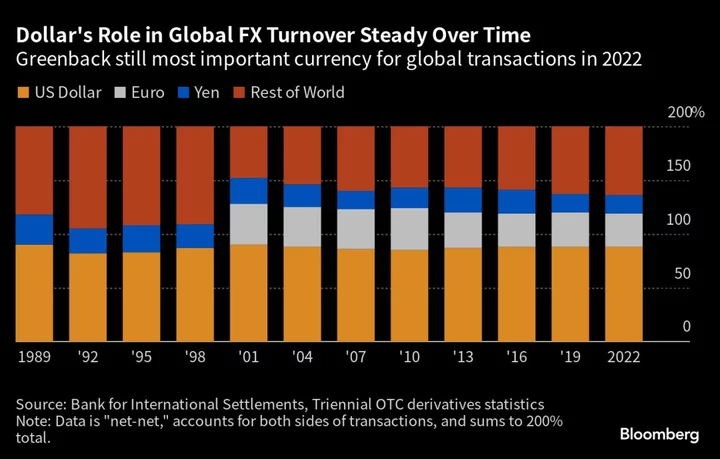

Paraguay’s incoming finance minister, Carlos Fernandez, wants to reduce the government’s dependence on dollar funding by making it easier for foreign investors to buy local currency bonds on the domestic debt market.

Paraguay is a regular issuer of global bonds, selling more than $6.5 billion since 2013, and domestic bonds denominated in the country’s currency, the guarani. Morgan Stanley’s Eaton Vance unit, through Brazil’s Itau Unibanco Holding SA, became the first foreign investor to purchase guarani bonds under new rules at a government debt auction in June.

“We need to issue more in guarani and we are going to implement the necessary measures to make the domestic bond market more attractive,” Fernandez said in an interview. “That could change the mix of how much we issue abroad and locally.”

The administration of President-elect Santiago Peña also plans to issue at least $500 million of global bonds early next year to fund the budget, refinance debt and pay suppliers, he said.

Fernandez, who led the central bank from 2013 to 2018, will take the reins of the $43 billion South American economy when Peña starts his term Aug. 15. After five years of lackluster growth averaging about 1.2%, Peña inherits an economy that is forecast to expand about 4.5% this year and 4% in 2024.

Read more: Paraguay Conservatives’ Win Defies Region’s Anti-Incumbent Wave

Even so, Fernandez faces the challenge of cutting a fiscal deficit swollen by pandemic stimulus and spending more on social services and public works with one of the lowest tax-to-GDP ratios in Latin America.

The economy could log consistent annual growth of about 4% and create the hundreds of thousands of jobs Peña promised voters if the new government can convince businesses to invest more by repairing public finances without raising taxes, Fernandez said.

“We aren’t considering any type of tax increase,” he said. “It’s unnecessary to increase taxes because that has been one of Paraguay’s biggest advantages: being competitive in tax terms.”

A tax reform approved in 2019 and legislation that would centralize tax collection in a new agency should yield more revenue, said Fernandez, who also plans to cut wasteful spending to free up more money.

Fernandez aims to gradually lower the deficit to 1.5% of GDP by the end of 2026 instead of 2024 to avoid harming the economy.

The deficit will probably finish this year around 3% because the Peña administration is going to pay roughly $500 million owed to drug companies, construction firms and other government contractors by next March, he said. That debt will be paid with some combination of tax revenue, multilateral loans and bonds, Fernandez said.

“I’m absolutely committed to this not happening again,” he said. “With the economy recovering we need all sectors in good shape and the financial squeeze these companies are suffering isn’t good for them nor the banks” who lend to those firms.

Other key items from the interview:

- Peña administration will respect the central bank’s autonomy and its 4% inflation target

- ”That is going to be fundamental so that the public’s pocketbook doesn’t continue deteriorating because of price increases,” Fernandez said

- Fernandez wants to accelerate public-private participation infrastructure tenders

- Peña reform agenda includes backing legislation that would create a pension system regulator

(Updates with additional interview highlights after paragraph 12)