Blackstone Inc. sees opportunities to build out private credit offerings for high net worth investors in Japan after a strong start for a fund it launched with Daiwa Securities Group Inc. in April.

The offering from Blackstone, the world’s largest alternative-asset manager, and the Tokyo-based brokerage is the first publicly offered private credit fund in Japan that follows an offshore strategy, according to Daiwa. It invests in US loans of speculative-grade type companies via the Blackstone Private Credit Fund and raised more than ¥40 billion ($287 million) in its first two months — more than the amount collected by a similar Blackstone fund in Europe in its first half year.

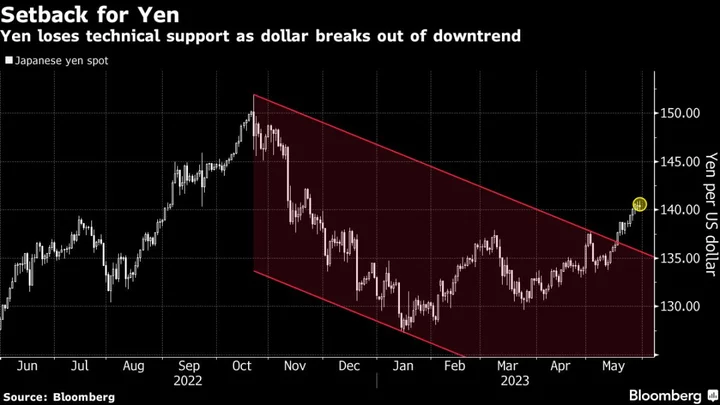

Returns on these direct lending deals are around 12%, versus about 7.5% two years ago, according Blackstone’s chief of credit, Dwight Scott. This makes them very appealing to the nation’s wealthy given the massive impact the Bank of Japan’s monetary policy has had in depressing interest rates at home.

“The response from investors has been incredible,” Scott said in interview last week. “There’s been an increase in the basic return profile of the credit market as a whole and direct lending particularly.”

Rich Japanese haven’t always done well in their hunt for higher-paying overseas assets. Clients of Mitsubishi UFJ Financial Group Inc. lost more than $700 million from investments in the riskiest bonds of Credit Suisse this year when the notes were wiped out by the Swiss regulator as part of a rescue package.

And Blackstone, which has long targeted Japanese institutional credit investors, hasn’t been immune to the volatility created by the rapid-fire rate hikes of the Federal Reserve to fight inflation. The firm’s flagship private real estate investment fund for wealthy investors, Blackstone Real Estate Income Trust Inc., has limited withdrawals for eight straight months, though there are signs that a backlog of redemption requests is easing.

Yield premiums on junk-rated US bonds have fallen more than 80 basis points this year, according to a Bloomberg index, in a sign that investors are expecting most riskier borrowers to be able to navigate a slowdown. All-in yields at around 8.3% are still some 2 percentage points higher than their 10-year average.

Other takeaways from the interview with Scott:

- Blackstone isn’t expecting a recession in the US and sees private credit remaining resilient in any downturn given the relatively strong financial standing of borrowers coming into the current higher-rate environment.

- While defaults in the US may rise from very low levels, Blackstone is lending on average to larger firms and almost all direct loans are on a secured basis.

- “We have built our portfolio on the expectation that we we are going to face a weak market at some point in the future,” Scott said. “We’ve invested in software, healthcare, professional services, areas where we think the business will be resilient even if we go through an economic downturn.”

- “On the lending side, we are growing our business in Asia broadly. We’re building out our team in Singapore, we’re building on our team in Australia, and eventually we will likely move into Japan.”