Zoom Video Communications Inc. reported better-than-expected revenue on strong enterprise sales, a sign the company is holding its own in a competitive market for business collaboration software.

Fiscal third-quarter sales increased 3.2% to about $1.14 billion, the company said Monday in a statement. Analysts, on average, estimated $1.12 billion, according to data compiled by Bloomberg. Profit, excluding some items, was $1.29 a share, compared with the average estimate of $1.10 a share.

The company, whose signature video software became the essential communications tool for homebound Americans during the pandemic, has turned its focus to business customers. Zoom has added features for those clients, including word processing, and stepped up the use of artificial intelligence to buttress its main videoconferencing service, which competes fiercely with Microsoft Corp.’s Teams product.

Enterprise revenue from 219,700 customers rose 7.5% to $661 million in the quarter ended Oct. 31, topping analysts’ average estimate. Zoom said it had 3,731 clients that contribute more than $100,000 in trailing 12-month revenue — an increase of almost 14% from the period a year earlier.

“We bolstered Zoom’s all-in-one intelligent collaboration platform with advanced new capabilities like Zoom AI Companion and continued to evolve our customer and employee engagement solutions,” Chief Executive Officer Eric Yuan said in the statement.

Shares gained about 1% in extended trading after closing at $66 in New York. Zoom has missed the artificial-intelligence fueled tech rally this year, with the stock dropping 2.6% through Monday’s close.

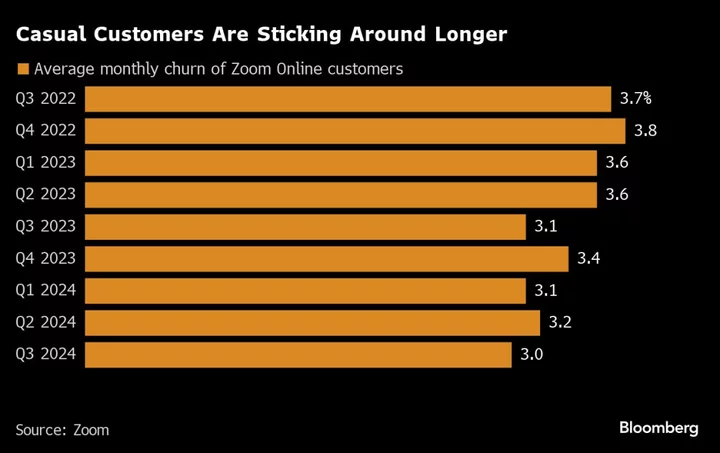

A post-pandemic exodus of casual customers and small businesses from Zoom has worried investors over the last year. Yuan highlighted “higher retention” and usage of new AI features among those online users, but Zoom, on average, lost 3% of those customers each month in the quarter. Still, that was the slowest rate of churn the company has ever reported.

Zoom gave a forecast for revenue of about $1.13 billion in the current period ending in January, in line with analysts’ estimates. Profit, excluding some items, will be about $1.14 a share, compared with the $1.09 average estimate.

(Updates with enterprise revenue in the fourth paragraph.)