Traders who piled into South Korean bonds last year were handed a 15% loss — the worst outcome in emerging Asia. But things are starting to look up.

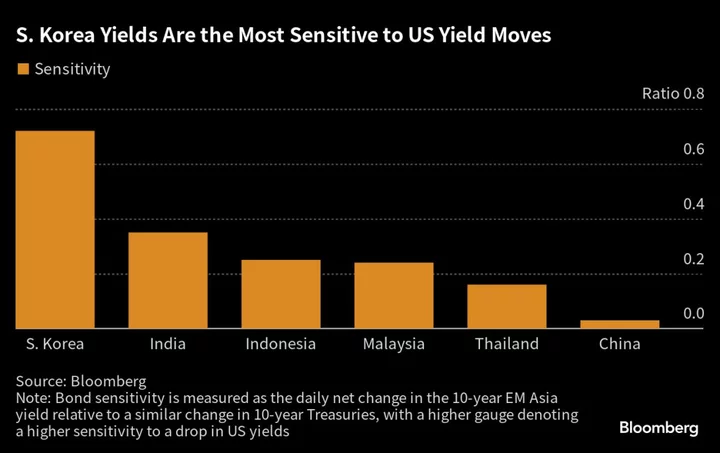

South Korea’s 10-year yields are the most sensitive to swings in similar-maturity Treasuries, according to an analysis by Bloomberg, making the notes a likely candidate to outperform when the Federal Reserve starts easing policy. The Asian bond market is liquid and has a relatively high level of foreign ownership — factors that may help explain the greater degree of sensitivity.

The pieces are finally falling into place for South Korean securities after more than a year of monetary tightening by the central bank torpedoed the market. Add to the mix a plethora of positives including dwindling bond supply and the stage is set for South Korean notes to make up for 2022’s dismal performance.

Bonds are expected to get a boost “from prospects of the Bank of Korea reverting to rate cuts soon, more foreign inflows if the FTSE Russell index inclusion materializes and bond supply this year which is the lowest since 2020,” said Bloomberg Intelligence strategist Stephen Chiu. The nation may be included in the FTSE bond gauge as early as March 2024, he added.

A Bloomberg index of South Korean bonds which measures returns to dollar-based investors has gained about 4% so far in July to beat all its emerging Asian peers.

Central to the optimism is the expectation that South Korean debt will be the biggest beneficiary when Treasury yields start to decline. Bond sensitivity is measured as the daily net change in the 10-year yield of the relevant emerging Asia note relative to a similar change in 10-year Treasuries, with a bigger number denoting a higher sensitivity to US yield movements.

In the region, South Korean bonds rank as the most sensitive with a reading of 0.72, followed by India at 0.35 and Indonesia at 0.25. In contrast, Thai and Chinese notes are the least likely to move in tandem with US yields due to local monetary policy drivers, the analysis showed.

South Korean debt may be more sensitive due to the market’s liquidity, as data from the Asian Development Bank show that its trading volume is the highest in emerging Asia after China. Foreign ownership is also sizable, with global funds holding about 18% of the nation’s local-currency government bonds as of March 2023, a higher proportion than in Indonesia, Philippines and Thailand, according to the the ADB data.

It also helps that there are some expectations for the Bank of Korea to lower borrowing costs in the coming months. The median forecast in a Bloomberg survey of economists is for the central bank to deliver a 25-basis point cut by the first quarter of 2024 as data including exports point to a weakening growth momentum. July inflation data due Aug. 2 may help to shape the policy outlook.

Traders will be watching the Federal Reserve’s next review in September to gauge when the US central bank may pivot to an easing. Officials raised interest rates on Wednesday and Chair Jerome Powell left open the possibility of further hikes, which he emphasized will depend on incoming data.

--With assistance from Hooyeon Kim.

(Updates with date of release of inflation data in penultimate paragraph)