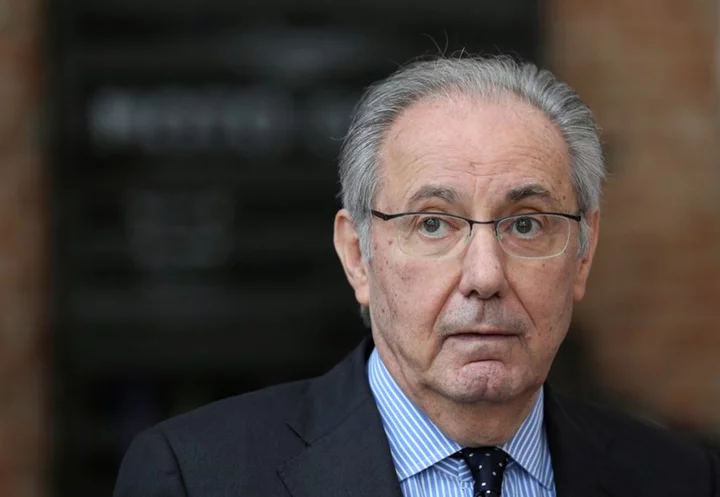

(Reuters) -Wall Street bonuses could fall 16% this year as interest rates possibly staying higher for longer threatens the performance of financial companies, according to New York State Comptroller Thomas DiNapoli.

The drop, however, would be less sharp than last year's 26% decline that shrank bonuses to $176,700 on average.

The Federal Reserve is tiptoeing towards the end of its tightening cycle, though rate cuts in 2024 are expected to be fewer than previously expected as the central bank seeks to rein in inflation closer to its 2% target.

While higher-for-longer rates could impede business activity, some experts have predicted the central bank would manage to guide the economy to a soft landing.

Securities firms in New York City are on pace to add 4,300 jobs in 2023 to take the total to 195,100, climbing 2% from last year and to the highest in over 20 years, DiNapoli said, while cautioning it "remains to be seen" whether the companies would retain staff as profits normalize following the pandemic-era boom.

Banking heavyweights including Goldman Sachs and Morgan Stanley have announced a string of layoffs this year as they race to cut costs.

Pretax profits for the securities industry totaled $13 billion in the first half of the year, declining 4.3% from a year earlier, the report said.

(Reporting by Niket Nishant in BengaluruEditing by Vinay Dwivedi)