Access to direct investments and real estate opportunities are key factors driving wealthy entrepreneurs’ decisions when it comes to international expansion, a survey by HSBC Holdings Plc found.

Almost half of respondents cited such investments as reasons for their businesses looking abroad, along with education opportunities for their children and buying property for their personal use, according to the bank’s “Global Entrepreneurial Wealth Report 2023.”

Widening entrepreneur’s global reach can fortify profit margins, increase their customer base and bolster the operational efficiency of their businesses, according to the survey, which was released Wednesday.

“Despite acknowledging some disadvantages to doing business beyond borders, such as complex regulatory environments and exchange-rate risk, entrepreneurs still see potential in overseas markets,” according to the report, which surveyed 973 individuals with at least $2 million of investable assets.

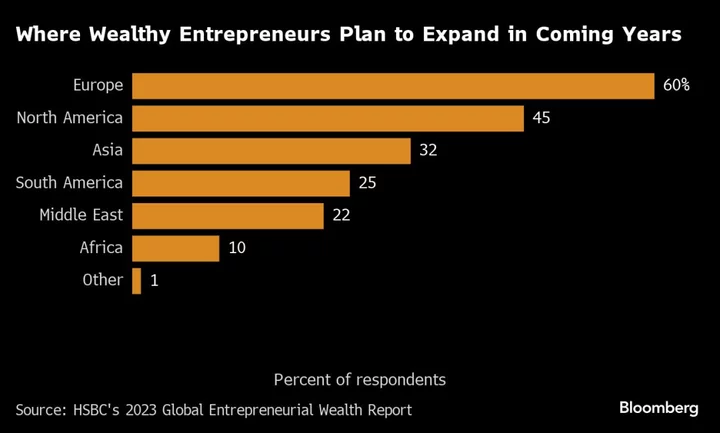

The majority of those responding identified Europe as an important growth market, with 60% saying they anticipate fortifying their ties to the Continent in the next three to five years. North America and Asia were also popular, with the latter attracting younger entrepreneurs who value lax barriers to entry and easy access to capital.

Still, almost two-thirds of those responding said they have yet to discuss succession plans with their families, according to the report. About 8% said they don’t plan on ever broaching the subject.