Russian liquefied natural gas shipments to the European Union slumped last month due to plant maintenance and weaker demand, but exports could rebound if a cold snap this winter boosts consumption.

Russian LNG arrivals in EU ports fell more than 25% in August from a year earlier to about 770,000 tons, the lowest level for any month since 2021, according to preliminary ship-tracking data compiled by Bloomberg. While the region’s overall imports also declined, Russia’s export capacity was also curbed by annual works.

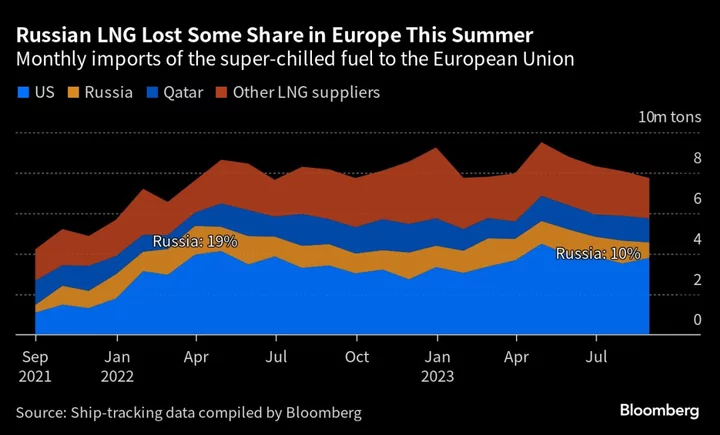

The country’s share of EU LNG imports dropped to about 10% in August — down from 19% in March last year, during the panic buying triggered by Moscow’s invasion of Ukraine. The US, Europe’s No. 1 LNG supplier, increased its share to 49% last month, while Qatar maintained its 15%.

A record surge in Russian LNG shipments to Europe has put the super-chilled fuel in political spotlight since 2022. While Germany, Poland and the Baltic states have increasingly shunned Russian LNG, Spain, Belgium and France are among the countries to boost purchases after the Kremlin choked off pipeline gas flows. The 27-nation bloc has never formally discussed an EU-wide embargo on Russian gas, including LNG, but Brussels has looked at ways for individual member states to ban the fuel.

Officials in Brussels have called for companies and EU member states to not renew long-term Russian LNG contracts once the current ones end. Yet, activists and some industry watchers have urged the bloc to consider a complete embargo on Russian LNG. The UK banned the fuel in 2022.

The EU is “making efforts to divest away from Russian gas as quickly as possible,” while also keeping in mind its energy security, European Commission spokesman Tim McPhie told reporters in Brussels on Thursday. He said overall reliance on Moscow — even after the jump in Russian LNG flows last year — is far less than it used to be.

Russian gas, both piped and liquefied, now covers less than 10% of Europe’s total demand compared with more than a third before the invasion.

LNG flows from Russia have been mostly down year-on-year since March, but remain far above 2021 levels, according to ship-tracking data. That slide came as the Netherlands curbed purchases and Germany shunned them altogether, relying on the US and other suppliers. There was also some increase in demand for the Russian fuel in Asia.

Still, the situation may change this winter, especially if cold weather boosts demand. Should that happen, Russia will be prepared, with export capacities set to rebound this month after annual maintenance.

--With assistance from Anna Shiryaevskaya and Lyubov Pronina.