After 10 consecutive interest rate hikes, Federal Reserve officials announced on Wednesday that they would pause their fight against inflation to figure out whether the US economy was fully absorbing all that harsh medicine.

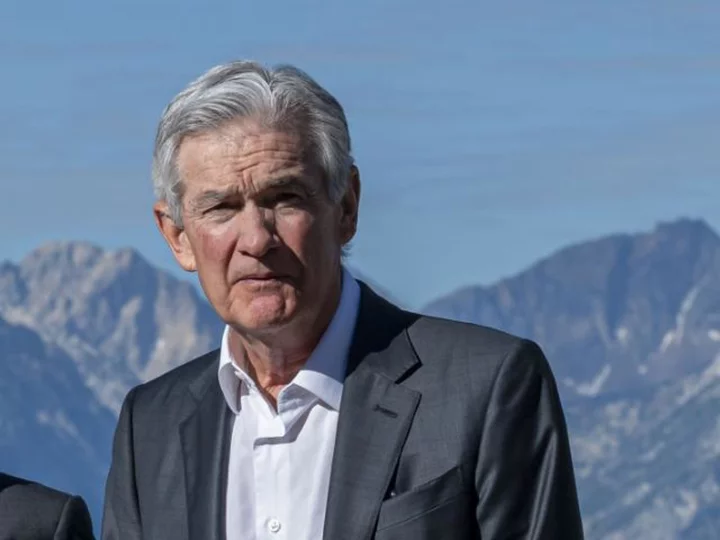

Following the policy announcement, Fed Chair Jerome Powell noted that rate hikes typically filter through the economy with "uncertain lags." In other words, the Fed has been playing an (educated) guessing game, taking action before it understands the results.

But the trick is the Fed doesn't even know how long these lags may last between a rate hike and its effect on inflation. Now it wants to see some hard evidence.

What's happening: As much as Federal Reserve officials wish they could, they can't just wave a wand and lower inflation rates. Instead there's a flow of monetary policy through the economy.

Here's how the system works: First, the Fed raises interest rates for overnight loans between financial institutions.

Those hikes then filter through the rest of the economy as banks make up for pricier loans by increasing the cost of lending for households and businesses.

That makes household savings drop. It also makes businesses less profitable, and they typically hire less. That takes money out of the economy, and eventually spending will stall. Less demand for goods reduces incentives to raise prices and inflation rates will fall.

But there are a large number of factors that can get in the way of this system working properly, The economy is complex, things get especially fuzzy when you try to pinpoint the timing and size of an interest rate hike's economic impact.

Timing the lag: "It's an art, not a science," said Jack McIntyre, portfolio manager at Brandywine Global, of the US central bank's inflation-busting objective. Even in a normal economic cycle, "there's no magic equation of 'if I raise interest rates by one percentage point, inflation will fall by a certain amount,'" he said.

And this is not a normal economic cycle. Pandemic relief programs pumped extraordinary sums of money into the US economy and Covid-19 significantly altered the labor market. There's no guidebook for how to deal with that, said McIntyre.

Another complication in determining how long the Fed's actions will take to fix inflation: Federal Reserve officials are raising interest rates in a very different communications landscape than they have before. This is the era of social media, when news (and rumors) spread and swings markets at a rapid pace.

"It's a challenging thing in economics," Powell said in his press conference. "It's sort of standard thinking that monetary policy affects economic activity with long and variable lags." But these days, he said, "tightening happens much sooner than it used to in a world where news was in newspapers and not, you know, not on the wire."

This is the first major hiking cycle in the age of social media and "interest sensitive spending is affected very, very quickly," said Powell. "Financial conditions begin to tighten well in advance of actual rate hikes."

A confidence problem: Financial markets have always tried to be forward looking and react to expectations, and banks regularly try to adjust credit policy against potential headwinds, said Yung-Yu Ma, chief investment strategist at BMO Wealth Management.

The difference here is that there's more tangible economic data made available than ever before. "I don't necessarily agree strongly with what Chairman Powell said," commented Ma. "I don't think it's that different than it used to be in terms of the speed with which these things take place. I do think however, it's a bit less haphazard, and people can react to specific data points more than they could in the past."

In other words, analysts, investors and business leaders are able to consider the same economic data as Fed policymakers in real time. That means they're able to draw their own conclusions about the trajectory of inflation rates.

For the Federal Reserve, which counts public confidence as one of its most powerful tools, that spells more uncertainty ahead.

Biden announces Live Nation and Ticketmaster will allow consumers to see all fees up front

President Joe Biden announced from a White House roundtable on Thursday that entertainment giant Live Nation and ticketing behemoth Ticketmaster have pledged to give US consumers the ability to see the full price of tickets up front, minimizing the frequently frustrating experience of watching additional fees add up late in the checkout process when buying online, reports my colleague Sam Fossum.

The announcement came amid increased pressure on the industry from debacles over exorbitant ticketing fees and as the president has urged Congress to pass legislation targeting other hidden costs paid by consumers throughout the economy. It marked Biden's latest effort to address kitchen-table issues as economic concerns remain top of mind for voters heading into the 2024 election.

"The solution is what is called 'all-in pricing' and that's where companies fully disclose their fees up front, when you start shopping, so you're not surprised at the end when you check out," Biden said at the White House event.

"President Biden has been working to lower costs for hardworking families by bringing down inflation, capping insulin prices for seniors, and eliminating hidden junk fees," said National Economic Council Director Lael Brainard in a written statement. "More companies are heeding the President's call so that Americans know what they're paying for up front and can save money as a result."

Lawmakers wrangle over measures to address pilot shortage

A series of controversial proposals to address the airline pilot shortage is complicating Congress' consideration of a new slate of Federal Aviation Administration policies with one senator warning fellow lawmakers there will be blood on their hands if reduced pilot training causes a fatal accident, reports CNN's Greg Wallace.

The measures presented by lawmakers include raising the pilot retirement age, allowing more training to occur in a flight simulator rather than aircraft cockpit, and fast-tracking training programs. The measures are hotly contested and are aimed at addressing a shortage in airline pilots that was exacerbated by the pandemic. That shortage is already grounding planes and is projected to get worse in the coming years.

A proposal that would change the minimum number of training hours for an airline pilot scuttled plans for a Senate committee to vote on the underlying policy bundle, legislation known as the FAA reauthorization, according to a source familiar with the matter.

The measure was sponsored by Sen. John Thune of South Dakota, one of the body's top Republicans. Republican Sen. Jerry Moran, of Kansas, criticized the holdup. "Our aviation system should not be subject to last minute political whims," he wrote.