Companies storming the bond market at record-breaking pace made one thing clear: They don’t expect rates to stay elevated for long.

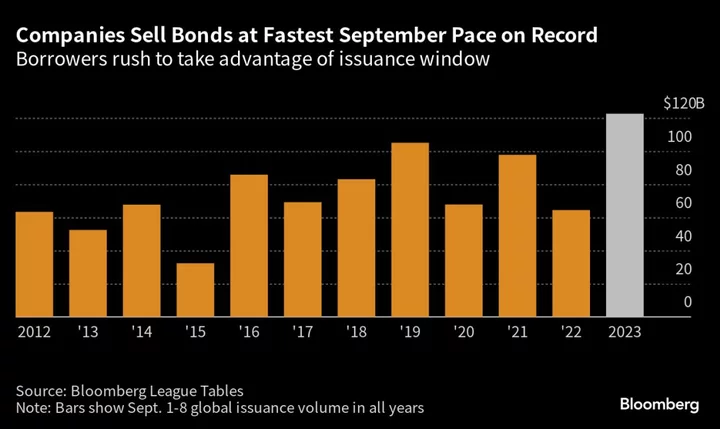

More than $110 billion in bonds sold globally this week, the busiest start to September on record, with issuance heavily skewed to debt due in under 10 years. The barrage was led by investment-grade issuers, teeing up a wave of junk, including billions of dollars in buyout funding.

“Companies don’t really want to lock in these high yields for a very long time if they can avoid it,” said Matt Brill, head of North America investment-grade credit at Invesco Ltd., which manages $1.5 trillion in assets.

Prospects of a soft landing in the US and hopes that central banks will soon be able to slow their tightening campaigns make longer-dated debt more attractive to investors. But companies are instead opting to borrow for shorter periods, hoping the money will get cheaper soon.

“Many issuers are reluctant to lock in these higher absolute rates for longer term,” said Dan Mead, head of the investment-grade syndicate at Bank of America Corp., the biggest underwriter of corporate bonds, according to current Bloomberg rankings.

The share of US high-grade corporate bond issuance with a maturity of 10 years or longer was just 10% in the month to Sept. 6, the lowest since at least 2010, according to strategists at Bank of America.

The September rush to raise debt is fairly typical of the corporate bond market, which usually sees issuers take advantage of pent-up demand after a seasonal summer slowdown. It’s not expected to continue at the same pace, or shift credit spreads much from current compressed levels.

“Investors were set up for this,” said Steven Boothe, head of global investment-grade fixed income at T. Rowe Price Group Inc, which manages about $1.4 trillion. “Once we get through this wave, there’s not going to be much remaining supply for the rest of the year.”

Issuance will likely taper after the first two weeks of September as companies enter earnings blackout periods, according to Bank of America’s Mead. “There’s certainly the ability for this market to take on more supply but I also don’t think we will continue at this run rate,” said Mead in an interview.

The US debt market is already showing some signs of indigestion, with some issuers struggling to generate enough demand to get deals done. Despite this, September sales already exceed $55 billion, nearly half way to the forecasted $120 billion total for the month — with another $30 billion expected in the week ahead.

Even then, demand is anticipated to outstrip supply, as the predicted September total would fall short of most prior years, and year-to-date US high-grade sales are down 4%. And even after jumping 14% this year, global issuance is still running behind 2020 and 2021 levels, data compiled by Bloomberg show.

“Companies don’t want to issue as much, which is going to make life a little harder for the buyers,” said Invesco’s Brill. “There won’t be the concessions that we had kind of hoped for and thought there would be.”

In Europe, debt sales are also expected to slow down later this month. Companies had accelerated issuance to get ahead of central bank meetings and blackouts, according to Tom Moulds, senior portfolio manager at BlueBay Asset Management.

“This seasonal period of activity has been well received,” said Moulds.

Week in Review

- Companies with leveraged loans and junk bonds coming due soon are increasingly turning to private credit to refinance.

- A group of lenders led by firms including Blue Owl Capital Inc. and Blackstone Inc. is providing $2.7 billion of financing to help fund BradyIFS’s acquisition of competitor Envoy Solutions.

