Global central banks can’t afford to flinch in what may be a prolonged struggle to fully tame consumer prices, according to the head of the Bank for International Settlements.

“Over the coming years, monetary policy should focus squarely on bringing inflation back to levels consistent with central-bank objectives,” Agustin Carstens, general manager of the Basel-based institution, said in Sao Paulo on Friday. “This process may run into obstacles, particularly in the final stretch toward eventual convergence with inflation targets. But it is essential to achieve this objective.”

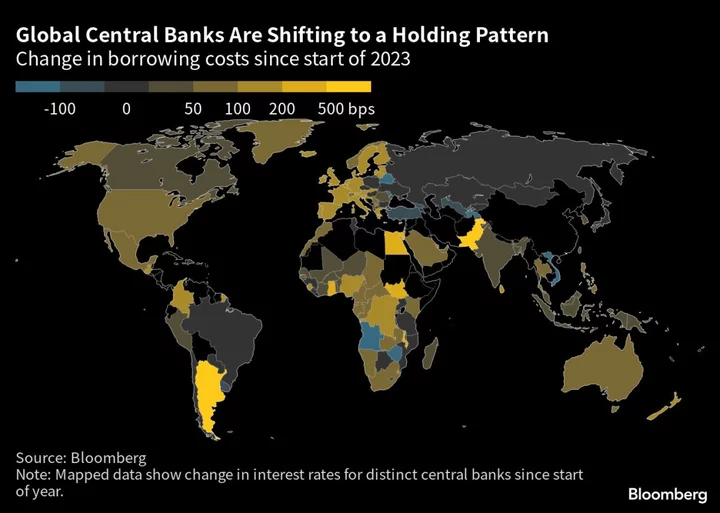

While the former Mexican central bank chief didn’t refer to any specific jurisdiction, his remarks coincide with a possible shift toward pausing interest-rate hikes by the US Federal Reserve after 500 basis points of increases so far. Enthusiasm to keep tightening is also waning elsewhere as inflation shows signs of peaking.

“This strong response must continue as long as necessary,” Carstens told a conference organized by the Brazilian central bank. “Only by resolve, perseverance and success in this task can trust in money be preserved.”

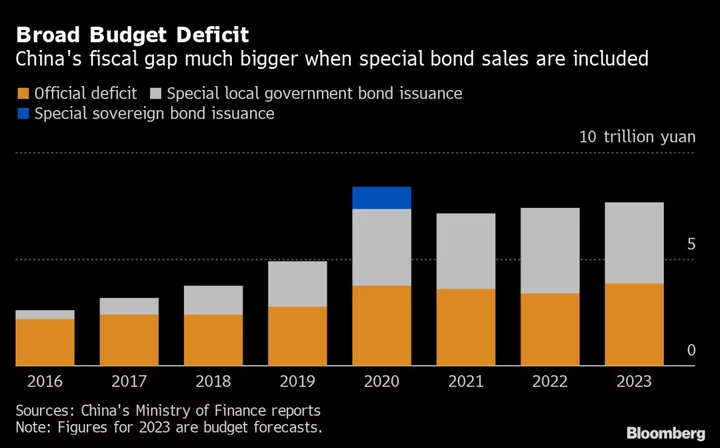

The BIS chief, whose speech focused on trust in public policies, reiterated his view that pandemic-era stimulus aimed at protecting economic growth is partly to blame for the current inflation shock.

Carstens suggested central banks shouldn’t do that again.

“Trust in monetary and fiscal policies could be compromised if we continue to attribute to them great power to stabilize economic activity without consequences for inflation,” he said.

His speech warned that a failure to bring consumer prices definitively under control could ultimately have long-lasting consequences.

“Some generations are experiencing the risk of the economy transitioning to a high-inflation regime for the first time,” Carstens said. “Once this transition starts, it can become increasingly difficult to stop.”