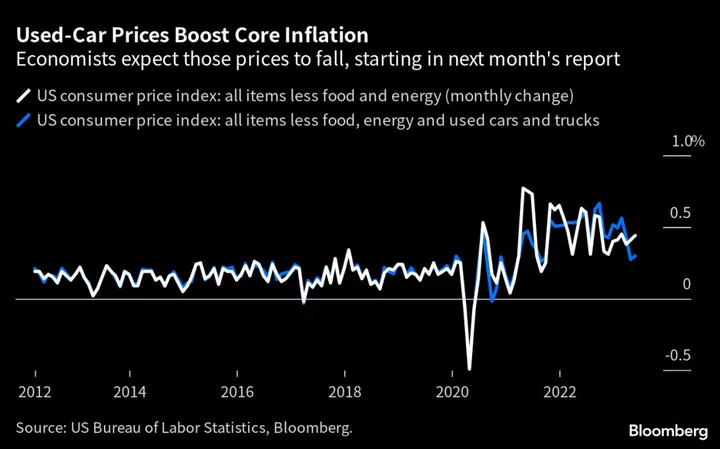

The jump in used-car costs that propped up US inflation last month is widely expected to swing into reverse in June, finally delivering a slowdown in one of the most-watched price gauges.

Core inflation, which typically strips out food and energy prices, has proved sticky this year even as the headline rate has plunged. In the May data published Tuesday, an increase in used-car prices played a major part in keeping it high.

But leading indicators of auto prices compiled by private firms like Manheim have already begun falling — and those declines should begin filtering into the official Bureau of Labor Statistics data for consumer prices in the next monthly report, due July 12.

“Since Manheim prices have begun to fall pretty significantly, we aren’t expecting too much inflationary pressure from used cars and trucks over the back half of the year, especially since new car prices haven’t really been going anywhere,” said Justin Weidner, a US economist at Deutsche Bank.

An alternative measure of “core” consumer prices, which excludes used cars as well as food and energy, illustrates the outsize impact that the now-stale car price data had on the latest BLS inflation numbers. Including used cars, the core index was up 0.44% in May, suggesting little disinflation. But excluding them, the core index was up just 0.3%.

‘Upside Surprise’

Big swings in used-car prices over the course of the pandemic have put intense focus on indicators like the Manheim US Used Vehicle Value Index that typically give an earlier glimpse of market shifts. Even though used cars make up less than 3% of the consumer price index, the monthly changes have been so large that at times they’ve been the main story.

After rising in each month from December to March, Manheim’s index fell 3.1% in April and dropped another 2.7% in May. A similar index maintained by Black Book has also logged declines in each of the last two months.

Not all the volatility has necessarily gone away, according to Veronica Clark, an economist at Citigroup Inc. She sees “some dynamics of pent-up demand and inventory rebuild” that may keep auto demand strong, and prices moving around month-by-month.

Still, some other categories in the core index are also pointing to lower inflation ahead. Rents, the biggest component of the consumer price index, posted monthly increases in May that were smaller than over much of the past year, and forecasters see more deceleration ahead.

And increases in services prices excluding rents are also losing steam. They rose 4.6% in the 12 months through May, the smallest annual increase in 15 months.

“While May core inflation was stronger than expected, most of the upside surprise came from used car prices, which we view as a transitory uptick,” Barclays economists led by Pooja Sriram said Tuesday in a note. Core inflation, which stood at 5.3% in May, should decelerate to 3.8% by the end of the year, they said.