A record 30 million people are expected to catch a flight over the Thanksgiving holiday, but airlines that specialize in low-cost US travel still don’t have much of a reason to celebrate.

Spirit Airlines Inc., Southwest Airlines Co. and other domestic-focused carriers are slashing their already low prices. After pandemic-related lockdowns ended, budget domestic airlines bolstered their supply of seats to accommodate a massive influx of travelers in 2022. But these days they’re often empty because passengers are gravitating toward more-expensive, internationally focused competitors.

As a result, domestic-focused carriers, a group that also includes Frontier Group Holdings Inc. and JetBlue Airways Corp., are expected to struggle financially in 2024 and possibly 2025, analysts say. Those companies have already had a hard year. They’ve been battered by grounded or delayed aircraft, rising labor costs, volatile fuel prices, and congestion magnified by a shortage of air traffic controllers that’s affecting the whole industry.

“I get a fare sale promotion, like, four times a day now,” Conor Cunningham, a Melius Research analyst, said in an interview. “It’s insane.”

Domestic air fares for Thanksgiving have averaged $266 round trip, down 7% from 2022 and below pre-pandemic 2019, according to booking app Hopper Inc. Tickets for Christmas are at $324, down 12% from 2022 and 10% under 2019. Average domestic round-trip fares have declined year-over-year each month from April through October, based on US travel agency ticket sales, according to ARC Corp.

Low-cost US airlines aren’t done building out their capacity. Believing a post-lockdown travel boom would last — as it has in the long-haul international and premium travel market — domestic carriers ratcheted up expansion plans already in the works. So the supply-demand mismatch could worsen if their main customers, budget travelers, remain home.

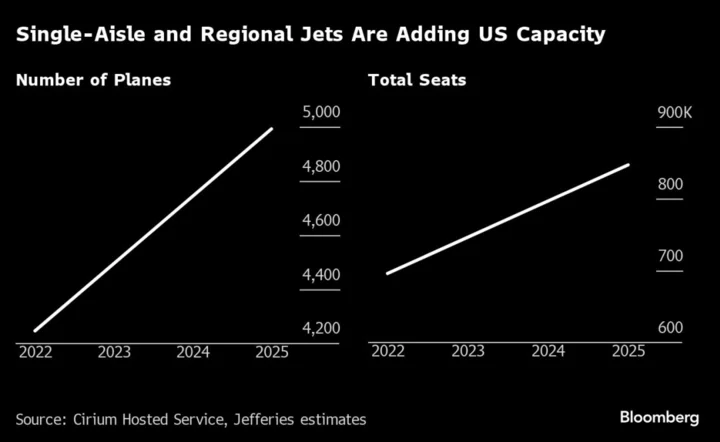

The combined domestic fleet of single-aisle planes and regional jets is scheduled to expand 18% to about 5,000 aircraft in 2025 from 4,247 at the end of 2022, according to Jefferies Financial Group. That’s a 22% increase in the number of domestic seats, compared with about 4% expected growth in air traffic over the period.

“Clearly that’s going to exasperate the issues,” said Sheila Kahyaoglu, a Jefferies analyst. “And costs are increasing, whether labor agreements — labor is 30% of airline costs — or maintenance costs spread over potentially less aircraft” due to engine manufacturing problems, constrained parts and delivery delays.

Low-cost carriers have historically relied on high daily usage of their planes and growth to make money from cheap fares.

Meanwhile, profits are being bolstered at carriers like United Airlines Holdings Inc., Delta Air Lines Inc. and American Airlines Group Inc. by international routes that were particularly popular this year, premium-class seating and other amenities, and rapidly growing loyalty programs and co-branded credit card deals that produce billions in revenue annually.

Self-Help Remedies

The cheaper, domestic-focused airlines are trying some self-help remedies. Dallas-based Southwest is slowing capacity growth in 2024’s first quarter to between 10% and 12% from as much as 16% originally. It will expand no more than 8% for the full year.

Frontier plans to trim capacity growth to mid-single-digits in the first quarter of 2024, but will be in the mid-teens for the full year as the carrier also shifts how it schedules flights. Chief Executive Officer Barry Biffle has said he believes demand patterns will normalize and capacity growth will moderate in 2024.

Spirit has been hit particularly hard by heavy fare discounting and waning domestic demand across the normally busy summer and into the winter holidays. The carrier, whose acquisition by JetBlue is the focus of a federal antitrust challenge, is evaluating its growth plan and has slowed capacity additions and aircraft deliveries.

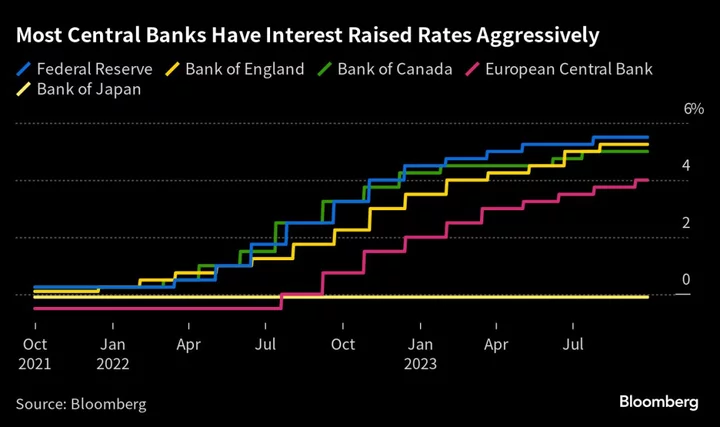

Even those actions may not be enough to address changes to the travel market. Inflationary pressures that already pummeled lower-end consumers may be filtering up to mid-level consumers, said Kahyaoglu, the Jefferies analyst. “Inflation has been very high for very long, and the consumer has already eaten into their savings,” she said.

And a shift of more consumers back from international adventures to the domestic market won’t guarantee a rebound for the discounters, Melius’s Cunningham said. Delta, United and American have seen growth in premium travel and a doubling of loyalty program members.

“Are we sure they’re going to shift back to Spirit or Frontier?” he said. “I’m not so sure. The model feels broken.”

--With assistance from Catherine Larkin.