AstraZeneca Plc clinched a deal to develop a drug from the pharma industry’s hottest class of medicines, agreeing to pay as much as $2 billion to gain an experimental pill for diabetes and obesity.

The treatment developed by closely held Chinese biotech Eccogene is in early-stage clinical tests for diabetes. Unlike existing blockbusters, the treatment doesn’t require an injection.

The success of weight-loss drugs has sparked something of a gold rush in the pharma industry, and some analysts predict the class of treatments known as GLP-1s could become one of the biggest-ever blockbusters.

Chief Executive Officer Pascal Soriot is entering a field led by Novo Nordisk A/S and Eli Lilly & Co. as he reaps the benefits of a risky bet on cancer years ago to transform the UK drugmaker’s once meager pipeline. The timing places Astra behind the next wave of market entrants, which include Pfizer Inc.

The stock rose as much as 4.2% in London trading. Astra shares have declined over the past year.

“Buying an oral GLP-1 is a positive even in phase 1,” Jefferies analysts Peter Welford and Lucy Codrington said in a note, referring to the earliest stage of clinical trials. However, the medicine’s profile “is unclear for now and is many years from market,” Bloomberg Intelligence’s John Murphy and Sam Fazeli wrote in a note.

Pills for obesity and diabetes are the new frontier for drugmakers working to emulate Novo’s success. The Danish drugmaker has become Europe’s most valuable company even as it struggles to meet demand for its injection. US and UK regulators just approved Lilly’s diabetes medicine for obesity as well, offering patients another option though both require injections.

“Over a billion people are living with obesity today and many suffering from co-morbidities such as type 2 diabetes, heart failure, hypertension and renal disease,” Soriot said in a video statement. Regarding the medicine, “preliminary data shows it has a differentiated clinical profile in terms of offering good tolerability and has shown encouraging glucose and body weight reduction.”

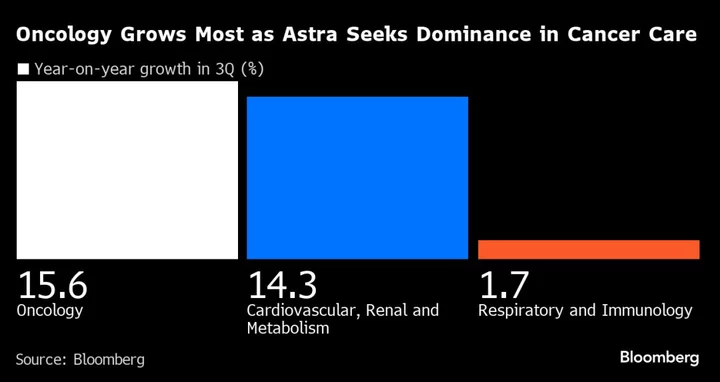

Astra on Thursday also raised its profit outlook. Revenue will probably rise by a mid single-digit percentage overall this year and core earnings per share by a percentage up to the low teens, the UK drugmaker said in a statement.

The Cambridge-based company reported core earnings per share of $1.73 for the third quarter, matching analysts’ expectations, fueled by demand for its blockbuster cancer medicines.

Soriot has made cancer a priority, establishing a collaboration with Daiichi Sankyo Co. that’s already yielded one possible future blockbuster, the breast cancer drug Enhertu. Astra last month reported partial results that seemed to fall short of investors’ expectations for another medicine, called datopotamab deruxtecan or Dato-DXd.

China is becoming increasingly important for Astra, Soriot said. Eccogene will get an upfront payment of $185 million, with the remainder coming as milestones if the drug reaches certain targets. Western drugmakers have been looking to China for innovation lately, with Astra following in the footsteps of Merck & Co. and GSK Plc.

--With assistance from Dong Lyu.

(Updates with CEO comment in eighth paragraph)