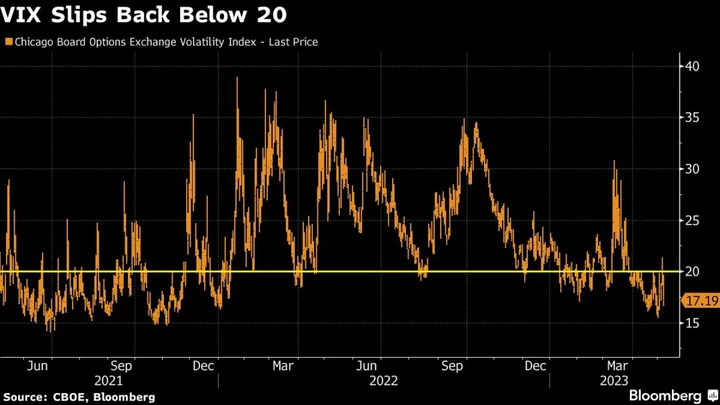

US stocks struggled for direction on Monday as traders assess the outlook for monetary policy ahead of key inflation data later this week.

The S&P 500 edged higher after the gauge jumped 1.9% Friday to halt its longest losing streak since February. The Nasdaq 100 slipped. PacWest Bancorp rose 30% extending Friday’s brisk rally and leading gains in US regional banks as they recover from a selloff sparked by the recent collapse of several lenders. A gauge of the dollar slipped for a fifth straight day and Treasury yields rose.

US stocks have traded sideways since the beginning of April as better-than-feared corporate earnings offset concerns around an economic slowdown and the health of regional banks. Resilient jobs data Friday supported bets the Federal Reserve will hold rates high for longer, straining consumer spending, corporate profits and bank balance sheets.

“Economic growth while slowing has not yet confirmed the arrival of a recession even as the Federal Reserve has had to raise rates fairly aggressively in an effort to bring an end to an era of ‘free money,’” John Stoltzfus, chief investment strategist at Oppenheimer & Co., wrote in a note.

Any slowing of activity in the regional banking sector with potential regulatory efforts to trim growth enough “to allow the Fed to stay light on the monetary ‘brake pedal’ going forward even as it may need to continue to raise rates for longer than many would like in order to push inflation toward its target level,” he said.

Rates on swap contracts linked to Fed meetings — which on Thursday briefly priced in a cut in July — moved higher, to levels consistent with a stable policy rate until September, followed by at least two quarter-point cuts by year-end. Consumer-inflation data Wednesday may provide further clues on the rates path.

“Unless we see a sharp turnaround in the inflation numbers, the Fed ought to be quite comfortable with where policy rates are right now,” Tai Hui, chief Asia market strategist at JPMorgan Asset Management, said on Bloomberg Television.

While the Fed has signaled that it may pause its tightening cycle, its counterpart in the euro region isn’t done yet, muddying the outlook for economic growth and corporate profits.

The European Central Bank needs to continue raising interest rates amid a “too high” underlying inflation rate, Governing Council member Klaas Knot said Sunday. ECB President Christine Lagarde also signaled that there are more hikes to come after the central bank last week raised the deposit rate by a quarter-point to 3.25%, following three moves of double that size.

Worries Remain

Despite Friday’s stock rebound, investors still have much to worry about. The rout in US bank shares has the S&P 500 financials index on the verge of falling back below its 2007 peak.

Meanwhile, Treasury Secretary Janet Yellen sees “simply no good options” for solving the debt limit stalemate in Washington without Congress raising the cap. She even cautioned that resorting to the 14th Amendment would provoke a constitutional crisis.

“We see a chance that Treasury’s cash amount is enough to sustain till mid-June and probably slightly beyond that,” Oversea-Chinese Banking Corp. strategists Frances Cheung and Christopher Wong wrote in a note. However, “the irregular nature of fiscal receipts and outlays shall render investors staying cautious,” they said.

Elsewhere in markets, oil gained as investors assessed a complex outlook for global demand after a period of volatile trading. Bitcoin slipped below $28,000.

Key events this week:

- US wholesale inventories, Monday

- US President Joe Biden scheduled to meet with congressional leaders on debt limit, Tuesday

- New York Fed President John Williams speaks to Economic Club of New York, Tuesday

- US CPI, Wednesday

- China PPI, CPI, Thursday

- UK BOE rate decision, industrial production, GDP, Thursday

- US PPI, initial jobless claims, Thursday

- Group of Seven finance minister and central bank governors meet in Japan, Thursday

- US University of Michigan consumer sentiment, Friday

- Fed Governor Philip Jefferson and St. Louis Fed President James Bullard participate in panel discussion on monetary policy at Stanford University, Friday.

Some of the main moves in markets:

Stocks

- The S&P 500 was little changed as of 9:32 a.m. New York time

- The Nasdaq 100 fell 0.2%

- The Dow Jones Industrial Average was little changed

- The Stoxx Europe 600 rose 0.3%

- The MSCI World index rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro rose 0.2% to $1.1040

- The British pound rose 0.1% to $1.2651

- The Japanese yen fell 0.2% to 135.02 per dollar

Cryptocurrencies

- Bitcoin fell 3.6% to $27,912.91

- Ether fell 2.9% to $1,864.29

Bonds

- The yield on 10-year Treasuries advanced eight basis points to 3.51%

- Germany’s 10-year yield advanced six basis points to 2.35%

- Britain’s 10-year yield advanced 13 basis points to 3.78%

Commodities

- West Texas Intermediate crude rose 3% to $73.50 a barrel

- Gold futures rose 0.3% to $2,029.90 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Michael Msika and Tassia Sipahutar.