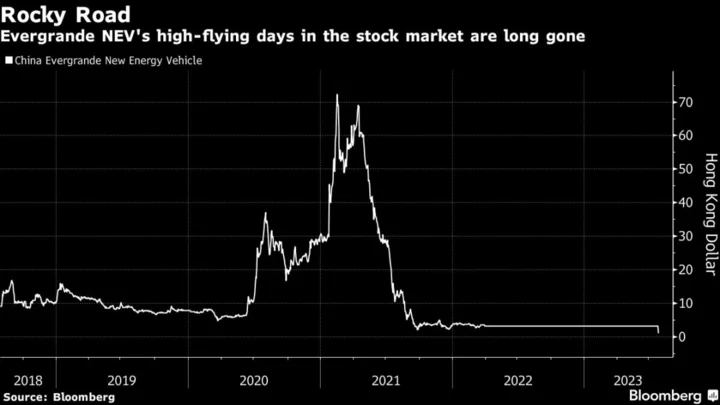

The deal comes as the crisis in China’s credit market is deepening, with the contagion spreading to some of Europe’s junk credit markets. Chinese developer Country Garden Holdings Co. last week was deemed to be in default on a dollar bond, while China Evergrande Group is struggling to finalize a restructuring plan and may end up being liquidated.

Since its inception in 2013, WeLab has disbursed more than $13 billion in loans, and has become a pan-Asian fintech platform with more over 60 million users and more than 700 enterprise customers in Hong Kong, China, Indonesia, and Malaysia.