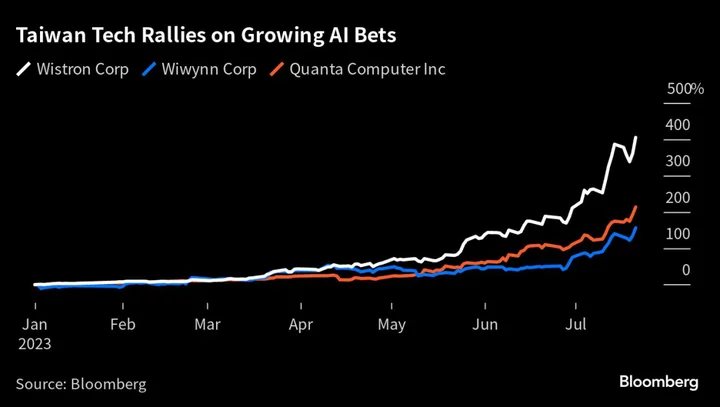

The rally in Taiwan’s technology stocks is likely to continue as earnings at hardware firms are expected to get a boost from booming demand for artificial intelligence servers.

Hardware makers Wistron Corp., its affiliate Wiwynn Corp. and Quanta Computer Inc. jumped to record highs on Monday following recent upgrades by banks including Morgan Stanley and Citigroup Inc. Analysts said these firms will benefit from the rise in AI server adoption by hyper-scalers such as Alphabet Inc.’s Google in the US.

Tech original design manufacturers have long been overlooked by investors due to the lack of growth catalysts despite their relatively stable earnings and high cash payouts, Citi said. But investors have become increasingly bullish on these stocks in the face of an intensifying AI arms race.

“There’s still room for these shares to go higher, as we are still in the early innings of the paradigm shift brought about by generative AI,” Citi analysts wrote in a note on July 19.

Taiwanese hardware firms produce parts for computer servers and supply to some of the world’s biggest tech companies including Google and Apple Inc., according to Bloomberg-compiled data. A huge sales forecast last quarter by Nvidia Corp. may also translate to positive earnings trend for their suppliers including Taiwan Semiconductor Manufacturing Co. and those who build servers using Nvidia’s chips.

BofA Global Research in a July 14 note said Taiwan tech was the fund’s largest overweight in Asia Pacific, along with India financials.

Still, some analysts cautioned that gains in tech stocks are increasingly sentiment-driven.

“The share price rally could have reached a point where investors may start to wonder if AI’s contributions to these stocks actually deserve all the valuation hypes,” said Steven Tseng, a senior analyst at Bloomberg Intelligence.

Investors should take note on “how concrete each stock’s AI story is,” he said. “Those companies with good exposures in AI server supply chain may sustain better than others.”

--With assistance from Cindy Wang.