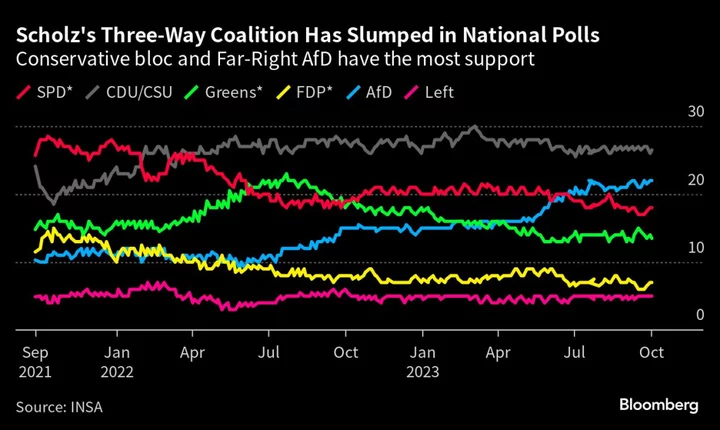

A far-right election victory and the likelihood of tricky coalition talks have put Dutch businesses on edge about political uncertainty, loss of skilled workers and risks to a business environment that’s served them well in recent years.

Stability and consistency were the key pleas that emerged in early reactions after the far-right politician Geert Wilders’s shock victory. He will have the largest party in parliament, though won’t have enough to lead, meaning the stage is set for haggling with rivals to form a coalition.

“The business community needs a stable government and direction,” said Medy van der Laan, chair of the Dutch Banking Association. “The dust has yet to settle in The Hague. A lot depends on the coalition formation and the compromises made.”

Wilders’ election campaign included policies such as restricting immigration and even holding a referendum on leaving the European Union. Businesses will be keen to avoid the latter, given the Netherlands has benefited from the UK’s departure from the bloc. Amsterdam is home to the world’s oldest stock exchange and its financial center has overtaken London as a share trading venue since Brexit.

Read more: Far-Right Won the Dutch Election: Here’s What You Need to Know

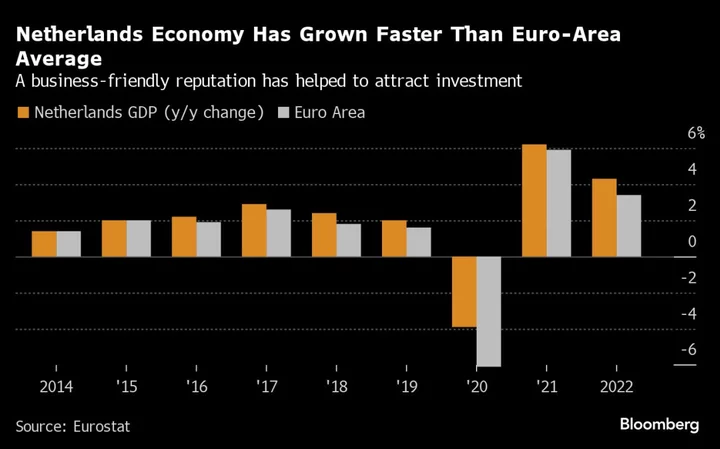

In recent years, the economy has outpaced the euro-area average, and the country has a thriving technology sector that’s drawn established firms, startups, investors and foreign talent.

Given the labor demand, the reactions on Thursday included barely veiled comments about Wilders’s anti-immigration stance, with some companies saying it’s vital that they can continue to attract skilled workers from outside the country.

“Any restrictions on the amount of knowledge workers or international students relevant for our industry are undesirable,” said ASML Holding NV, the Netherlands’ most valuable firm. “We need the international talent as we the availability of Dutch talent is not sufficient to meet the current demand for workforce.”

For now, with little certainty on whether Wilders will be able to govern and the sense his more extreme positions would be moderated by the need to form a coalition government, bond and equity markets were little ruffled.

‘Major Issues’

But there’s still the broader issue about how the Netherlands is now perceived.

The election is “going to create a lot of additional uncertainty,” ABN Amro Chief Economist Sandra Phlippen said. “What businesses value the most in the Netherlands is exactly what ASML is asking for — stable policies.”

“We’ll have to see whether that’s going to happen, but what you see is that there will be less experienced politicians and less experienced ministers,” she added.

Entrepreneurs’ association VNO-NCW and business lobby MKB-Nederland, also urged stability, and called for steps on housing and regulation to improve the investment climate.

“We cannot afford to stand still, because we are facing major issues and that requires long-term clarity,” they said in a statement.

Ali Niknam, founder of Dutch bank Bunq BV, had spoken previously about the changing shift in policies in the Netherlands, warning that the country should be careful not to lose all the great things they have worked so hard for. On Thursday, he said one the bank’s strongest values has always been “togetherness.”

“We believe in a unified world where people live in peace and harmony,” said Niknam. “Anyone and everyone guiding us in that direction can count on Bunq’s support.”

Daan Sanders, a Dutch tech investor at VNV Global, said any tightening of immigration laws could also hinder the growth of Dutch firms. And headlines about the far right and anti-Islam will be offputting as the average tech employee tends to be more progressive.

“Everyone is extremely surprised, personally worried and slightly ashamed,” he said.

--With assistance from Aisha S Gani, Leonard Kehnscherper, Verena Sepp and Sarah Jacob.