Analysts are rushing to raise target prices on Japanese trading companies as Warren Buffett’s increased holdings drive their shares to new records.

Four of the top 10 firms that saw the steepest target increases among Japan’s largest companies were trading houses, according to data compiled by Bloomberg. The nation’s five biggest trading companies may rise in Tokyo after Berkshire Hathaway Inc. said on Monday it raised its stake further in the firms to an average of over 8.5%.

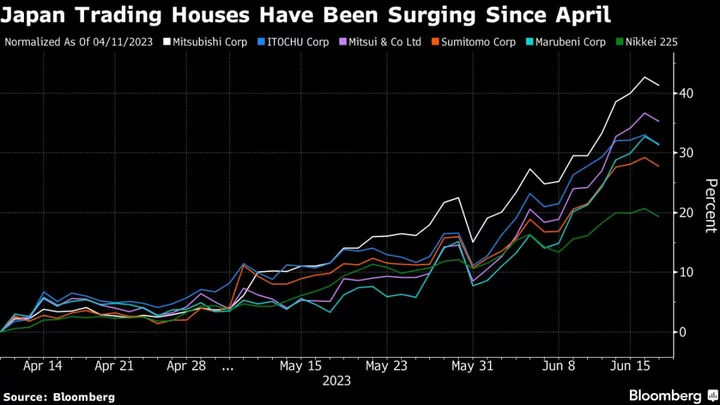

Trading houses have soared since Buffett, the chairman of Berkshire, said in April during a trip to Japan that the firm would boost its holdings.

Mitsubishi Corp., the biggest trading firm, saw analysts lifting their price target by 18% over the past month. The target price of peers Sumitomo Corp. and Marubeni Corp. rose by an average of 12.3%, compared with 5% for Japan’s 50 largest firms by market cap.

Berkshire plans to increase investments to up to 9.9% of each of the five Japanese firms, the company said Monday.

While Berkshire’s stakes are getting closer to this level, “we could equally argue there is still room for more buying,” SMBC Nikko analyst Akira Morimoto wrote in a note after Berkshire’s announcement, adding that share prices for trading companies bounced in the past after additional buying was announced.

Still, chip-related stocks Advantest Corp. and Tokyo Electron Ltd. were the two companies that saw the biggest target price change over the month. Their shares rallied amid a global jump in semiconductor stocks and investment plans in Japan amid geopolitical tensions between the US and China.

There are signs of overheating in the sector. The Topix Wholesale Trade Index, which has soared about 39% this year to become the best performing sector in the country’s stock market, has been trading in technically overbought territory since earlier this month.

--With assistance from Naoto Hosoda.