- Private credit lenders are just getting started in the world of consumer and asset based finance, according to Rob Camacho, Blackstone’s co-head of asset based finance.

- Dwight Scott, Blackstone’s global head of credit, talked with Bloomberg News about what he sees as the advantage that private lending funds have over investment banks when funding take-private transactions.

- Blackstone’s credit unit is helping to finance Permira Holdings’ takeover of biopharmaceutical services firm Ergomed Plc.

- Meanwhile, Blackstone’s nearly $50 billion private credit fund for affluent individuals attracted the most capital in more than a year.

- Dwight Scott, Blackstone’s global head of credit, talked with Bloomberg News about what he sees as the advantage that private lending funds have over investment banks when funding take-private transactions.

- Armen Panossian, one of Oaktree Capital Management’s two incoming co-chief executive officers, said the demand for private credit is tempting investors who might otherwise have placed funds with private equity firms.

- In another C-suite interview, Blue Owl Capital Inc.’s Marc Lipschultz said a $10 billion private credit loan is within reach.

- In emerging markets, private credit deals are picking up again as companies seek more flexible, longer-term financing in an uncertain economic environment, according to the Global Private Capital Association.

- Barclays Plc is finalizing a private credit partnership with AGL Credit Management.

- US regional banks may need to raise significant amounts of additional debt to comply with new regulatory requirements, but the extra capital might not be enough to prevent future failures.

- After bouncing back from Credit Suisse’s AT1 writedown debacle, the market for European banks’ riskiest debt is set to be tested again, with $84 billion notes facing calls in the next two years.

- AB CarVal Investors LP and Serone Capital Management LLP are joining a growing roster of hedge funds trying to carve out their first slice of Europe’s market for collateralized loan obligations.

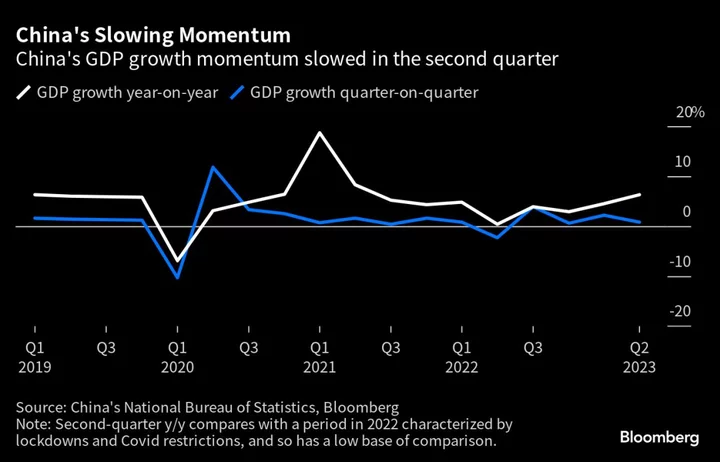

- China’s housing crisis has engulfed the country’s private developers, producing record waves of defaults and leaving a shrinking group of survivors.

- Taiwanese banks are fast disappearing from loan deals with Chinese companies, the latest indication of a collective effort to cut exposure to the world’s second-biggest economy.

On the Move

- Judith Fishlow Minter, co-head of US loan capital markets at RBC Capital Markets, is retiring at the end of October.

- Deutsche Bank AG has hired Saju Georgekutty to lead investment-grade cash trading in the US. Georgekutty previously led the investment-grade bond trading desk at Morgan Stanley.

- 26North Partners, the investment firm started by Apollo Global Management Inc. co-founder Josh Harris, named seven new partners for an array of roles as it starts a direct-lending business.

- Dan Loeb’s Third Point recruited Chris Taylor, a former New York Life Investments executive, to head the hedge fund firm’s new direct-lending strategy.

- Canadian Imperial Bank of Commerce hired Andras Gajdos as a director to structure collateralized loan obligations. Gajdos previously worked at Morgan Stanley.

- Swedish lender SEB AB has appointed Karl-Johan Nystedt to lead a debt capital markets team focused on financial institutions in Stockholm.

- Sumitomo Mitsui Financial Group’s US arm recruited Chris Castelli and Miguel Freyre as directors in its emerging markets fixed income sales and trading team.

--With assistance from Ronan Martin, Taryana Odayar and Andrew Monahan.